The latest Progress Report from Glasgow Financial Alliance for Net Zero (GFANZ), launched during COP28, has highlighted continued progress with members on track to publish transition plans this year, while they are also prioritising closing investment and data gaps for the year ahead.

According to the report, GFANZ saw strong adoption of the Net-Zero Transition Plan framework that was delivered at COP27 last year and it expects to see approximately 250 financial institutions publish their transition plans based on it in the next year. Policymakers in several major economies including the US, UK, EU, Singapore and Hong Kong have already recommended or mandated transition planning by financial institutions and businesses.

Membership has risen by over 20% in sector-specific alliances affiliated with GFANZ, with two new net-zero alliances, a third regional network and two chapters launched within the last year, the report highlighted. GFANZ affiliated alliances now comprise over 675 financial institutions from 50 countries, with more than 100 financial institutions joining this year alone.

Mark Carney, GFANZ co-chair and UN special envoy on climate action and finance, said: “At the outset of 2023, we set two priorities: the mainstreaming of transition plans and the mobilising of capital to emerging and developing countries. The commitment of dedicated financial institutions has driven significant momentum in both. We are focused on building on this progress by going where the emissions are to ensure that finance flows to those countries and industries with the ambition to reach net zero.”

COP28 initiatives

GFANZ announced at COP28 it would be among the founding members of a new Global Capacity Building Coalition, designed to provide technical assistance to financial institutions in emerging and developing markets. Alongside institutions such as Principles for Responsible Investment (PRI), the IMF and Bloomberg Philanthropies, the collaboration was formed in response to requests for support to develop transition plans through capacity-building, training, knowledge-sharing and research.

GFANZ has also partnered with the Industrial Transition Accelerator to represent a financial industry perspective in a multi-stakeholder effort to harness leading heavy-emitting industrial decarbonisation efforts by business, governments, finance and civil society. Additionally, the Alliance has made efforts to actively support material progress on the Just Energy Transition Partnerships in emerging markets such as Vietnam, Indonesia and Senegal, as well as endorsing the work of the Net-Zero Data Public Utility in providing climate transition-related data in a free and accessible manner.

Nature, indices and carbon

Outlining key 2024 priorities, GFANZ said aiming to integrate nature into net-zero transition plans, support the development of next-generation net-zero indices, unlock high-integrity carbon markets and support current and developing public-private finance solutions in Indonesia, Vietnam, Brazil and Senegal was high on the agenda.

Similarly, closing the data gap will be a key focus with GFANZ supporting the work of the Net-Zero Data Public Utility (NZDPU), which aims to address the limited availability and variable quality of climate data critical for the net-zero transition.

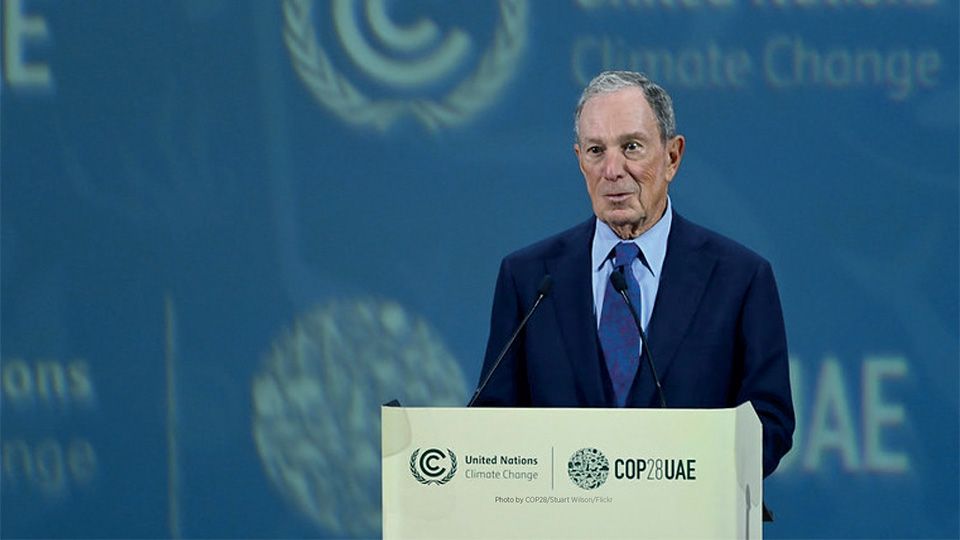

“Businesses and investors increasingly have the data they need to identify risks from climate change and find the emissions that are driving it,” said Michael R. Bloomberg (pictured), GFANZ co-chair and UN special envoy on climate ambition and solutions.

“Armed with that data, more and more of the world’s biggest financial firms are producing plans to reach net-zero emissions, with many more on track to do so in the year ahead. This is a critical step forward in the fight against climate change that can help to unleash the capital we need to invest in clean energy, decarbonise heavy-emitting industries, and build a more resilient global economy. The faster we move, the more lives we will save and improve.”