Investors looking to reduce the biodiversity footprint of their portfolios are one step closer, with the release of the ISS STOXX Biodiversity Index Suite. Advisory firm Institutional Shareholder Services (ISS) and index creator Qontigo joined forces to build a suite of eight indices that screen companies deemed to inflict significant harm to biodiversity or that reduce its footprint.

Axel Lomholt, chief product officer for indices and benchmarks at STOXX said: “This launch comes as global investors are urged by some to account for and price nature into their sustainable investment strategies.”

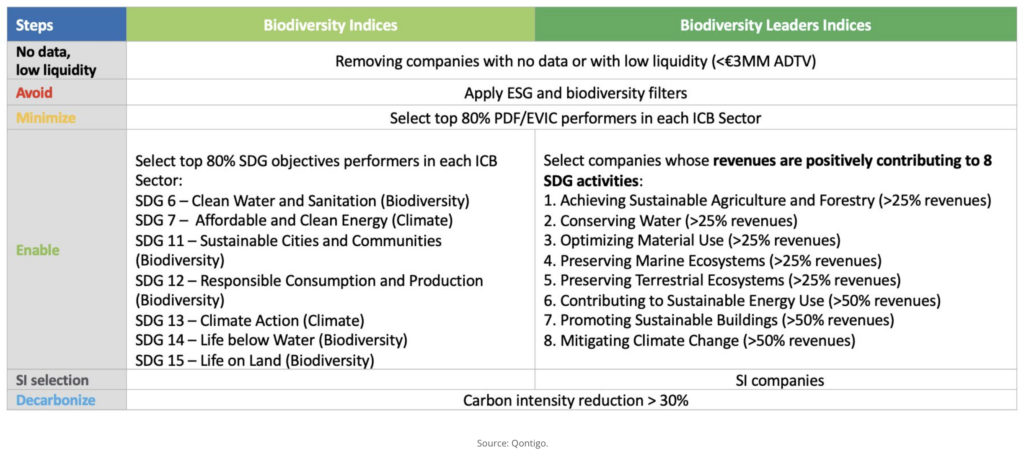

Seven of the indices track companies with high biodiversity and climate-related Sustainable Development Goal (SDG) scores using three screens. The index methodology targets an aggregate reduction in carbon intensity of at least 30 percent across the included constituents.

Meanwhile, the ISS STOXX Biodiversity Leaders goes one step further. It includes only companies that earn at least 20% of their revenues from activities that are deemed to make a positive net contribution to the UN’s SDGs, like preservation of marine ecosystems and sustainable agriculture and forestry.

The decline in the variety of the Earth’s living species is of growing concern to investors, but how to evaluate this growing risk is far from clear-cut. It is a “complex topic with data challenges”, according to data expert MSCI; as such, there is no general consensus on how investors can measure the impact and risk of biodiversity loss.

Nevertheless, it is moving up the global agenda. The UN SDGs 14 and 15 are to conserve both life below water and life on land, respectively. To mark International Day for Biological Diversity this year, the UN called on the private sector to invest in impact funds and other instruments, as part of its 23-action oriented goals to build back biodiversity. 196 countries have now signed up to the groundbreaking Kunming-Montreal global biodiversity framework at COP15 in Montreal.

“Investor focus on managing biodiversity impact has the potential to become as significant and enduring as the current focus on climate change,” said Lorraine Kelly, global head of investment stewardship at ISS (pictured).