Following the recent invasion of Ukraine by Russia, European leaders have been reminded of the region’s high dependency to fossil fuels extracted in Russia. Addressing Europe’s energy independence is going to be a mammoth task, but increasingly necessary for politicians wanting to limit reliance on Russia. More than 40% of Europe’s natural gas imports come from Russia so achieving energy security will require a dramatic shift in policy. Fortunately, policymakers have several options.

We could see some of the dirtier fossil fuels such as coal used in greater quantities. However, a good proportion of Europe’s coal imports also come from Russia, and dirtier fuels would be counterproductive to existing climate change goals. There has been some discussion in the UK around whether fracking rules should be changed. But new natural gas-fired plants take two to three years to bring online.

There has also been some debate around how nuclear power can play a role in the energy mix. But new nuclear capacity is also likely to come online too late. Reactors regularly take more than 10 years to complete – construction of the UK’s Hinkley Point C began in 2018 and is not expected to come online before 2026, 14 years after it was first approved.

Fortunately, there is an attractive solution that is consistent with climate change goals and has shorter lead times: renewables. Unlike the years-long timescales for nuclear and gas, a solar installation will take approximately six months to bring online (depending on the size and scale of the project), while small-scale wind farms can be built in as little as two months.

Market valuation

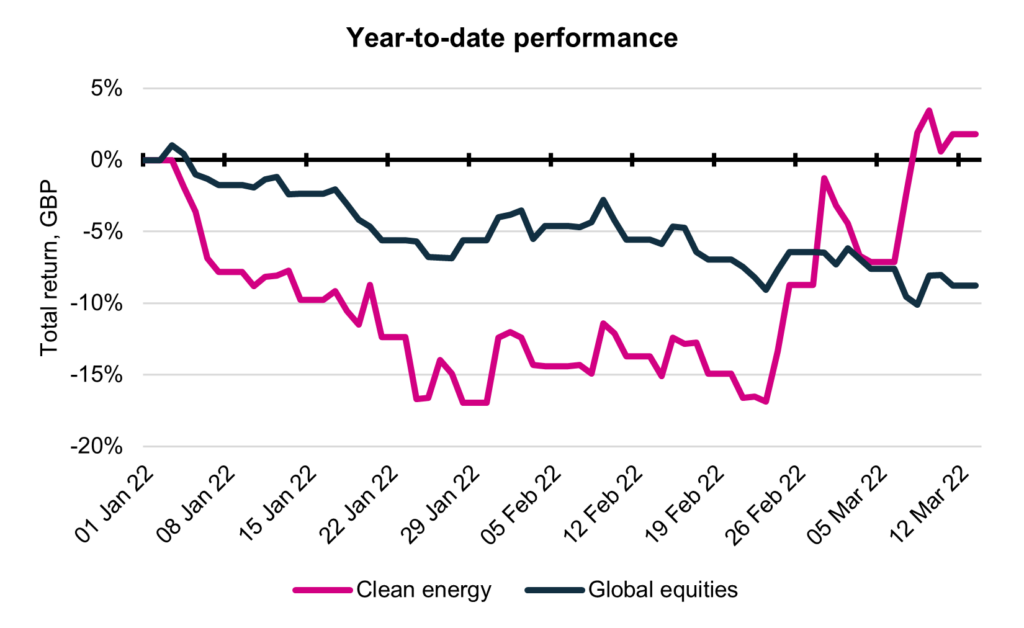

Since the start of the year, many renewable energy companies had seen their share prices dropping by 20% or more until the conflict in Ukraine started. This was due to rising concerns for inflation, where faster growing companies had seen an almost indiscriminate selling pressure regardless of whether underlying businesses were performing well or not versus expectations.

Consequently, clean energy stocks have been trading at valuations at or below levels prior to the announcement of the US infrastructure plan that significantly boosted the growth expectations for the sector. It is therefore no surprise to see the renewable energy sector bounding back sharply since the invasion of Ukraine as governments highlighted their ambition to become energy independent.

Despite this recent bounce back, the renewable energy sector is still trading at attractive valuations as the long-term prospects of renewable energy companies remain underestimated by the market. Though there may be some shorter-term re-alignments to increase energy security, many governments around the world are committed to the long-term goals of achieving net-zero emissions by 2050.

To do this, new solar farms will require more specialist glass equipment and wind farms will need more blades and turbines. So, the adoption of renewable energies globally (and particularly in Europe) is likely to accelerate in the coming years as they provide a partial but necessary solution to reduce dependency on Russian gas. Until now, there have been barriers to rolling out renewables at a large scale such as an inherent volatility in solar or wind generation. But developments in energy storage is providing a solution to this intermittency. Finally, the rise in fossil fuel prices is making renewable business models even more attractive from a financial perspective.

The need to secure homegrown energy supplies and fight climate change, means renewables should be the key pillar of the new government energy strategy. This will help free the UK from dependence on imported oil & gas and spare households and businesses from the effects of wild fluctuations on global energy markets.

With smarter grid plus storage, it will be virtually impossible to compete against renewables economically by the end of the decade.