In its annual Positive Impact Report, EQ Investors has shared how an increased focus on engagement has contributed to performance, while also highlighting the companies it is supporting amid government and company plans to ‘build back better’ from the Covid-19 crisis.

The report has also explored scenario analysis with a specific focus on climate change, and shared how it is aligned with the UN’s Sustainable Development Goals (SDGs).

ESG Clarity editor Natalie Kenway interviews impact specialist Louisiana Salge in the above video, who gives an overview of the 2020 report, and key environmental and social impacts the firm’s Positive Impact portfolios have made.

Below, Salge also answers ESG Clarity‘s further questions on carbon emissions disclosure and engagement experiences with fund managers.

ESGC: Can you reiterate to us what Positive Impact means to EQ Investors?

LS: The EQ Positive Impact Portfolios are managed with a dual mandate to maximise positive impact on society and the environment, while also maximising risk-adjusted returns.

We seek investments in businesses and organisations that, through their core products and services, are contributing to solutions to social and environmental challenges. We use the UN’s Sustainable Development Goals as a framework for understanding those challenges that need tackling, and thus to identify positive impact businesses. Additionally, we also require these to be well-run (ESG credentials).

Can you talk a bit about the investor base of the Positive Impact portfolios?

Our analysis shows that the Positive Impact Portfolios are a more inclusive offering than traditional investments. They attract a higher proportion of female investors than the UK average, and are also more attractive to younger investors.

Women in the UK are less likely to invest in stock markets than men. Reducing the ‘gender investment gap’ is an important part of tackling the overall gender wealth gap.

Investing for positive impact attracts a broad range of age groups, with significantly higher interest relative to traditional investments from those under 50.

How have your investments supported the UN Sustainable Development Goals (examples)?

We map our underlying investments to the goals by looking at the core business (products and services) that each company provides. This allows us to understand the total alignment of the portfolios to the UN SDGs, and maximise this over time in line with our objectives. Currently, about 84% of underlying holdings contribute to solutions to the UN Goals, with the rest presenting businesses in transition to become UN SDG aligned, or showing best-in-class responsible operations.

One example of UN SDG contribution would be on Goal 7 – Affordable and Clean Energy. Combining renewable energy with electrification is the most effective way to limit global climate change. We invest in the electric utilities Iberdrola, Europe’s top clean energy producer, and Ørsted, the Danish utility that transitioned its entire business model to meet carbon neutrality by 2025. In 2019 alone, Iberdrola added 2864MW of new renewable energy capacity and Ørsted completed the construction of Hornsea One – the largest offshore wind farm in the world with 174 turbines.

Earlier this year EQ Investors announced it would be reporting on the carbon emissions of portfolios. Can you explain the progress on the Positive Impact portfolios from this perspective?

We have partnered with a specialist carbon data provider, Urgentem, in order to most accurately report our portfolios carbon footprint. We now report across our sustainable portfolio ranges on climate risk and alignment with a transition to a low-carbon future.

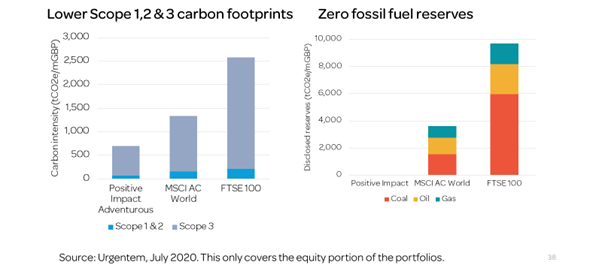

On the left-hand side, we compare our footprint across scope 1,2,3 carbon emissions to that of a world market index and that of the FTSE100. We show that investing through our EQ Positive impact portfolios, your investments contribute significantly less to climate change.

On the right-hand side, we demonstrate the embedded emissions through fossil fuel reserves held by invested companies. The EQ Positive Impact Portfolios have zero exposure to these assets. through actively avoiding investments in fossil fuel companies.

So what does that all mean in context of climate change?

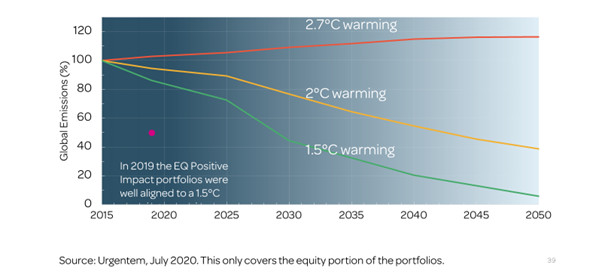

We also put this into the context of climate scenarios. Under the Paris Climate Agreement, the global target was set to keep global warming to 1.5 degrees of warming since preindustrial levels. As you can see by the green line, we need to bring global emissions down rapidly to achieve this target. Currently, we are happy to share that our portfolios are aligned to the Paris Climate Agreement, and we will monitor our Portfolios alignment over time to ensure this remains.

Carbon footprint

Panel on Climate Change (1.5°C).

Can you share some examples of positive engagement experiences where you have effected real change with fund managers?

We conducted engagement along our ‘vision for change’, pushing for change along four UN-Goal aligned themes. In the report we share our progress. One strategic theme has been health & nutrition.

Childhood obesity is a problem in the UK, where one in five children start school overweight or obese. The coronavirus pandemic is further underscoring the importance of a healthy society: several underlying health conditions associated with obesity are implicated in more severe cases of Covid-19.

The relevant fund managers we engaged with have committed to the new investor expectations published this year by the Access to Nutrition Initiative. These raise the standards that investors should expect from investee companies active in the food value chain, including responsible marketing, nutritional strategy setting, affordability and more transparent disclosure.

We have also directly targeted UK food retailers through engagement on the nutritional content of food sold. As part of that, we asked a question at Tesco’s annual AGM in order to push the firm to set targets for healthy foods, and report more transparently.

What are your hopes and aspirations for the Positive Impact fund for the coming year?

Over the past eight years, our Positive Impact portfolios have been a great success since their launch in 2012, in line with growing evidence that companies run in a sustainable and responsible manner generate higher returns. We hope and expect this to continue!

Interest is growing year-on-year as more investors look to invest in line with their values and commit to building a better future. At this critical moment, where the decisions we all take will shape our lives for decades to come, where our money is invested matters more than ever.

What about the wider industry?

It’s clear that responsible investment is growing rapidly in the UK and globally. One example of this is the ‘Make My Money Matter’ campaign calling for the trillions of pounds invested through our pensions to build a better world (EQ is a launch partner).

Obviously, we welcome this, but we also need to be aware of greenwashing and to avoid confusing investors with too much jargon.