Assets in Article 9 and Article 8 funds have exceeded €5trn for the first time, research from Morningstar has found.

SFDR Article 8 and Article 9 Funds: Q2 2023 in Review found despite outflows of €14.6bn from Article 8 funds in the second quarter of 2023, total assets in both Sustainable Finance Disclosure Regulation (SFDR) classifications – mainly in passive funds – rose by 1.4%.

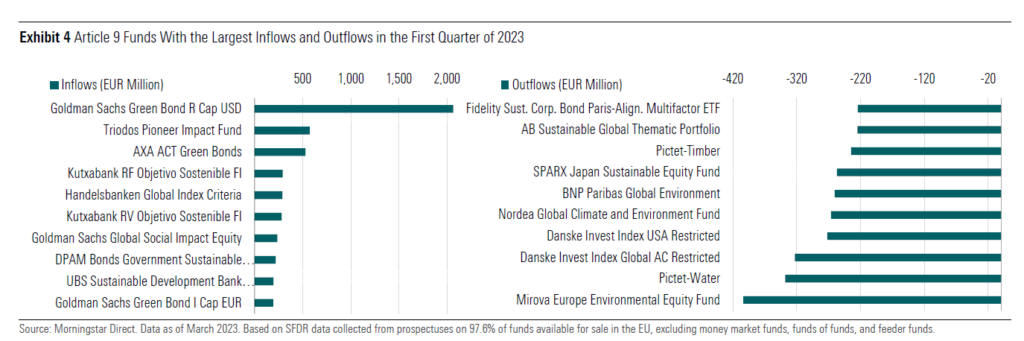

Article 9 funds continued to see inflows, attracting €3.6bn this quarter, but this represented the lowest inflows on record for funds using this classification.

“Despite the continuously challenging macro environment and the net outflows, assets in Article 8 and Article 9 rose over the second quarter,” commented Morningstar global director of sustainability research and ESG Clarity EU Committee member Hortense Bioy.

Morningstar also found fund reclassifications under SFDR have slowed this quarter with only six downgrading from Article 9 to 8.

Following the wave of reclassifications at the start of the year due to the introduction of Level 2’s regulatory technical standards, Morningstar’s report found this trend to be easing off, with around 180 funds upgraded to Article 8 from Article 6 this quarter, while only six downgraded to Article 8 from Article 9. Seven Handelsbanken Paris-aligned index funds, which were previously downgraded to Article 8 from Article 9, reverted to Article 9. This compares with around 350 Article 9 funds downgrading to Article 8 in the same period last year.

Last summer ESMA specified that funds making Article 9 disclosures should hold only sustainable investments, except for cash and assets used for hedging purposes, and Morningstar found a higher proportion of funds are therefore upping their sustainability requirements, although the number of Article 9 funds with 100% sustainable investments (62) remains largely unchanged.

A much higher proportion (75% versus 69% three months ago) of Article 9 funds report committing at least 80% exposure to sustainable investments. Additionally, 41% of Article 9 funds now report targeting between 90% and 100%, compared with 38% in March.

Similarly, in the last three months, 190 Article 8 funds updated their minimum sustainable-investment allocations. Asset managers are also keen to add carbon emission reduction objectives to their strategies. Close to 600 Article 8 and Article 9 funds now report having a carbon reduction objective.

This shows many funds (59% of Article 9 for example) are not meeting ESMA’s requirements for sustainable investments, which complements recent findings from MSCI that 88% of Article 8 funds and 63% of Article 9 funds did not include taxonomy-aligned investments.

According to MSCI’s paper, this may be attributed to a shortfall in disclosures by underlying companies, whether as a result of the “incomplete nature of the EU taxonomy” or the level of stringency set for sustainable activity.

SFDR requires asset managers to disclose Principle Adverse Impact (PAI) indicators, the deadline for which was June 2023. Like MSCI, Morningstar found differences in scope of disclosure, asset mix, data sources, and methodologies made comparisons between managers impossible.

“They just started to disclose PAIs at entity-level,” Bioy said.

“PAIs are a cornerstone of SFDR, but their implementations remain a challenge, not least because of a lack of standard data and methodologies. Investors will need to understand the limitations of these new disclosures and learn how to use them over time.”