In this series for ESG Clarity EU, Hargreaves Lansdown dives into ESG funds available in the UK and EU, analysing their investments, performance and ESG credentials.

For this latest article, Dominic Rowles takes a look at the Janus Henderson UK Responsible Income Fund.

UK Equity Income funds are often the first port of call for UK-based income investors.

But our analysis of the IA UK Equity Income sector suggests more than 60% of UK Equity Income funds invest in tobacco companies, with an average weighting of 4.2%. 84% invest in oil and gas, 81% hold mining companies, and around 45% invest in aerospace and defence businesses.

It’s easy to see why. These sectors have traditionally paid some of the highest dividends across the UK stock market. The current average yield of the UK’s two largest tobacco companies, for example, is a whopping 7.9%. Tobacco dividends have tended to be relatively stable because people buy cigarettes regardless of how the economy’s doing.

Some investors might want more income but feel uncomfortable that their money could be used to support industries they think are unethical. For those people, an exclusions-based income fund could be an option.

Fund team

The Janus Henderson UK Responsible Income fund aims to provide a good level of income alongside capital growth over the long term while avoiding areas some may find unethical, such as tobacco, armaments and fossil fuel extraction. That could make it a strong choice for investors who would prefer their money didn’t support controversial industries, or those seeking to diversify a more traditional equity income portfolio.

Andrew Jones has managed the fund since January 2012 and has more than two decades of experience managing UK equity income funds. He started his career at GT Management in 1995, and managed his first fund from 1999, shortly after GT Management was acquired by Invesco. He left Invesco in 2005 and joined Henderson as a portfolio manager in the UK Equities Team.

Jones is supported by the wider Janus Henderson Global Equity Income team, which is stacked with experience. Three members of the team – Job Curtis, James Henderson and Alex Crooke – have more than three decades of investment experience individually. Janus Henderson’s collaborative culture means Jones can make the most of the experience around him.

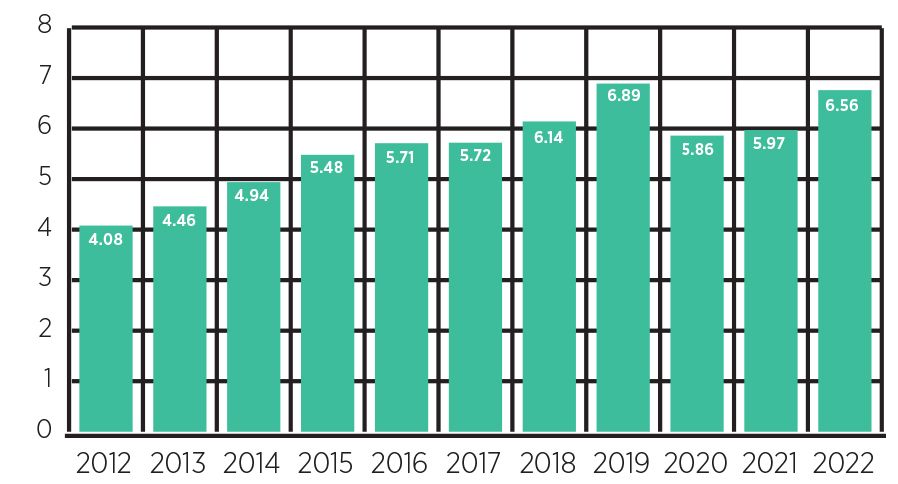

Dividend growth under Jones’s tenure (pence per unit)

Exclusions

The investment process starts with a screen that excludes companies involved in areas like alcohol, armaments, gambling, non-medical animal testing, nuclear power, tobacco and fossil fuel power generation, although companies generating power from natural gas may be allowed if the company’s strategy includes a clear plan to transition to renewable energy power generation.

All investments must also be compliant with the UN Global Compact (a United Nations pact on human rights, labour, the environment and anti-corruption).

From the remaining universe, Jones looks for companies with proven and understandable business models, high-quality management teams and strong positions in their industries. He thinks about how the company defends its position through competitive advantages like brand strength and intellectual property, and whether those advantages can endure over time. He also likes companies in a strong financial position with plenty of cash flow, allowing them to reinvest for future growth, while at the same time rewarding shareholders with rising dividends.

Finally, he considers the company’s valuation, applying a range of valuation techniques that are relevant to the company and the industry it operates in.

Current investments include Renishaw, a specialist engineering company that designs and manufactures high tech measuring and calibration equipment. The company is highly innovative and invests significantly into research and development each year. This approach has led to the company growing very strongly over many years.

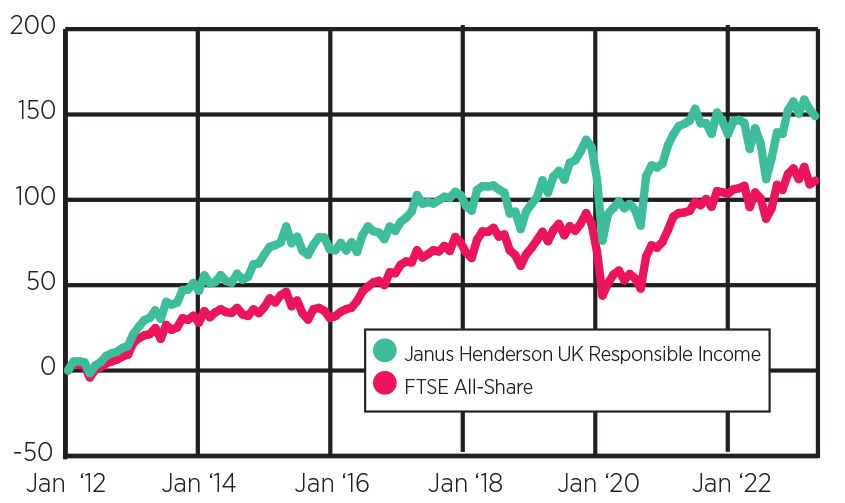

The fund’s exclusions mean I expect it to perform differently to the broader UK stock market, and its peers in the IA UK Equity Income sector. But Jones has done a good job of growing the income over time, particularly given the additional challenge of managing an exclusions-based fund.

Performance differs from peers but rises to income growth challenge