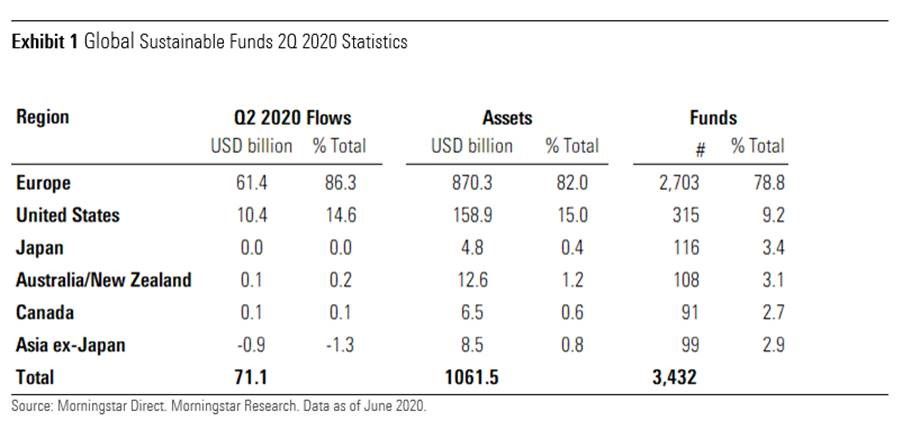

Flows into sustainable funds continued at a significant pace in the second quarter of 2020, climbing 72% to $71.1 billion, while assets under management reached record levels of over $1 trillion, according to Morningstar’s Global Sustainable Fund Flows report.

During a rebound following the coronavirus market sell-off, assets in sustainable funds hit a record high of $1.06 trillion during the three months ending June 30, which was 23% higher than at the end of the previous quarter.

In the report, Morningstar examined fund flows of 3,432 global ESG open-ended funds and ETFs in Q2. Sustainable fund flows accounted for almost a third of overall European fund flows, and sustainable equity funds continued to outpace their traditional counterparts.

“The continued inflows speak of the growing investor interest in ESG issues, especially in the wake of the COVID-19 crisis,” the report said.

“The disruption caused by the pandemic has highlighted the importance of building sustainable and resilient business models based on multi-stakeholder considerations.”

Hortense Bioy, director of sustainability research for EMEA and APAC at Morningstar and an ESG Clarity editorial panelist, commented on the report findings: “The European universe of sustainable funds is rapidly expanding by all measures: flows, assets, and products. The first half of the year saw a record number of new ESG fund launches. Asset managers also continued adapting their offerings by repurposing existing funds into ESG-focused funds and being awarded ESG labels.

“Investors have more options to choose from than ever before to build portfolios that meet their financial needs as well as their sustainability preferences. But at the same time, the need for clarity and standards on ESG has never been so pressing. It is encouraging to see that the COVID-19 crisis hasn’t stopped the EU regulator from making progress on the green taxonomy and disclosure requirements front.”

Although sustainable funds reported substantial inflows in Q1 – while traditional funds reported overall outflows – assets under management (AUM) in sustainable funds fell 12% to $846 billion amid investor despair at the start of lockdowns throughout the world. However, AUM has since rebounded with sustainable funds topping $1 trillion at the end of June.

Given the significant number of new products appearing in ESG Clarity’s Latest Launches fund stream, it is no surprise global fund launches in ESG also continued apace. Morningstar reported launches in all geographic regions covered in its study amounting to 125 new offerings in Q2 overall.

Europe

Sustainable funds in European countries continued to gain the lion’s share of flows, taking 86% of the total. The report said: “ Assets remain dominated by Europe, accounting for over 86% of the global sustainable fund universe owing to its long history of responsible investing and favorable regulatory environment.

“With currently 2,706 sustainable funds available and many more that now formally consider ESG factors in a non-constraining way to mitigate risk and/or find opportunities, Europe is by far the most developed and diverse ESG market.”

Inflows in to European sustainable funds more than doubled to $61.3 billion in Q2, meaning the quarterly organic growth stood at 79% on the previous quarter.

Overall, 107 new ESG products came to the European market, remaining level with the previous five quarters. Open-ended new offerings included RobecoSAM Global Green Bonds, DNCA Invest Beyond Climate, and Raiffeisen-SmartEnergy-ESG-Aktien, while in passives, Lyxor launched a series of climate change ETFs tracking Paris-aligned and climate transition benchmarks, as well as thematic ETFs, including Lyxor MSCI Millennials ESG Filtered (DR) UCITS ETF and Lyxor MSCI Smart Cities ESG Filtered (DR) ETF.

Additionally, asset managers continued to convert existing strategies into more responsibly invested vehicles, with 40 funds across Europe repurposed. Morningstar also said it had identified more than 586 live traditional funds in Europe that have transitioned into ESG-focused strategies in the past decade, including 477 that changed names to reflect their new sustainable mandate.

U.S.

The U.S. also continued its record pace of inflows in Q2, taking 14.6% of the global share, with estimated net flows of $10.4 billion. Much of this was in April when the nation recorded its largest monthly flow ever for sustainable funds with $5.8 billion inflows – mostly into equity funds.

Passives attracted 62% of flows for the quarter, a considerlable portion but lower than the 80% chunk in Q1.

AUM in sustainable funds in the US climbed to $159 billion, up a third on the previous quarter.

Morningstar also said the number of funds in the U.S. universe continues to grow with 21 new funds and three ETFs repurposed into ESG. Notably, there are also more than 20 new funds currently being registered with the SEC with Morningstar predicting a record number of launches in the U.S. this year.

Asia ex-Japan

Despite inflows in the more developed regions Asia ex-Japan saw $894 million of outflows from sustainable funds in Q2, almost cancelling out the record $905 million inflows in Q1.

See also: – Interest in ESG investing grows in Asia

Morningstar said every country registered lower flows, but China registered the most with $1 billion outflow.

“This considerable outflow can be explained by a well-known practice in the country called “churning”. Chinese investors commonly treat equity fund launches like stock IPOs. They buy them, hold them for a few days or weeks, and sell them as soon as the funds have generated a certain return,” the report said.

Taiwan recorded the largest inflow for the region for the second consecutive quarter indicating consistent appetite for ESG funds in the country. It saw $130 million of inflows in Q2.

Sustainable fund assets grew to $8.5 billion, the fourth consecutive quarter of expansion and up 11% from March.