In this series for ESG Clarity Asia, Morningstar dives into ESG funds available in Asia, analysing their investments, performance and ESG credentials.

For this latest article, Morningstar manager research analyst Steven Le takes a look at Fidelity’s Sustainable Emerging Markets Equity Fund.

Fidelity Sustainable Emerging Markets is a reasonable investment offering that has some appealing attributes, but the current portfolio manager, Amit Goel, has more to prove because he is in the early stages of managing this strategy.

Goel took the lead role on this strategy in May 2021. Goel’s analytical background in Asian and Indian equities is a likeable aspect; he began managing the Asian equity component of another Fidelity emerging markets strategy in 2014, before rising to co-manager in December 2019, as well as becoming the sole lead of an Indian equity strategy from February 2020.

While this gives him the relevant knowledge and experience to run an emerging markets fund, it’s too soon to form a stronger view because of his relatively limited portfolio management experience and short tenure managing the strategy.

The strategy seeks high-quality companies in structural growth segments or market-leading positions. It targets companies that have strong governance, sustainable business models and a healthy balance sheet. The portfolio leans towards a growth investment style, though Goel’s valuation discipline is likely to ensure this isn’t too pronounced.

The portfolio consists of around 40 stocks, with the top 10 names normally accounting for approximately 40% of assets. Ideas can come from up-and-down the market-cap spectrum, as well as any of the emerging markets regions depending on the company’s fundamentals. Giant- and large-cap stocks typically compose more than 90% of the portfolio, meaning an increase in assets under management shouldn’t impede performance.

As of August 2023, the portfolio’s largest absolute country exposure was India making up around 19%, followed by 17% in China, 14% in Taiwan and 10% in Hong Kong. From a sector viewpoint, financials dominated in exposure accounting for 30% of the portfolio, succeeded by information technology at 25% and consumer discretionary at 17%.

The fund must have 70% of its net assets invested in securities deemed to maintain sustainable characteristics, defined by measurements from third-party ESG ratings agencies or Fidelity Sustainability Ratings. The remaining 30% must be invested in issuers that have improving characteristics or with potential for improvement as determined by Fidelity. The are also formal exclusions that apply to strategy such as weapons, fossil fuels, tobacco, gambling and more.

The strategy performed exceptionally strong in calendar year 2021, though Goel assumed control about halfway through the year. The portfolio he inherited from the former portfolio manager was well prepared for the volatile environment over the period, with existing positions such as an underweighting to China relative to the Morningstar Category Index (MSCI Emerging Market Index), including ecommerce giant Alibaba, and an overweighting in consumer sportwear company Li Ning among the top performing positions.

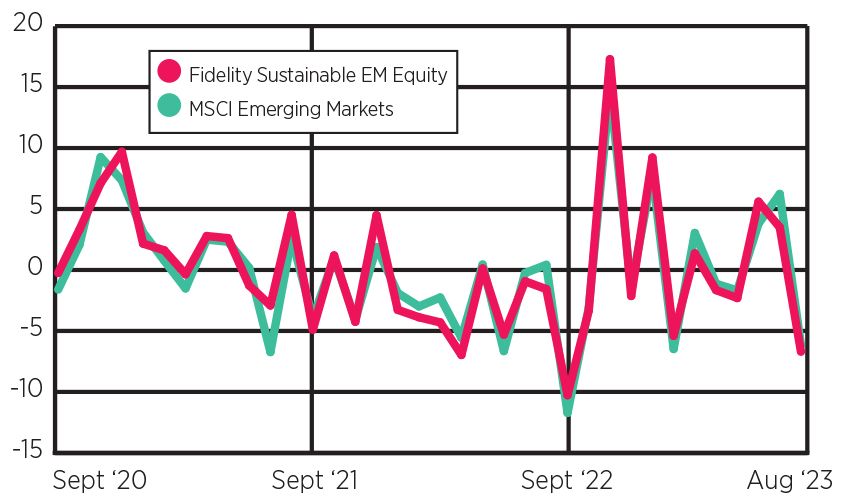

Over his full tenure to August 2023, the strategy is keeping pace with the Morningstar Category Index, despite both posting negative returns during this time. Although, it’s important to note that this is a relatively short timeframe, as well as quality as an investment style and emerging markets broadly have faced challenges over this period.

Goel inherited the portfolio halfway through 2021

Source: Morningstar