Fund managers should pay attention to portfolio diversification as well as sustainability goals when investing in decarbonisation and renewables, according to Amundi’s head of equity solutions Piergaetano Iaccarino.

After a prolonged bear market in clean energy and renewables stocks, many investors have been wondering if their desire to put money behind decarbonisation has come at the cost of returns.

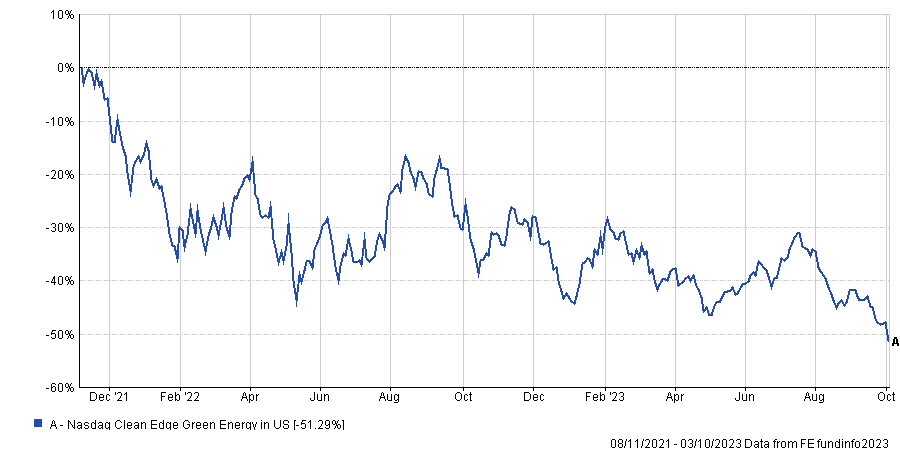

The Nasdaq Clean Edge Green Energy Index is down over 50% from its peak in 2021 after a boom in sustainable fund inflows and a bust on the back of markets adjusting to stickier than expected inflation and central banks raising interest rates to levels not seen two decades.

However, Iaccarino argued that there is no need to compromise on returns if investors avoid falling into the trap of tunnel vision – focusing solely on one particular theme like renewables or clean energy.

He said: “Renewable projects tend to be more long-duration and with long-duration project builds in an inflationary environment, you have an overrun in terms of costs, you have an increase in financing costs and the economics don’t work anymore.”

Similarly, if such an investor only picks companies that have great ESG credentials, they are often paying a premium for the stock relative to their competitors, colloquially dubbed the ‘ESG premium’.

This means fund managers run the risk of overpaying for their investments and giving up future returns in favour of being committed solely to investing in firms with the best ESG practices.

“If you only invest in the best-in-class companies from a sustainability perspective, you run the risk of having a clear growth bias, and when growth is out of fashion and value comes into play you will underperform because you have this style tilt,” Iaccarino explained.

Iaccarino is the portfolio manager of multiple Amundi recently launched ESG funds including Global Equity Sustainable Income, Global Equity ESG Improvers, and Net Zero Ambition Global Equity.

He revealed that despite running sustainability focused funds, his bottom-up approach led his team to avoid investing in any renewables stocks because they were worried about the factors mentioned above.

“We had the privilege of not investing in renewables thanks to a wide spectrum of opportunities that we chase,” he said. “We are not subject to this boom and bust that is quite typical of the more thematic funds.”

As the strategy approaches its one-year launch anniversary, it is up 7.6% over the past 11 months, roughly in line with 7% from the MSCI World Climate Paris aligned benchmark but well ahead of the 34% decline in the Nasdaq Clean Edge Green Energy index.

“Investment is intrinsically a selfish activity,” Iaccarino said. “Your main objective is your own returns. There is this belief that there is a trade-off between your own goals and the planet’s goals.”

“But there is no trade off,” he asserted. “I’m deeply convinced about that.” If ESG is fully integrated into the analysis of an investment case, instead of being “painted on” like some investment firms do, he argued that investors can understand the fundamentals of a business better.

This is why Amundi uses its own proprietary Return on Invested Capital (ROIC) adjustment labelled ‘environmental capital’. When assessing a company, the investment team adjusts the company’s assumed ROIC to include the costs and capital expenditure the company will need to spend to reduce its carbon intensity.

ROIC is a common way investors assess a company’s ability to generate value through their activities. This is primarily because financial capital is limited in different forms such as equity, bonds, working capital, etc.

The problem with ROIC as it stands today is that it assumes other capital is unlimited, one of which is the environment. “There was no need to price the use of planet because the assumption was that the planet is unlimited,” Iaccarino said.

“We’ve finally realised that the planet has limited resources, so to the overall concept of return on capital should be extended beyond the financial capital into any sort of capital that is limited,” he added.

“In our case we focus on the environmental capital that is limited, once you expand the concept of invested capital and you extend it beyond the financial drivers you get a better idea of how the company is behaving.”