A coalition of asset managers and owners representing $5trn in assets is launching a framework assessing the low-carbon transition progress of governments.

The Assessing Sovereign Climate-related Opportunities and Risks (Ascor) project hopes to get asset managers talking with sovereign debt issuers in order to facilitate more net-zero aligned issuance, as well as provide a one-stop shop framework for issuers to use.

“Unlike other asset classes such as equities or corporate credit, there is currently no internationally agreed framework for assessing the climate-related risks and opportunities associated with sovereign debt instruments,” the consultation report for the framework said.

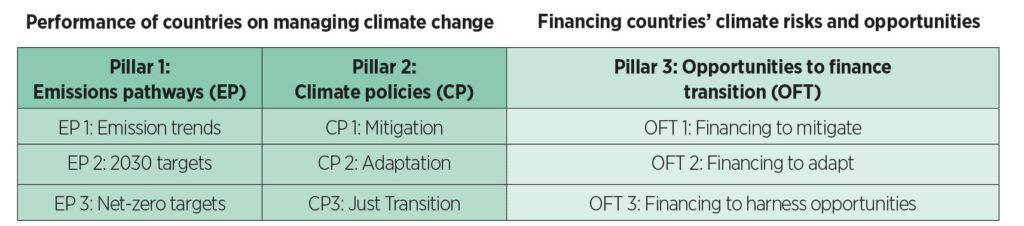

Using publicly available data, the framework is composed of three pillars organised under nine themes, each of which includes ‘yes’ or ‘no’ indicators and, where relevant, quantitative metrics.

Framework overview

It will show how each country performs on each indicator, and then provide a ‘yes’, ‘no’ or ‘partial’ for each of the themes, similar to the format of the Climate Action 100+ benchmark.

The aim is to make it easier for issuers to demonstrate their progress on climate change to investors over time, thereby giving investors the relevant information to integrate into decision-making to reduce their exposure to climate risk and increase their financing of climate opportunities.

“The Ascor framework and country assessments will also help prioritise issuer engagement efforts to support increased ambition and help investors meet their net-zero and just transition commitments,” the report said.

The framework builds on the initial structure tested by the project’s academic partner, the Transition Pathway Initiative Global Climate Transition Centre.

The coalition includes Ceres, the Institutional Investors Group on Climate Change, the Principles for Responsible Investment and Sura Asset Management, and is supported by Chronos Sustainability. Its advisory committee includes Allspring Global Investments, Amundi Asset Management, Colchester Global Investors, Franklin Templeton, MFS Investment Management and Ninety One.

The project is currently seeking feedback for the framework by 31 March 2023 via this survey from governments, development finance institutions, investors, civil society, academia and the wider public.