As governments rush to pledge a green recovery post-coronavirus, and fossil fuel companies are forced to write dramatic write-downs of assets, investment commentators have said resistance to oil’s decline is futile, and the world is on the cusp of a renewable revolution.

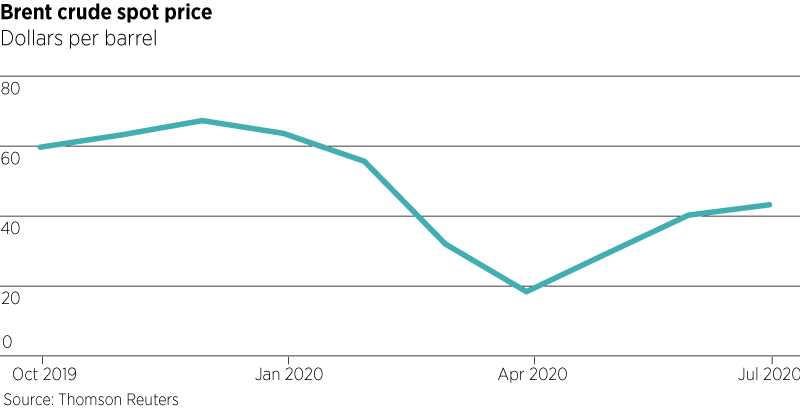

Oil prices have slumped since the start of the year amid over-production and a collapse in demand from global shutdowns and air travel bans due to the Covid-19 pandemic. As a result, Shell has slashed $16.8bn from the value of its assets, BP predicts it will have to write down $17.5bn, while Total estimates a $8bn write-down.

Trading in fossil fuels is becoming increasingly ruinous, key commentators in the investment industry suggest, making alternatives attractive from the vantage point of the moral high ground and down at the level of brass tacks.

“The write-down of these assets is in direct response to plummeting oil demand and price, something climate campaigners have been warning about for years,” says Beau O’Sullivan, spokesperson for ShareAction, which promotes responsible investment and aims to improve corporate behaviour on ESG.

O’Sullivan adds now could be a tipping point “as oil companies and their investors become more alert to the reality of a world moving away from dirtier energies, whether that’s during this health crisis or the potential next climate one”.

See also: – The oil shock and its impact on transitioning to a low-carbon economy

It is predicted the value of the world’s fossil fuel reserves could fall by as much two-thirds, some £20trn, in the next three decades, according to think tank Carbon Tracker. This has been sped up by the Covid-19 effect of bringing forward the peak and decline in demand and, analysts at Bank of America expect oil write-downs alone for just this year to total $60bn. Market watchers are seeing this as the end of business as usual for traditional energy companies.

“If the world is to meet the commitments set out in Paris half a decade ago,” says Mark Lacey, head of commodities at Schroders, referring to the global accord to keep temperature rises this century below 2°C and greenhouse gas emissions zero before 2050 – “and there are growing reasons to think it will, the fossil fuel industry will need to diminish.”

Oil companies are cutting their long-term oil and refined product price assumptions, Lacey says, which are key causes of the value write-downs. “Management teams are making conscious decisions to reduce their net carbon emissions by 2030 and 2040,” he notes. Capital expenditure, he adds, is “being cut in oil fields and diverted to renewables”.

Green projects

Furthermore, fossil fuel producers face a concertina of global pressures to hasten their adoption and development of renewable energies. While the UK plans a new Green Investment Bank, Japan has vowed to cut funding to coal power in the developing world, and Christine Lagarde, European Central Bank president, has said she wants to “explore every avenue available to combat climate change” including using the ECB’s $2.8trn bond buying programme to favour green projects.

Parul Chopra, vice president of analysts Rystad Energy, says these measures are forcing companies to transition to renewables and not delay it into the future. However, the road ahead is not smooth, he says: “It will require strict policy measures from the government, and sufficient financial rewards for the companies.”

