The biggest challenge in reaching net-zero emissions is the inability to bring strategic capital where it is most needed, according to Isabel Chatterton, APAC head of industry, infrastructure and natural resources at the International Finance Corporation.

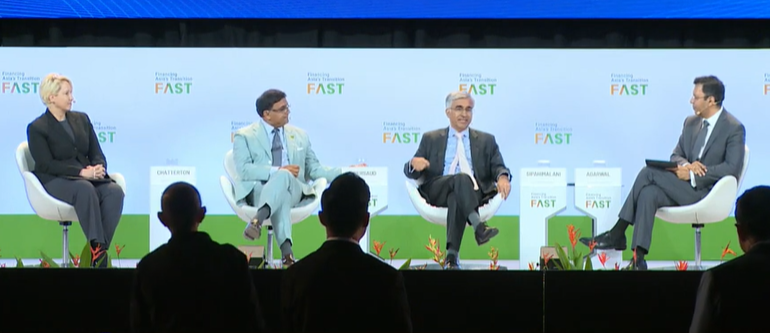

Chatterton’s comments came on the final day of Ecosperity Week during a panel discussion entitled ‘Scaling Climate Financing: Breakthrough Solutions and Pathways’.

“There is a misallocation of capital, most of the capital is really going into those spaces where the energy transition or climate story is not the most urgent,” she said.

Joining Chatterton on the panel at the Singapore event organised by sovereign wealth fund Temasek Holdings were Rohit Sipahimalani, chief investment officer of Temasek, and Avinash Persaud, special envoy on climate finance to the prime minister of Barbados.

Persuad added: “There is no pathway to [the world] fixing [its] problem without developing countries being fully involved”. He said the cost of capital to finance green energy projects in these regions are higher than those of developed countries because of “macro risks”.

These are typically currency related risks, or risks related to political stability of a nation which Persaud says can be addressed through the implementation of a foreign exchange guarantee for green transition projects.

Sipahimalani is of the view that regulation and policies by governments is critical in combatting these problems.

“What you need is governments willing to stand by clear policies and regulation. You need multilateral involvement, so that investors are confident that governments will stick to their commitments,” he said.

To explain this, he referenced Southeast Asia’s Green Economy 2023 report by Bain & Company, which indicated that only $5.2bn was invested in green projects in Southeast Asia in 2022, a quarter that of India.

He attributes this to the consistency of solar and renewable policy in India for more than a decade.

Singapore Sustainable Finance Association

Elsewhere at Ecosperity Week, the Monetary Authority of Singapore (MAS) announced it would establish the Singapore Sustainable Finance Association (SSFA), along with other financial institutions in the city-state.

The organisation’s initial focus will be on initiatives to scale voluntary carbon markets, transition finance and blended finance.

According to MAS, the SSFA will include representatives from financial institutions, financial industry associations, relevant corporates and service providers, such as ESG rating agencies.

Singapore’s senior minister Tharman Shanmugaratnam, who also serves as the chair of MAS, said he does not see carbon taxes “coming in time” to meet global net-zero targets.

“If we don’t have carbon taxes rising to adequate levels globally, without lots of free-riders, [then] we need financial regulation as a major public policy tool, and we must use it. Otherwise, the markets will be too slow.

“Many of our banks are taking a forward-looking view, but there is a lot of unevenness”, he said.

“The leading banks and financial institutions have to be provided clear guidance, so none of them has to move ahead of the rest and feel [a] competitive disadvantage. That’s why we need guidance across the board,” detailed Shanmugaratnam. He is slated to resign from his political posts on 7 July to stand for Singapore’s upcoming presidential elections.

Meanwhile, the city-state’s government is now looking to develop a new vehicle to catalyse blended finance in Asia by working with regional partners, Shangmuratnam said. This ranges from collaborating with government agencies to Singapore-based infrastructure financing vehicles like Clifford Capital and Pentagreen Capital, as well as commercial banks and multilateral development banks like the Asian Infrastructure Investment Bank, the Asian Development Bank and the World Bank.

Along with other government agencies, MAS said it is collaborating with industry players to explore platforms to channel blended finance at scale into transition and green infrastructure projects in the region.

Shanmugaratnam said: “MAS aims to bring together patient, concessionary capital from philanthropies, multilateral development banks, development finance institutions and donor partners. This will help crowd more conventional infrastructure financiers, including banks and institutional investors.”