“This is an important moment in our industry’s efforts to build greater confidence and trust among retail investors in the UK’s evolving sustainable investing market,” said James Alexander, chief executive of UKSIF, echoing the sentiments and general positivity among the investment community in the wake of the Financial Conduct Authority (FCA) launching their much-anticipated Sustainability Disclosure Requirements (SDR).

A fourth investment label, scrapping of the requirement firms outline a causal link between stewardship activities and asset improvements, and a new implementation timeline, are among changes to the final policy statement after the FCA made efforts to listen to market feedback during the consultation period.

Stewardship in the spotlight

One of the big talking points has been around changes to the rules around stewardship. Lindsey Stewart, director of investment stewardship at Morningstar, said that it is no great surprise that the ‘Sustainable Improvers’ label has undergone some revision following industry feedback.

“Being the first regulatory label of its kind that aims to accommodate investments intended to transition from the status quo to a more sustainable footing, there was a lot of emphasis in the FCA’s original proposal on demonstrating evidence of effective investment stewardship to avoid greenwashing. However, the final wording seems to acknowledge a fundamental issue in stewardship: namely that drawing a causal link between activity and outcome is usually difficult, and often impossible. So, some of the proposed stewardship requirements specific to ‘Sustainable Improvers’ have been dialled back and now feature as part of the general criteria,” commented Stewart.

“Firms are still required to ‘identify and disclose the stewardship strategy needed to support the delivery of [their] sustainability objective, including activities they expect to take and outcomes they expect to achieve.’ I think that’s a requirement that most industry participants could agree on.”

Seb Beloe, head of research at WHEB Asset Management, agreed: “The causal link between stewardship and outcomes clearly wasn’t going to be needed, because it is vanishingly rare that you can say it’s because of engagement that a certain thing happens. So I’m pleased to see this rule has been weakened because I think it was unattainable.

“I suppose it is possible that it creates some space for greenwashing, but I don’t think requiring a causal link was the solution. I think probably more transparency around those engagement activities is probably the solution.”

‘Mixed goal’ label

After taking feedback from the market, the FCA also revamped its labelling system to include a ‘Sustainability Mixed Goals’ label designed for multi-asset funds. Phuong Gomard, sustainable finance practice leader at Mazars, noted that this “provides a useful signpost for end consumers with multi-asset solutions and smaller investment pots”.

The addition was also welcomed by Ashley Hamilton Claxton, head of responsible investment and Royal London Asset Management: “One improvement is the addition of the fourth label for ‘mixed’ sustainable funds, recognising that, in reality, many clients may use discretionary fund managers or have pension products that must mix and match approaches in order to meet clients’ risk profile and financial goals. This is a welcome, practical suggestion that Royal London Asset Management was advocating for.”

However, there was some concern about the implementation timeline: “The timeline to comply may pose challenges, emphasising the need for firms to proactively embed the rules without delay to navigate any potential obstacles as soon as possible,” added Gomard.

Support for advisers incoming

Castlefield’s head of client management, Matt Ralph, also welcomed the FCA plans to establish an independent working group to support advisers: “The new requirements should allow advisers to have more meaningful conversations with clients about investing sustainably which we think is a really good thing. Importantly, we anticipate this will make it easier to compare different products and enhance clients understanding of their purpose and the associated risks.

“We expect a wider scope of products and services to be captured in the future underscoring the importance for advisers to understand and embed the changes in their advice processes. It is encouraging the regulator plans to establish an independent working group to support advisers, and we look forward to learning more about this initiative.”

Greenwashing and SFDR comparisons

The FCA also announced anti-greenwashing rules are still in consultation, and laid out a timeframe for implementation. This is important and timely, says Nick Britton, research director at the Association of Investment Companies, given the sharp increase in concerns about greenwashing.

“Our ESG Attitudes Tracker survey showed 63% of private investors are not convinced by ESG claims from funds, up from 48% two years ago. That’s a worrying trend, and the FCA’s measures are an important step towards restoring confidence in sustainability claims.”

Bhavik Parekh, research associate at MainStreet Partners, added the new FCA SDR is well thought out and “has clearly benefitted from watching developments in Europe.”

“The inclusion of a specific ‘anti-greenwashing’ rule rather than relying on the labelling regime alone allows the FCA to crackdown on greenwashing even if only minor. However, under both SFDR and SDR, asset managers are allowed to implement their own framework on what is considered sustainable, impact, improving, etc. This is not ideal (though no better system is viable currently), as shown by the already large difference in both quality of and disclosure on these frameworks between asset managers.

