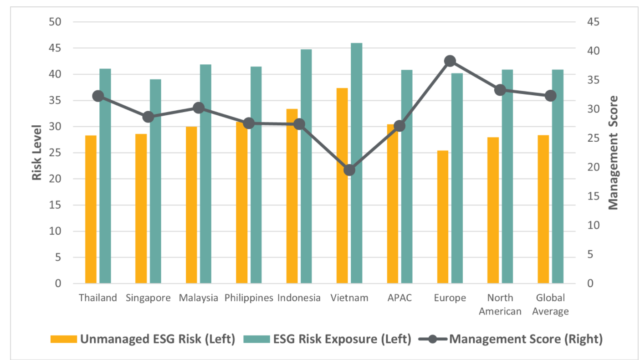

Thailand leads the six Asean countries (Singapore, Malaysia, Thailand, Vietnam, Indonesia, and the Philippines) in terms of average ESG performance, as a result of moderate risk exposure level and relatively good management score, according to the firm, which is owned by Morningstar.

However, compared with other regions, Asean countries have a higher ESG risk than companies in Europe and North American, while in line with the rest of Asia Pacific. Five out of six countries, except for Thailand, lag behind the global average level.

“All six countries require a particular form of ESG disclosure and governments provide guidelines to help issuers prepare sustainability information, “said Frank Pan, manager, Asia-Pacific research of Sustainalytics and author of the report.

“However, countries [such as] Indonesia and the Philippines only had a requirement after 2020; therefore, we might see further improvement in ESG disclosure in these markets in the next few years,” he said.

The stock exchanges in all six countries are members of the Sustainable Stock Exchange Initiative, and in the 2019 sustainability disclosure performance ranking by Corporate Knights, a research firm, the Stock Exchange of Thailand ranked ninth of 47 stock exchanges worldwide, the highest of all exchanges in the APAC region.

The Singapore Exchange, Philippine Stock Exchange, and Indonesia Stock Exchange rank 24, 30 and 36, respectively.

Vietnam and Indonesia show higher unmanaged ESG risk due to lower management score and higher exposure to high ESG risk industries such as steel, mining, oil and gas, electric utilities, and food, according to Sustainalytics.

The firm used it ESG Risk Ratings, which asses ESG risk exposure and ESG risk management. Exposure reflects the extent to which a company is exposed to material ESG risks; the management component incorporates company commitments and actions that demonstrate how the company approaches and handles ESG issues.

Disparate regional frameworks

The ESG disclosure regimes vary across the region.

In Thailand’s corporate governance code issued in 2017, the country’s Securities and Exchange Commission requires that company boards ensure sustainability reporting, as appropriate, using a framework that is “proportionate to the company’s size and complexity and meets domestic and international standards”.

In addition, the Stock Exchange of Thailand (SET) provides resources on its Sustainable Business Development Centre website to encourage best practices. As per the SET’s guidelines, Many companies choose to use the Global Reporting Initiative as their reporting framework, following SET guidance.

The Singapore Exchange published the Sustainability Reporting Guide in 2016, which requires every listed issuer to prepare an annual sustainability report on a comply-or-explain basis. The Guide suggests issuers select a globally recognised sustainability reporting framework that is appropriate for and suited to their industry and business model and explain their choice.

Issuers are also required to identify material ESG factors in financial terms, and their sustainability report should set out the issuer’s policies, practices, performance and targets related to the material ESG factors identified.

According to the listing requirements issued by Bursa Malaysia, issuers are required to disclose a narrative statement of the management of material economic, environmental and social (EES) risks and opportunities (a sustainability statement) in their annual reports.

For main market listed issuers, they must include in their statement information about governance structure, the scope of the statement and the management of material EES risks and opportunities.

In Vietnam, public companies must produce an annual report disclosing their environmental and social impact and objectives. In 2016, the State Securities Commission of Vietnam, in cooperation with the International Finance Corporation of World Bank Group, published an Environmental and Social Disclosure Guide, which is compiled based on the GRI G4 and encourages independent external assurance.

In Indonesia, all listed companies are required to publish Sustainability Reporting starting from 2020 according to the Indonesia Financial Services Authority. Moreover, financial services providers must also submit a Sustainable Finance Action Plan, which describes their plan for implementing sustainable finance.

The Philippines Securities and Exchange Commission requires all publicly listed companies to submit sustainability information together with their annual report on a comply or explain basis. A penalty for incomplete annual reporting is imposed on companies that fail to do the same.

Asean ESG performance comparison