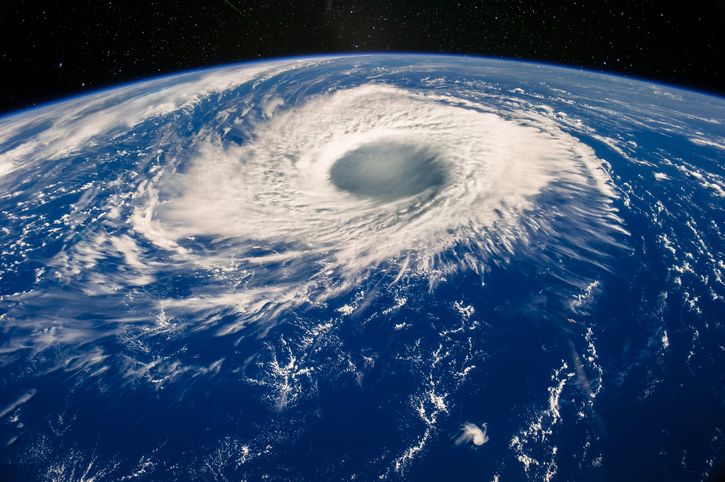

With hurricane Idalia making landfall in Florida, a report conducted by Persefoni has found that the US insurance sector held $536bn in fossil-fuel related assets in 2019, despite some insurers citing climate-related risk and natural disasters as factors in raising premiums and dropping coverage within certain high-risk regions.

Alongside partners ERM and Ceres, Persefoni said in the report Changing Climate for the Insurance Sector: Research and insights that the top 16 US insurers alone held more than 50% of the half trillion dollars in fossil fuel-related assets owned by the sector.

The top two US property and casualty companies, Berkshire Hathaway and State Farm Insurance, owned 44% of total fossil fuel-related assets owned by the entire sector. Asset ownership among life insurance companies was more broadly distributed, with the top two life insurance companies, TIAA Family Group and New York Life, owning 14% of assets owned by companies in that sector.

According to the report, this means that a small number of insurers hold a great amount of influence over the future direction of the industry’s collective holdings, and they are well positioned to incentivize decarbonization across the economy.

In January, research from management consulting company, Aon, revealed that the US accounted for 75% of global insured losses stemming from natural disasters in 2022.

“We hope that insurers, regulators and other stakeholders read this report in the context of the climate crisis and find urgent reason and opportunity to address the climate-related risks and opportunities related to their investments and underwriting, helping to accelerate the transition to a low-carbon economy,” said co-signatories Kentaro Kawamori, Mindy Lubber and Tom Reichert, CEO’s of Persefoni, Ceres and ERM respectively.