Today, the food and farming industries are facing a daunting task. It is estimated that they will need to produce more food in the next 40 years than humankind has produced in its entire history, while working with more limited resources.

At the same time, they are under pressure from consumers and regulators to make production healthier for people and the planet: our food system currently contributes one-third of global greenhouse gas emissions.

COP26 has accelerated pressure, with governments around the world pledging to hit net zero, but there is still a long way to go.

Meanwhile, Russia’s invasion of Ukraine has exposed the vulnerability of global supply chains.

One-third of global wheat exports come from Russia and Ukraine, as well as crucial crop inputs such as fertilisers. With exports halted, fertilisers and natural gas prices have dramatically increased, becoming unaffordable for farmers, which in turn, has impacted output.

The global yield of rice – the third largest crop in terms of calorific provision – could drop by 10% this year.

On top of this, we are facing some of the biggest labour shortages we have ever seen.

In the US, there are currently 11.5 million vacant job positions, and the agriculture sector is being hit particularly hard.

A perfect storm of crises is hitting food and farming, highlighting the immediate need to move towards self-sufficiency in order to achieve global food security.

We are at the start of a tech-driven food transition, much like the energy transition we have seen unfold over the last 20 years.

Investing in technology is the most important enabler of an agricultural revolution, which is why we channel capital to sustainable projects, embracing technological innovations to improve agriculture and food value chains around the world.

At a time when the resilience of global food supply chains is increasingly under threat, this tech-driven food transition offers an incredible investment opportunity.

Let us look at the robots that are reducing environmentally harmful fossil fuel inputs at vineyards.

Currently, the European grape industry uses 62% of all fungicides produced and distributed in Europe. These chemicals, derived from fossil fuels, are sprayed across grape orchards every 7 – 10 days from spring to harvest. They end up as a residual in the fruit and from there enter our water supply.

To mitigate the need for fungicides, a Norwegian company, Saga Robotics, has developed an innovative technology.

Ultraviolet lights are mounted onto robots and driven along the aisles of grape orchards at night. The UV-B light destroys powdery mildew, the red spider mite and other harmful pests, without the use of fossil fuel inputs. It also does so far more cheaply and without creating natural resistance in pathogens.

Insect pollination is a critical aspect of the global food supply chain, but we are seeing a drastic loss in colonies and a lack of pollination providers, which again results in higher costs for farmers.

In the US, the annual average rate of honeybee colony loss is 45.5%. But globally, around 75% of crop species require some form of insect pollination, critical to yields.

BeeHero has developed a technology that detects key metrics required for hive health using relatively simple and cheap in-hive sensors coupled with advanced data analytics and AI.

Acting as a sort of ‘bee broker’, BeeHero can help farmers to dramatically reduce hive losses, providing them with real time insights into pollination efficiency and hive strength through user-friendly applications that can be accessed remotely.

If costs are preventing farmers from embracing technology, a Californian-based company, Burro, has come up with a solution.

The company has developed a robotic ‘wheelbarrow,’ the cheapest robot in agriculture today, that learns how to go from the picker to the packer and back, ‘speaking’ to other platforms and saving on physically demanding, repetitive tasks.

These machines cost $11,000 – 12,000 per piece. In terms of labour savings, they will pay back the farmer in under two months.

