Historically, emerging markets companies have lagged their Western counterparts on ESG awareness, but in recent years this situation has been improving. Governments in major emerging market countries have been rethinking their ESG-related policies. China and India have a long way to go, but China has committed to become carbon neutral before 2060. The China Securities Regulatory Commission also issued a set of risk disclosure rules in June this year that highlighted a growing interest in environment protection and social responsibility. In India, market regulator SEBI played a proactive role in making the country responsive to the implementation of an efficient ESG policy mechanism.

While intentional ESG mandates have started to appear in recent years, there have been some long-standing strategies with a heritage of focusing on the ‘G’ side. Quality growth offerings from the likes of JPMorgan, Fidelity, Stewart Investors, ASI, Comgest and Somerset stand out in this regard. Their investment approaches have favoured characteristics such as corporate governance, sustainability of a franchise, fair treatment of minority shareholders, management quality and sustainable capital allocation.

See also: – Grappling with governance in China to find green transition opportunities

In the past few years, some of the “quality growth” teams have started building on their existing capabilities and formally integrating ‘E’ and ‘S’ factors into their fundamental research and analysis. This has resulted in the launch of ESG specific mandates, such as JPM EM Sustainable in November 2019 and Somerset EM Future Leaders in September 2020, which use formal sectoral exclusions (tobacco, fossil fuels, weapons) as well as aiming to identify ESG leaders.

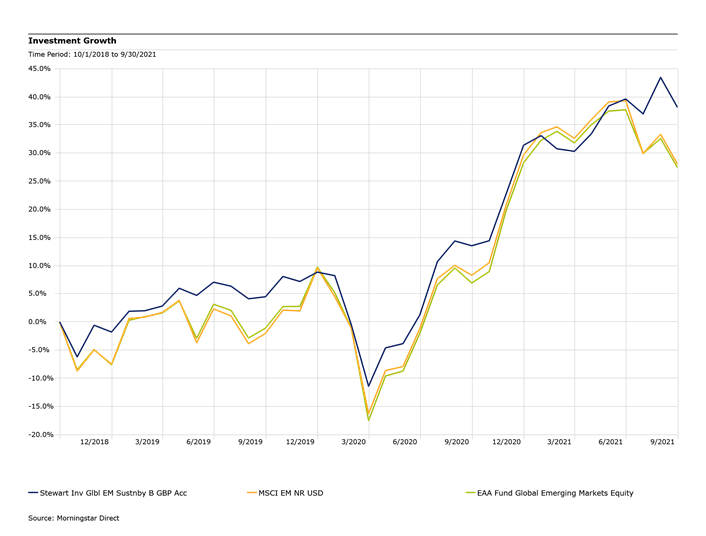

Stewart Investors Global Emerging Markets Sustainability

The strategy ranks among the industry’s finest global emerging markets equity ESG options, and it earns a Morningstar ESG Commitment Level of Leader as a result.

This strategy is led by the group’s 12-member Sustainable Funds Group, which is experienced and stable. The team focuses on hiring individuals with a passion for ESG matters, and all members fully incorporate ESG research into their daily work.

The team focuses on finding management teams with a shared vision of driving sustainable development in the markets in which they operate. A by-product of this philosophy is that the strategy will not invest in companies with material exposure to harmful products, including weapons, tobacco, alcohol, fossil fuels, and gambling. What’s more, the vision extends to more-subjective areas, including certain soft drink and snack manufacturers, with the rationale being the negative health effects of their product portfolios on the general population.

The team is responsible for the vast majority of ESG analysis, and active ownership is part of its tool set to try to improve the sustainability of companies it invests in. Outside the fundamental ESG analysis, the team works with two external ESG research providers to verify that holdings are not involved in harmful industries or breaching social norms.

