Despite the “remarkable” growth in the number of climate funds on the market over the past five years, Morningstar has found the most common stocks held within these portfolios are not aligned with 1.5C and have “difficult-to-manage” carbon emissions.

In the annual report Investing in Times of Climate Change, Morningstar reported the menu of climate-focused funds offered internationally has grown from 200 in 2018 to 1,400 as at June 2023 – this includes open-end and ETFs. Assets in these funds sit at $534bn driven by a surge in inflows and product development over the past 18 months. The funds were broken down into low carbon, climate transition, climate solutions, clean energy/tech and green bond categories.

See also: – US fund groups have larger carbon footprints than European peers

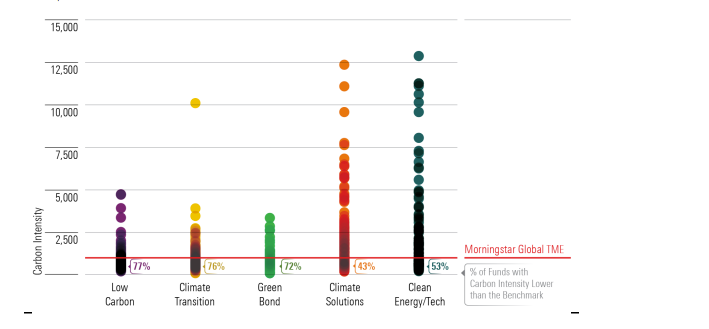

It found a high number of funds offering exposure to climate solutions also exhibit high carbon intensity. Morningstar analysed each portfolio holding within the funds and judged them on total emissions for Scope 1, 2 and 3 and aggregated at the fund level. Of the 1,157 funds analysed, 63% offered a carbon intensity better than the global equity benchmark, however, most climate solutions funds and close to half of the clean energy/tech funds exhibit higher carbon intensity than the benchmark.

“This reflects the fact that alongside pure-plays in the renewable energy sector like solar photovoltaic system manufacturers SolarEdge Tech and Enphase Energy, which score low on carbon intensity, many climate solutions and clean energy/tech portfolios invest in more-diversified companies that operate carbon intensive businesses. These currently high-emissions companies will be key drivers of the transition to a low-carbon economy,” the report said.

Carbon intensity for all fund groups (tCO2/$m)

Source: Morningstar Direct. Morningstar Research. Data as of June 2023.

Morningstar also tested climate funds’ exposure to fossil fuels by analysing the percentage of the portfolio that is exposed to companies with any revenue from thermal coal extraction, thermal coal power generation, oil and gas production, oil and gas power generation, and oil and gas products and services.

The overwhelming majority of low carbon (85%), climate transition (86%), and climate solutions (75%) funds have lower fossil fuel involvement than the index average of 11%. However, only 25% of green bond funds and 58% of clean energy/tech funds meet this criterion.

“This is because many of these portfolios invest in utilities companies that have built large renewable energy operations but still operate their legacy fossil fuel businesses”, the report explained.

However, when Morningstar tested funds’ exposure to oil and gas production the vast majority (88%) has lower exposure than the benchmark, which at the end of June 2023 amounted to 8.6%.

Most popular holdings

Morningstar also drilled down into the most popular 20 holdings within climate funds and gave them a Low Carbon Transition Rating (LCTR), which the firm said is a “science-based and forward-looking assessment of a company’s current alignment to a net-zero pathway that limits global warming to 1.5°C above pre-industrial levels”. These are expressed as an Implied Temperature Rise (ITR).

See more on LCTRs on ESG Clarity Intelligence: Morningstar Sustainalytics launches Low Carbon Transition ratings

Not a single company within the 20 most popular had an ITR of 1.5C or less, meaning they are not aligned with the Paris Agreement’s limit global warming to 1.5C.

The report added: “In fact, out of the 5,800 public companies currently covered under the LCTR, only one is aligned to a 1.5C pathway: healthcare firm Novartis, which can be found in roughly 120 of the 1,000-plus climate-fund portfolios for which we have equity holding data.”

Meanwhile, the 20 most common holdings in clean energy/tech funds are the most aligned, with average and median ITR scores of 2.4°C. Top companies in low carbon funds, on the other hand, tend to be the least aligned, with average and median ITR scores of 3.3C and 2.6C, respectively.

“This can be explained by the high and difficult-to-manage carbon emissions coming from the supply chain and/or customers (Scope 3) of top companies in broad market low carbon portfolios.”

Hortense Bioy (pictured), global director of sustainability research at Morningstar, commented on the findings: “The growth of climate-related funds over the past five years is simply remarkable and reflects the growing awareness of the investment risks and opportunities arising from climate change. Our analysis of these funds reveals a gloomy reality, though. None are aligned with the goal of limiting global warming to 1.5C. We’re not saying climate funds are greenwashing. The fact is that they’re investing in a tiny pool of companies and countries on track or close to being on track to achieve net zero emissions by 2050.”