Flows into global sustainable funds continued at an accelerated pace in the third quarter, while the number of new products launched hit an all-time high of 166 for the three-month period to the end of September.

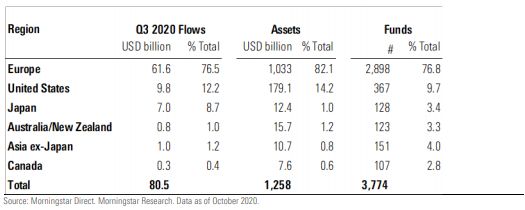

Stats in Morningstar’s Global Sustainable Fund Flows: Q3 2020 in Review show $80.56bn flowed into global sustainable funds, an increase of 14% on the previous quarter, and assets under management (AUM) climbed 19% to a fresh high of $1.23bn, having topped the $1trn mark in Q2.

European funds took the bulk of sustainable flows with 76.6% of the overall global inflows, albeit this was a slightly lower proportion than in Q2 when 86% was recorded. However, the region itself topped $1trn in sustainable AUM in the third quarter. US sustainable funds also took a lower proportion of the overall flows, at 12% compared to 14.6% in Q2, as investors’ interest from the rest of the world rebounded.

Canada, Australia and New Zealand, Japan, and Asia combined saw $9.1bn of inflows, compared to a £480m outflow in Q2. The report noted a newly launched fund in Japan that “garnered massive inflows of $5.5bn”.

Hortense Bioy, director of sustainability research, EMEA and APAC at Morningstar and ESG Clarity editorial panellist, commented: “The European sustainable fund space reached a milestone last quarter with $1trn of assets under management, an impressive feat when viewed against the backdrop of the Covid-19 crisis. The steady Q3 inflows were driven by continued investor interest in ESG issues, intensified in the wake of the pandemic.”

See also: – ESG fund outperformance begun well before covid downturn

Product development

Morningstar also highlighted the plethora of new products hitting the market continued with 166 new offerings launched in Q3. Adding to growth see around rest of the world, 38 of these new launches were outside of US and Europe – double the number seen in Q2. The total number of sustainable funds globally stood at 3,774 at the end of September 2020.

Bioy added: “The high level of product development we’re seeing in the European ESG space is unprecedented and, in part, in response to the European regulator that is aiming to reorient capital towards sustainable activities and align to the EU goal of net zero carbon emission by 2050.”

The 166 new offerings in Q3 2020 is up slightly from the 153 fund launches in the second quarter and breaks the record of 159 launches set in fourth quarter of 2018.

Europe

Inflows into sustainable funds in Europe “remained stable” with $62.6bn in Q3. Index and ETFs accounted for 31.8% of the total funds, up from 27% the previous quarter.

Assets increased 10% to top $1trn for the first time, while the overall European fund universe increased by 1.6%.

Some 105 new products came to the European market with these largely being broad ESG funds. However, Morningstar said 26% of launches were focused on the environment, and there were a number of new Paris Agreement-aligned funds unveiled including Lyxor S&P 500 Paris-Aligned Climate (EU PAB) (DR) UCITS ETF, Franklin S&P 500 Paris Aligned Climate ETF, and Swedbank Robur Access Edge Europe.

The third quarter also saw 32 conventional funds repurposed into sustainable offerings in Europe. The report explained: “Repurposing existing funds into sustainable offerings is a way for asset managers to leverage existing assets to build their sustainable-funds business, thereby avoiding having to create funds from scratch and, in some cases, accelerating the time frame required to reach scale. This may also be a way for fund companies to reinvigorate ailing funds that are struggling to attract new flows.”

Global Sustainable Funds Q3 2020