Smaller European fund managers top the rankings of asset managers supporting climate resolutions, a report has found, as reported by ESG Clarity in the UK.

In the report Voting Matters 2020, responsible investment non-profit organisation ShareAction analysed the voting decisions of 60 of the world’s largest asset managers on 102 shareholder resolutions on climate change and social issues from September 2019 to August 2020.

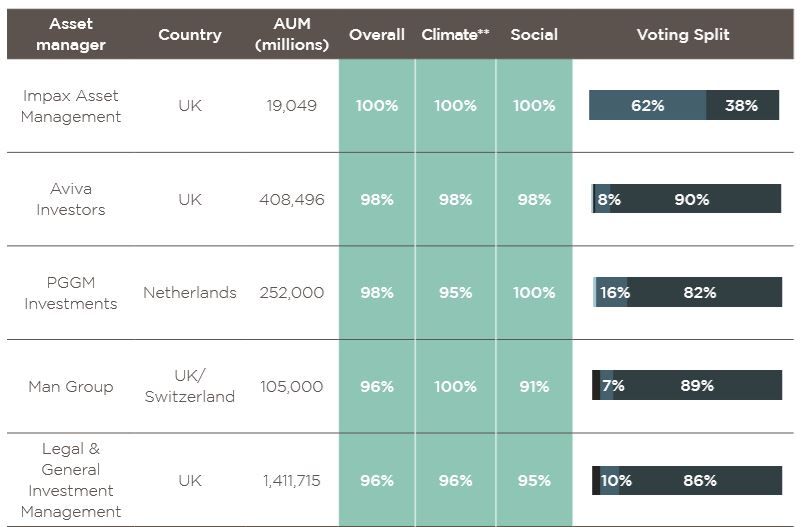

It found the top 17 managers were all based in Europe, with Impax Asset Management, Aviva Investors and PGGM Investments all supporting more than 95% of the resolutions analysed.

Top 5 asset managers

“We have a responsibility to press companies to adopt progressive climate and human rights practices, and to use our voting power to hold management accountable when they fall short,” Aviva head of governance and stewardship Mirza Baig said.

However, the report also found some big names to be lagging, causing several resolutions not to pass.

BlackRock and Vanguard supported fewer than 15% of the climate and social resolutions this year, causing 17 resolutions not to reach the 50% voting threshold. Both voted against all 17 resolutions, while State Street voted against 11. Instead, just 15 out of the 102 resolutions passed. IN contrast, Aegon Investment Management and Man Group supported 100% of climate resolutions.

Asset managers justified their refusal to support climate resolutions by saying they preferred to engage privately with companies.

The report’s co-author Jeanne Martin said: “Engagement through private meetings is important to gather information and build relationships but its effectiveness to enact change can be limited. Given the scale of the climate crisis, it is concerning that some investors shy away from voting on critical resolutions at high-carbon companies on the basis of engaging with them privately.”

On the resolutions themselves, the report found a lack of engagement on social issues, and where there was, it was solely in the diversity category and largely around disclosure (of pay gaps for example) rather than action.

Report co-author Martin Buttle said: “ESG funds are increasingly commonly used by asset owners, but the methodology behind these funds often fails to screen out some of the worst offenders on social factors. For ‘S’-conscious asset owners, this makes engagement with these companies – and specifically robust stewardship such as voting – even more important.”

Despite this, some asset managers – JP Morgan, Wellington and Northern Trust – improved from last year, upping their support for climate resolutions.

ShareAction CEO Catherine Howarth said: “As responsible investment strategies surge in popularity, voting on shareholder resolutions is a key test of authenticity and commitment. We applaud asset managers who voted with conviction in 2020’s proxy season on social and environmental resolutions. Pension fund clients of asset managers exposed as having a weak voting record must urgently challenge the gap between rhetoric and action on behalf of their beneficiaries.”