Running impact strategies and measuring the various impact outcomes can be complex and nuanced, so some asset managers have drawn on the expertise of external research houses to complement their own work.

Wellington Management has collaborated with the MIT’s Joint Program on the Science and Policy of Global Change and climate research institute Woodwell Research Centre to more deeply understand physical risk scenarios and how this can impact portfolios.

Here, Louise Kooy-Henckel, Wellington Management’s EMEA director of sustainable investing, talks us through how the group defines impact, how the research collaborations have helped equip the in-house team and discusses creating impact portfolios across different asset classes.

How does Wellington Management define impact?

We see a lot of different approaches and definitions across the industry, which leads to very different outcomes.

Impact investing was one of the earliest portfolio approaches on Wellington’s sustainable investment platform; the climate strategy came first in 2007 and we started investing in impact on the public equities side in 2015.

For a large asset manager, we were probably one of the first to enter that space – we had seen more approaches in the private equity space where impact investing originated, but this was newer in terms of equity markets.

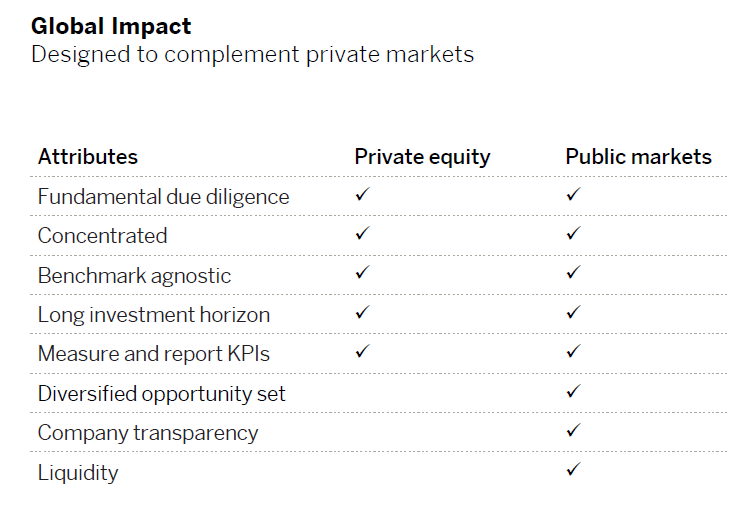

Our definition was one we anchored to all things that had been working very well. We carry out deep due diligence around every investment, have a long investment horizon, and are not benchmark focused. We report and manage impact as it had been done in private markets.

We tried to sort through the shortcomings that clients were concerned about on the private side, such as lack of deal flow, liquidity and transparency, and provide a fund giving broader access to impact investing outside of venture capital.

We set a high bar coming from private markets to public markets and only look at companies’ products and services if they are trying to tackle big world problems and have at least 50% revenues doing so – but, in reality, it is much higher across the board.

We also look at the concept of additionality; the companies’ products must be additional to what is already in market and not easily replicated.

How is impact investing measured?

Its an exciting area of the market and a complex one. A lot of work is being done to standardise market practices, which is slightly difficult. We rooted our approach in what worked on the private side and started a ‘logic’ model with five different assessments of impact.

We also look at how are they spending on research and development, what are their outcomes, how is this actually affecting people and the planet, and how does this contribution roll up in the global problem we are trying to work on.

It has been well received by clients as it is hard data, and it is something we can hold ourselves and our investees accountable for.

Can you provide some examples of areas you look at for impact investing?

We tend to focus on investment through a thematic framework that is divided into three categories.

- Life essentials: Food, water, health, shelter, affordable housing.

- Human empowerment: Increase access to basic financial services, education, job training, bridging the digital divide, safety and security.

- Environment: Alternative energy, resource stewardship and resource efficiency

We hold investments across all three at all times but some are easier to measure than others.

An area that is more challenging is developing cures for Alzheimer’s disease as it is difficult to measure improvement of life. It is more aspirational to be honest.

The environment is easier as everyone is measuring CO2, what is being generated from renewable energy and the alternative solutions that are coming into play.

In affordable housing, we are looking for newer concepts where companies are really understanding how they are improving the community for people that live there through transport links and better food options.

We think about outside the investment itself – how can they operate in the community for people that live there? The companies we invest in always have boots on the ground to understand how the people live there are having their lives enriched.

Tell us more about Wellington Management‘s collaboration with the MIT’s Joint Program on the Science and Policy of Global Change.

Wellington’s work on climate has held a long-term belief around the importance of climate change and how it will impact markets and economies over time.

We started a research collaboration prior to MIT with Woodwell research partnership and the interesting thing we found was that markets up until that point were not focused on physical risk – which was something we wanted to do.

The work we have carried out with MIT has been tremendously additive to client portfolios. It has really helped us to understand climate physical risk much better and very much underpins Wellington becoming a founding signatory of the Net Zero Asset Managers’ initiative in December 2020.

The MIT partnership is a really strong complement to our own research and what we were already doing with Woodwell. We have the best of three worlds working together focused on transition risk and scenario analysis.

It helps us to understand how to best equip our research teams as it is very nuanced and complex. Different climate and policy scenarios interacting will create very different outcomes, economic implications and impact. Our work with MIT helps us to understand that better and get that into our client portfolios.

This year, we have also worked with MIT to think about doing deep sector dives in carbon industries – we have already covered energy and transport but we also want to look at the technology and the potential of new tech such as hydrogen and carbon capture.

What has demand been like for your impact strategies? Is this accelerating?

Impact has seen very strong momentum and demand and has been strong across most of the platform. So we see some regional differences in take-up, but that is not a surprise.

Also, the market is very preoccupied at the moment in understanding what is being offered and it is very important for them to understand what they are getting with these portfolios. Clients are on different sustainability journeys and the more I think we can help them with approaches the better.

What does the future hold for impact at Wellington Management?

We have been building up our impact franchise and one of our strengths as a large asset manager is we have capabilities across equities, fixed income and alternatives.

We have been building up a range of impact options so global equity, bond, debt impact, private equity, for example.

We are now working on a dedicated emerging markets strategy.

There is this idea of total portfolio activation and more advanced clients want to implement impact across all asset classes.

Finding a provider that can do that can be difficult, but we have that holistic approach – we run portfolios across asset classes, and have partnerships on research trying to understand the problem from all sides.