The Taskforce for Nature-related Financial Disclosures (TNFD) has published its final recommendations for nature-related risk management and disclosure, alongside additional guidance to help market participants get started with integrating assessment and corporate reporting related to nature.

The launch of the TNFD’s 14 disclosure recommendations comes after two years of design and development, with the aim to inform better decision making by companies and capital providers who wish to contribute to a shift in global financial flows towards nature-positive outcomes. The Taskforce will now encourage and support voluntary market adoption.

In answer to ESG Clarity’s question at the launch about whether policy or regulatory bodies plan make the TNFD’s recommendations a mandatory part of their disclosure framework, Tony Goldner, executive director at the TNFD, said it is up to governments to decide within their own individual contexts.

“As we have seen with [Task Force on Climate-Related Financial Disclosures] TCFD, a number of governments have now introduced mandatory reporting requirements based on their recommendations, so it is entirely possible that the same will apply to the TNFD recommendations, and in some markets, participants are now expecting that to happen.

“In Europe, for example, CSRD covers many of the aspects that we discuss within these recommendations, and over the past two years we have been working to align our approach so that it remains consistent with the CSRD’s requirements. Other governments have shown interest in what we are doing, but it is ultimately up to them to decide whether they want to consider it as a mandatory option.”

See also: – TNFD mandating discussions are underway

Alignment

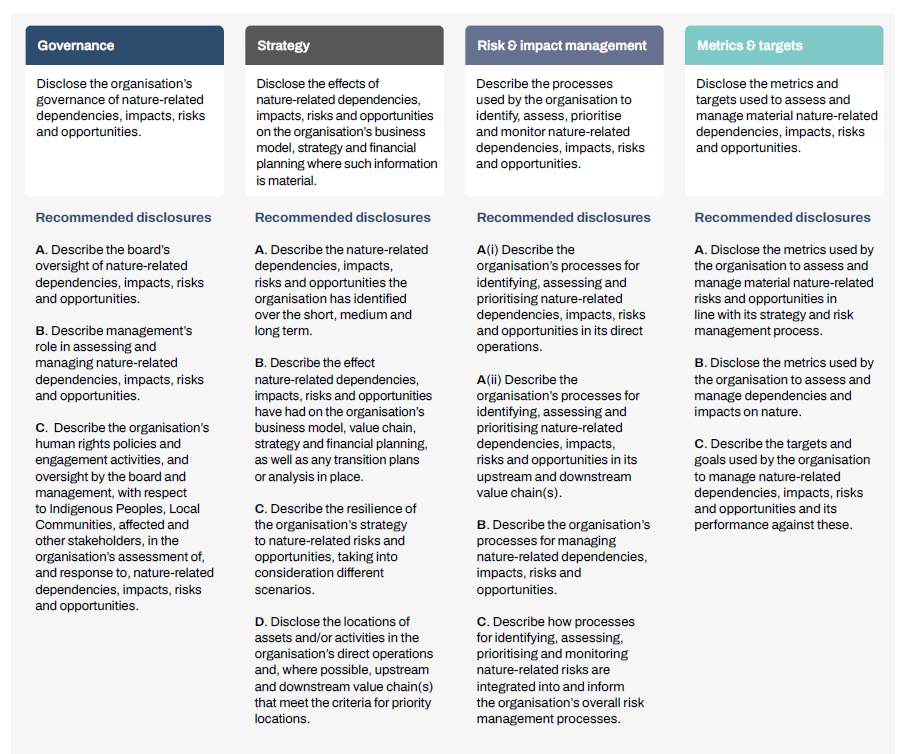

The 14 recommendations are incorporated within four conceptual pillars, in line with the disclosure framework developed by the TCFD: governance, risk and impact management, strategy and metrics, and targets.

They are intended to serve as a starting point for companies to begin identifying, assessing and disclosing the nature-related issues in their own time, and subject to their own strategy, materiality, cost and capability considerations.

TNFD’s recommendations and recommended disclosures

The recommendations are consistent with the TCFD, the ISSB and GRI standards, and are set to accommodate the different approaches to materiality taken by, for example, the ISSB and GRI standards..

They are also aligned with the requirement of Target 15 of the Global Biodiversity Framework for corporate reporting, which calls for assessment and disclosure of nature-related risks, impacts and dependencies, enabling companies to align their corporate reporting with global policy objectives.

“Nature loss is accelerating and businesses today are inadequately accounting for nature-related dependencies, impacts, risks and opportunities,” said David Craig, co-chair of the TNFD and former CEO of Refinitiv.

“Businesses and financial institutions now have the tools they need to act. Building on the language, structure and approach of the TCFD, and consistent with the International Sustainability Standards Board’s sustainability reporting baseline, the adoption of the TNFD recommendations represents a step-change in the momentum and capacity for business and finance to identify, assess and disclose their exposure to nature-related issues in a manner consistent with climate-related-reporting.”

Early adopters

According to the TNFD, policymakers, regulators, asset owners, asset managers and global companies are all increasing their focus on nature-related risk management and the necessity of mobilising private sector engagement and finance to tackle nature loss and scale-up nature-based solutions.

To that end, the Taskforce will track voluntary market adoption on an annual basis through an annual status report beginning in 2024.

Among the early adopters are GSK, which has announced its commitment to publishing its first TNFD disclosures from 2026, based on 2025 data. Others are anticipated to signal similar intentions in the coming weeks and the TNFD will announce an inaugural list of TNFD adopters at the World Economic Forum at Davos in January 2024.

“Protecting nature makes our business more resilient and helps us deliver for patients by ensuring the supply of raw materials needed to manufacture vital medicines and vaccines,” stated Julie Brown, chief financial officer at GSK.

“That is why we are proud to be a member of the Taskforce on Nature-related Financial Disclosures. We have started to implement the TNFD methodology to better understand our nature-related risks and opportunities and are committed to publish our first TNFD disclosures from 2026, based on 2025 data.”