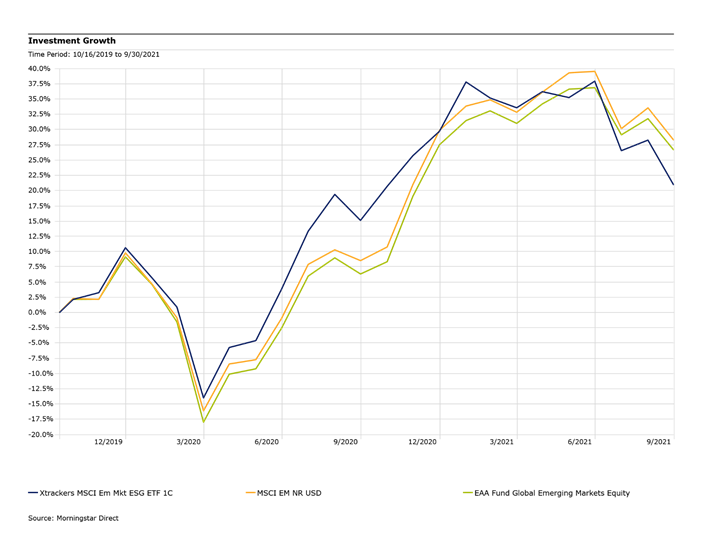

Xtrackers MSCI EM ESG ETF

Xtrackers MSCI EM ESG receives a Morningstar ESG Commitment Level of Advanced. The strategy seeks to negate carbon risk exposure.

This strategy begins by applying MSCI’s values-based exclusion criteria to select against controversial business exposures that carry heightened ESG risks. This mostly includes companies that derive more than 5% of their revenues from subsectors such as (but not limited to) controversial weapons, tobacco, gambling, nuclear power, or thermal coal. The MSCI Low Carbon Exposure methodology then applies two screens.

The first is a carbon emissions screen that excludes the highest 20% of carbon dioxide emitters from inclusion. The second is a potential carbon emissions screen that excludes 50% of the potential carbon emissions per dollar of market cap of the parent index. This screen is designed to select companies with low exposure to fossil fuel reserves.

The strategy does well to elevate the ESG profile of an otherwise market-cap-weighted strategy. As of our review, the fund receives a Morningstar Carbon Risk Score of 9.3.

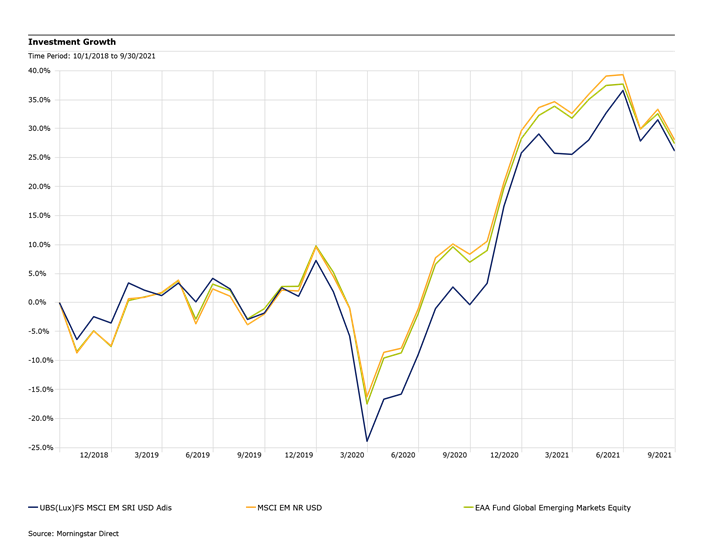

UBS ETF MSCI Emerging Markets SRI

UBS MSCI Emerging Markets SRI warrants a Morningstar ESG Commitment Level of Advanced. It offers investors a combination of strict business involvement and climate change-based screening to create a strong ESG offering with an elevated carbon risk profile.

This fund takes the MSCI Low Carbon Select 5% Capped methodology and applies it to the MSCI Emerging Markets universe. It combines MSCI’s Values and Climate Change-based Exclusions hard screens with a custom version of MSCI’s Low Carbon Exposure methodology. The MSCI Global Low Carbon Leaders applies two screens.

The first screen ranks the Parent Index’s constituents by carbon emission intensity. The top 10% of securities are excluded from the fund’s index, namely MSCI Emerging Markets SRI Low Carbon Select 5% Issuer Capped. The index methodology also applies a sector cap. If the cumulative weight of the stocks in any sector is 30% lower than the weight of the sector in the Parent Index then no additional stocks are excluded from that sector.

Meanwhile, the second screen identifies companies with low exposure to fossil-fuel reserves. Stocks in the Parent Index are ranked by their potential carbon emissions per dollar of the company’s market cap. Stocks are removed until the cumulative potential carbon emissions of the excluded stocks are half of the Parent Index’s total potential carbon emissions.

Given the strength of the methodology, the resulting portfolio carries moderate tracking error in the region of 4%-6% relative to its parent benchmark, the MSCI Emerging Markets Index.