Investors lack understanding and conviction a ‘just transition’ to a low carbon economy will be achieved, a Fidelity survey has found.

The survey, published in partnership with Coalition Greenwich, sought the opinions of over 120 institutional and intermediary investors to provide a deep dive into the awareness and appetite for a just transition. It found the concept, defined as achieving the transition to a low-carbon economy in a manner that is fair for everyone, is familiar to less than half (42%) of respondents, with awareness lower among Asian investors (30%) compared with European investors (47%).

Additionally, the survey found that investors were sceptical that a just transition is achievable, with 43% of respondents suggesting it is unlikely. Of those who do said it is achievable, more than a quarter (27%) believe the transition will take more than 15 years, while 52% said it will be an ongoing process.

“The scepticism we see from investors initially comes from a lack of familiarity with what is required to make it work, but once the concept is explained and broken down into practical examples assessed through measurable KPIs it becomes less daunting than it perhaps seems,” said Jenn-Hui Tan (pictured), chief sustainability officer at Fidelity.

“We know that decarbonising the entire economy is an enormous undertaking, given how heavily reliant we have historical been on fossil fuels for encouraging growth and development. So, to do that in a way that also manages its negative impacts is an even bigger task, and that is also a contributing factor that is fuelling scepticism from investors as well.

“However, we will not successfully decarbonise our economy without a just transition. If we were to simply pursue net zero as an exercise in reducing carbon emissions, without regard to how that might impact different communities, employees and industries, we are liable to lose the popular support for the transition.”

Among long-term investors, there is consensus in belief that investing in a just transition will have a positive (91%) impact on risk/return profiles, which serves to demonstrate that investors see this theme as an investment opportunity. Short-term investors, however, remain split on whether it will have a positive (21%), negative (26%) or neutral effect (52%).

When asked about the top reasons for investing in a just transition, over three quarters (77%) of respondents chose “having a positive impact on the environment by achieving net zero”. This correlates with the fact that 92% of the responses highlight the renewable energy sector as the most attractive from an investment perspective, followed by technology & IT (61%) and agrifoods (60%).

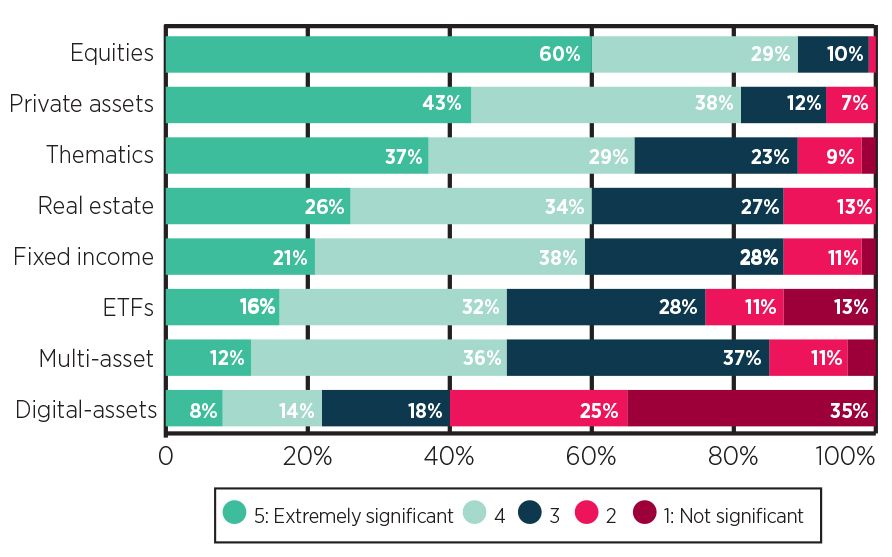

Asset class roles in achieving just transition

Source: Fidelity International

Moreover, in terms of asset class, 89% of investors believe equities (see graph above) will play the most significant role in achieving a just transition, followed by private assets (81%) and thematic investments (66%).

While these statistics show promising signs that investors see growth opportunities in achieving a just transition over the long term, the slow pace of development thus far can be attributed to several obstacles, such as a lack of clear government policy, proactive lobbying by legacy industries, geopolitical tensions and economic recession.

“A just transition encompasses a tangle of issues as it has many ramifications linked to climate, communities, labour markets and divergences between developed and developing countries. As a result, how to measure and implement a just transition is incredibly complex,” said Emilie Goodall, head of stewardship, Europe, at Fidelity.

“One thing is clear, though; the societal impact of transitioning to a sustainable economy must be a central consideration. While investors are starting to understand the importance of a just transition, our survey indicates that there is a need to promote further awareness.”