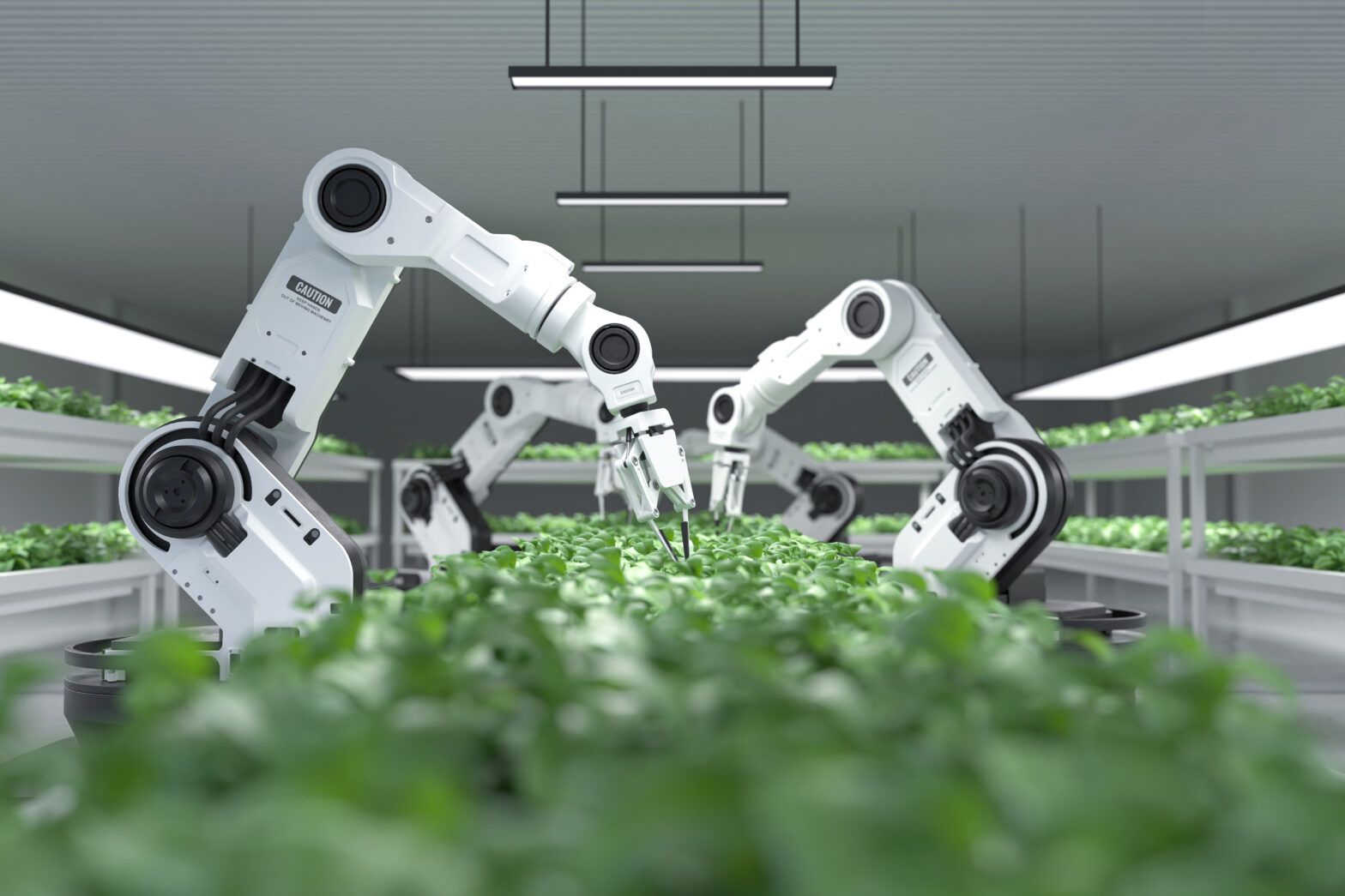

Finally, robotics in indoor farming is one of the most exciting places to be.

Certain fruits and most vegetables can now be grown indoors, with the indoor market set to grow at 18.7% between 2022-2027.

Dutch robotics company ISO Group, uses robotics and AI to sort, grade and plant seeds before propagating them at scale, allowing farmers to overcome the enormous challenges associated with finding labour to perform such menial, low-tech tasks.

For investors in the agrifood tech sector, the principal challenge is finding entrepreneurs who take great ideas and turn them into commercially realistic companies.

The speed by which this gets done is determined by adoption. We must tell farmers, growers and the financiers who support them, that it is time to embrace the opportunities made available by the tech-driven food transition.