“That said, SDR does go further than SFDR with respect to greenwashing rules, which should help. For example, we estimate one in five Article 8 funds within MainStreet’s proprietary universe of funds are likely to be exhibiting at least some greenwashing. Under SDR, there is a higher bar than Article 8 currently has, meaning the chance of greenwashing is likely smaller. Similarly, an Article 8 fund with ‘sustainable’ in the title is permissible, but this will not be the case under SDR unless the fund has a label.

“These reasons amongst others mean the UK regime has a clearer line around what qualifies and what doesn’t on sustainability, which we welcome.”

What’s next?

While many within the investment industry are happy with the steps taken with SDR, there is also recognition that these are the first steps on a longer journey. As Julian Parrott, partner at advice firm Ethical Futures, said: “To use a baseball analogy, we are only on 2nd base and a long way from a home run.”

Despite Parrott citing positives such as the removal of unexpected holdings and maintaining the 70% threshold for a sustainability objective, he also noted ethical investment has been “left out in the cold”.

“Unless the fund has a sustainability bias complying with the 70% threshold, ethical investment has been overlooked, and I think this ignores an important driver for many clients, raising questions over terminology and the naming and marketing rules.

“Ignoring ethical could even lead to concerns over viability of these funds if they don’t have a label. FCA research shows people like labels – I suspect this will now drive business away from traditional ethical funds to shiny new labelled sustainability funds.”

UKSIF’s Alexander, meanwhile, offers further food for thought for the FCA on convening the Disclosures and Labels Advisory Group on a regular basis: “This could help the regime’s implementation in the market and monitor greenwashing risks. Crucially, the regulator should continue to closely engage with regulatory authorities in overseas markets to positively shape jurisdictions’ approaches to disclosures and fund labels and promote international harmonisation.”

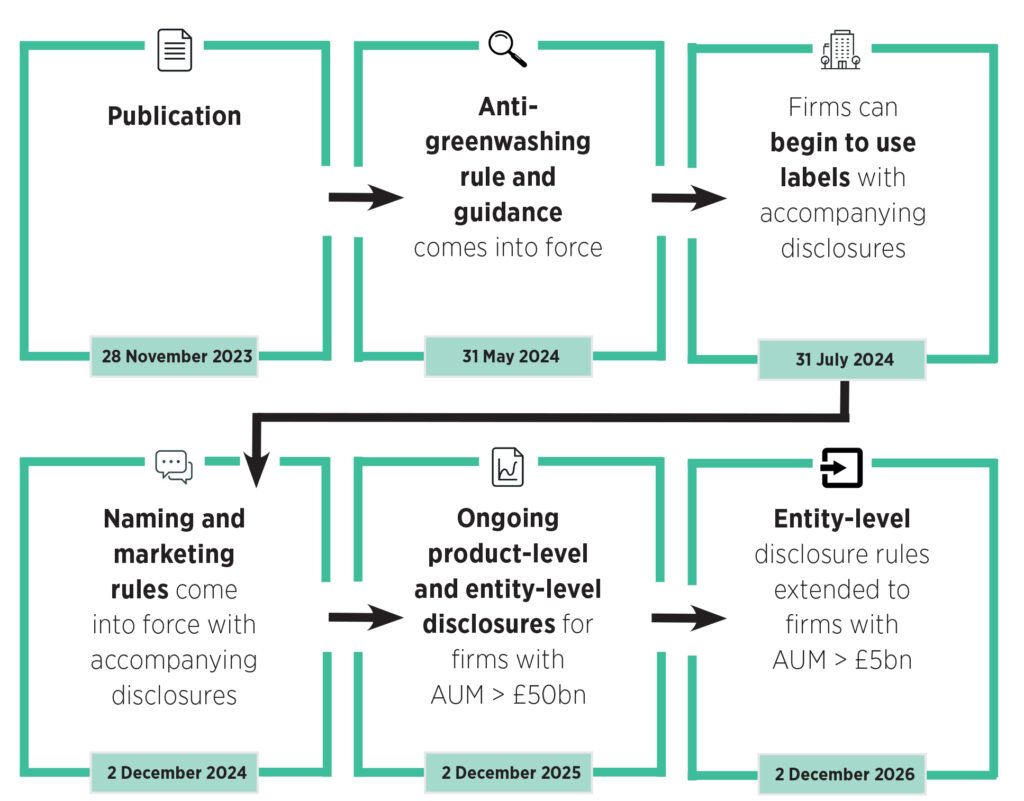

Implementation timeline

Source: FCA