We selected five of the most commonly used European climate funds to understand what type of companies, besides those involved in the transition to a low carbon economy, ESG investors are being exposed to.

The five funds are: 1) Nordea 1 – Global Climate and Environment Fund; 2) BNP Paribas Climate Impact; 3) DWS Invest ESG Climate Tech; 4) CPR Invest Climate Actions; and 5) Amundi Index MSCI Global Climate Change.

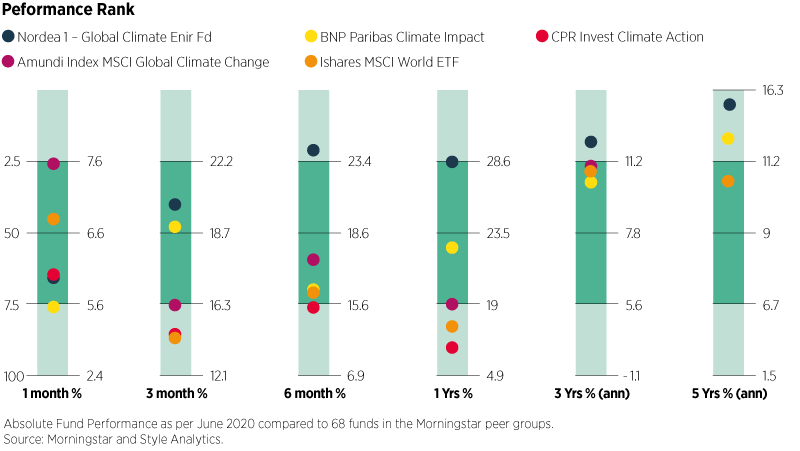

These funds were analysed over the past two years compared with the MSCI World Index and their Morningstar peer group (Sector Equity Ecology), which includes 68 funds as of June 2020.

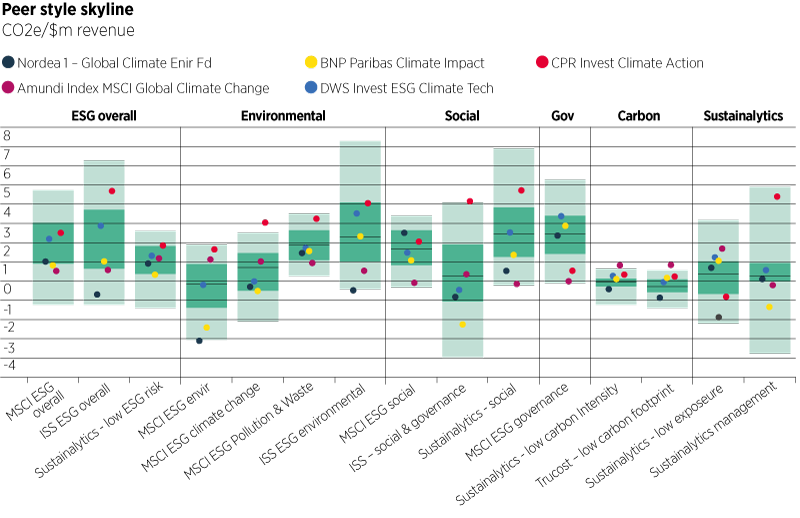

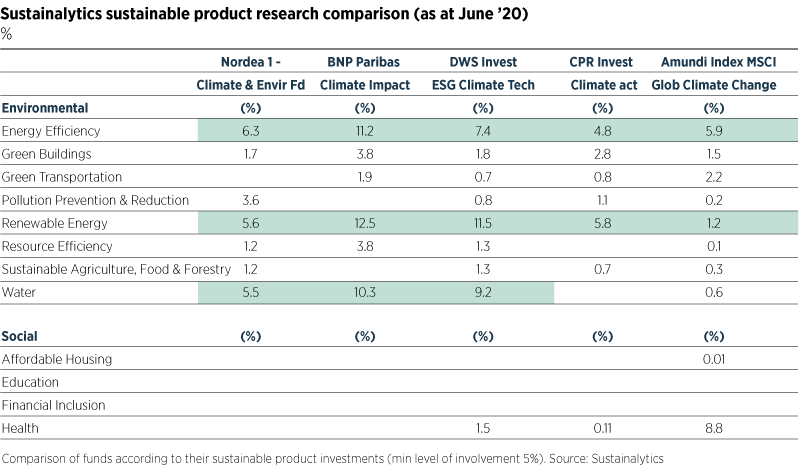

As you might expect, these top-selling climate funds have a better-than-average ESG score. Predominantly, ‘climate’ investing means a focus on energy (efficiency and renewability) and water.

But they also have:

- Low exposure to the ‘size’ factor, meaning they invest in smaller companies than the MSCI World Index;

- Strong bias towards high volatility and momentum stocks; and

- Bias away from value and yield stocks when compared with the benchmark.

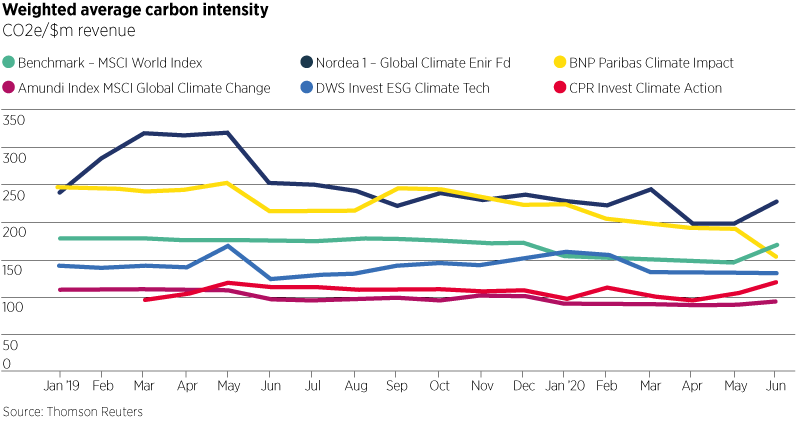

Interestingly, just over half of the funds have a consistently lower carbon exposure than the MSCI World Index. Looking at the funds’ exposures to carbon intensive companies using the standard measure of tons CO2 emissions per million dollars of annual revenue, we can see three of the funds – CPR, Amundi and DWS – consistently score better (lower) than the benchmark across time. CPR Invest Climate Actions is the clear stand-out across almost all ESG factors. It consistently scores better than the benchmark in terms of low carbon exposure.

There is a trade-off between good ESG and good returns. Funds with less strong environmental results had high returns. However, all five funds outperform the MSCI World Index across the short term (see below).

Factor bias

It is unsurprising that climate funds tend to invest in smaller-cap companies given they tend to be younger and more ‘ESG-minded’. There is also a correlation between size and volatility. The climate funds exposed to larger companies (for example Amundi) also have the lowest volatility of the five climate funds (larger-cap companies tend to be less volatile than smaller-cap companies).

Three out of the five are biased towards high volatility stocks (Nordea, DWS and BNP) and all but one (BNP) invest in high momentum stocks. The two consistently highest performing funds, Nordea and DWS, show a small overexposure to factors with modestly positive returns (volatility and momentum), but crucially they have big under-exposure to the factors that have generated lower investment returns – value and yield.

The bottom line is the five most popular European climate funds give investors exposure to the low carbon transition trend, but also mean investors are likely to be exposed to more volatility and momentum, and less value and yield. Someone who buys these climate funds is getting a factor bias, whether or not they know it and whether or not they want it.