The much-delayed UN biodiversity summit COP15 is finally underway in Montreal, where governments are expected to agree on a new Global Biodiversity Framework. Our societies and economies are already facing the ravages of environmental breakdown – and this could be a moment to change our planet’s future.

Human activities are driving a rate of species loss that is between 1,000 and 10,000 times higher than the natural extinction rate. According to WWF’s Living Planet report, global wildlife populations have collapsed by an average of 69% since 1970. The ‘five horsemen of the nature apocalypse’ – land-use change, overexploitation, climate change, pollution and invasive alien species – are destroying ecosystems and undermining the services they provide and which we rely on. Almost half of global GDP is generated by sectors that are moderately or highly dependent on resources extracted from forests and oceans, or on healthy soils, clean water, pollination and a stable climate.

See also: – All ESG Clarity’s COP15 coverage

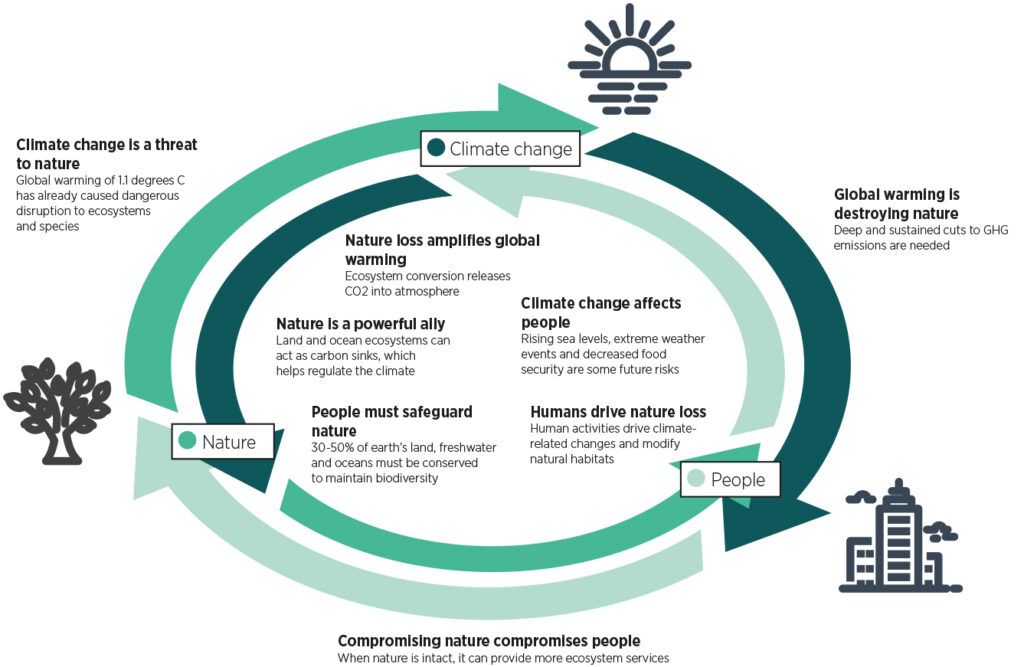

The climate and nature crises are deeply linked and require shared solutions. While the disagreements over quitting fossil fuels and scaling up efforts to cut emissions at the recent UN climate talks (COP27) were disastrous for our planet, governments there did at least recognize the importance of nature-based solutions. In Montreal, early signs of the draft agreement from COP15 are far from ambitious overall, despite some early progress on including the rights of Indigenous Peoples and local communities.

The scale of the challenge is enormous and the resources to address it are slow to arrive. According to the UN, annual investment in nature-based solutions needs to triple by 2030 in order to halt biodiversity loss, limit global warming to 1.5°C and tackle land degradation. To reverse the decline in biodiversity by 2030, we need to close the biodiversity financing gap that stands at an average of $711bn per year.

There are some key ‘must-haves’ for a strong Global Biodiversity Framework, including a clear goal like that of the Paris Agreement, and targets on finance and subsidies that can close this finance gap. This is what we need from leaders in Montreal so that we can unlock private capital for nature and trigger the transition to a nature-positive economy. There is enormous economic opportunity here: the World Economic Forum estimates that almost 395 million jobs could be created by 2030 from ‘nature positive’ economic activity.

The deliberations in Montreal will set the tone for the world’s response to biodiversity loss, but their outcome is only one part of the story. We are seeing a growing realization of the peril that nature is in, and a greater willingness – among voters, consumers, business and investors – to take action.

What should that action look like? At WWF, we have been encouraged to see companies commit to measuring, reporting and reducing their impacts and dependencies on nature. We are supportive of voluntary efforts such as the Taskforce on Nature-related Financial Disclosures and the Science-Based Targets Network that seek to drive financial flows toward nature-positive activities, while also encouraging a much stronger public policy response to addressing the dual crises of climate change and nature loss. We have also actively called for a Global Biodiversity Framework that is rights-based, recognizing the rights and leadership of Indigenous Peoples and local communities as stewards of nature.

Irrespective of the outcome in Montreal, financial institutions can play their part by following the guidance of the Taskforce on Nature-related Financial Disclosures; developing credible, science-based transition plans; aligning their portfolios with a net-zero, nature-positive future; and continuing to call on governments for the wider financial system reform we so badly need. Private sector investment will be essential to deliver nature-based solutions at scale, which should complement, rather than replace, aggressive action to reduce impacts on climate and nature.

We are running out of time. COP15 and an ambitious Global Biodiversity Framework can help accelerate the action our planet and its people so desperately need. But regardless of the outcome from Montreal, the private sector can play its part in addressing the nature and climate crises.