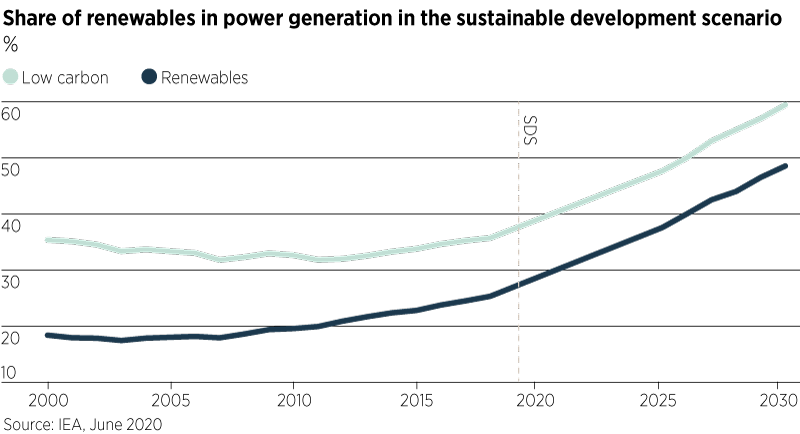

Investments in solar and wind energy projects by the world’s oil majors until 2025 are expected to exceed $18bn, according to analysis by Rystad Energy. However, $10bn of that, or 55%, is expected to come from a single company, Equinor, the Norwegian state-controlled energy giant, and the only operator planning to direct a majority of its greenfield capital expenditure towards renewable energy projects. In 2019, oil and gas companies’ investment in renewable energy was less than 1% of total capital spending, according to the International Energy Agency.

In August, BP pledged to do better, elaborating on its strategy to deliver net zero carbon emissions by 2050 – by cutting oil and gas production by “at least” 40% by 2030 and promising a 10 times increase in low carbon investment by that decade to around $5bn a year. It also committed to building out an integrated portfolio of low carbon technologies, including renewables, and by 2030 aims to have developed around 50GW of net renewable generating capacity – 20 times more than in 2019.

On the day of BP’s announcement, it’s share price rose 7%, highlighting the investor support for the strategy, momentum that will likely be key to the ongoing transition to renewables by oil companies that, for now, remain unpunished in terms of access to cheap cash. “Most oil companies issued bonds earlier this year at attractive rates,” points out Allen Good, energy strategist at ratings agency Morningstar. The international money market purse strings are expected to tighten, however.

Financial support

Access to capital through legacy bonds will dry up, says Schroders’ Lacey, and “investors’ efforts to limit those companies’ access to capital will provide a growing challenge unless those companies invest in more sustainable areas of the energy value chain”.

Invesco’s 2020 annual Global Sovereign Asset Management Study, which canvased the views of 139 financiers managing $19trn at 83 sovereign funds and 56 central banks, found 83% believe immediate action is required to combat climate change. This is increasingly being translated into strategies based on the view climate-related risk should be embedded into the wider investment process. For renewables as for oil, money talks.

See also: – Where next for the oil sector?

Amazon, for example – though subject to ESG criticism it treats workers like disposable inconveniences –launched a Climate Pledge Fund in June that will invest $2bn into sustainable and decarbonizing technologies. Meanwhile, Amazon’s founder Jeff Bezos, committed $10bn of his own fortune last year to a climate-friendly effort called the Bezos Earth Fund. Other investors are likely to see such financial support as a bellwether where traditional energy companies will lose out unless they adapt.

As oil companies nurse mammoth losses, Iberdrola, the clean energy specialist and Spain’s second biggest listed company, is investing $10bn in 2020 and beyond in renewables and building renewable energy networks. CEO and chairman Ignacia Galan told the Financial Times in July he wanted to ensure he was well-placed to take advantage of countries trying to “get out of the economic crisis as quickly as possible and look for sectors that can speedily generate jobs”.

Energy transition

Nations scrambling to kickstart economies that were dropped into a deep freeze to save lives during the depths of the coronavirus outbreak are pledging to make the economic recovery green-led, which opens wider opportunities beyond power. Power generation accounts for around one-third of global greenhouse gas emissions. A fifth (21%) comes from industry, 24% from agriculture and land use like deforestation, 14% from transportation, and 6% from buildings.

“It will be important government spending does not neglect these more challenging areas in favour of sectors like power, where that transition already has good momentum,” says Lacey.

Compromise is inevitable; EU leaders in July cut tens of billions of euros from the Just Transition Fund, aimed at helping the most polluting regions of Europe, from €40bn to €17bn, in order to pass the bloc’s €750bn coronavirus rescue package unopposed.

“To take the next step, broader buy-in will be needed from policymakers and other investors. This, coupled with new, creative solutions, can compel other investors to look at climate risks more closely,” says Rod Ringrow, head of official institutions at Invesco.

Mike Appleby, investment manager within the Liontrust Sustainable Investment Team, agrees: “Big drivers of pressure on oil companies will come from a reduction in the pro-fossil fuel subsidies and tightening global regulation to reduce emissions, which will put an increasing cost of carbon back onto the businesses that emit them.”

But he adds: “We think the speed of the energy transition is underestimated by the market.”