Much has been made of the US Supreme Court’s decision to overturn the Roe vs Wade judgement and to hand back decision making on the right of an abortion to individual states. As a result of the Court’s decision, abortion is now banned in 12 states with further states going through the process of restricting access.

It was not just abortion that the Court ruled on recently either. It also sided with Republican efforts to limit the Environmental Protection Agency in how it regulates greenhouse gases from energy companies. This is likely to have far reaching ramifications with the ability to set standards and regulation in other areas likely to become challenging.

This all comes off the back of US states also looking to stem divestment from fossil fuel industries. Texas has introduced a new state law that prohibits investment firms from managing pension funds in the state if they are found to be boycotting the fossil fuel industry. Texas has been sending out letters to major investment firms questioning their positioning on fossil fuels.

However, these issues are also not just contained to red-blooded Republican states either. Earlier this year California, one of the most liberal of US states, saw its courts rule that a law passed in 2018 that require public companies with five members on their boards to have at least one woman representative was unconstitutional to men.

This was despite a Bloomberg study finding that in 2018 just 546 (16%) of the 3,445 seats on boards at the 467 publicly traded Californian companies in the Russell 3000 index were held by women.

It could easily be argued, therefore, that in recent times the US has taken a major step backwards when it comes to responsible investment, and that this is going to make ESG factors harder to analyse and thus the risks for companies and investors are increased.

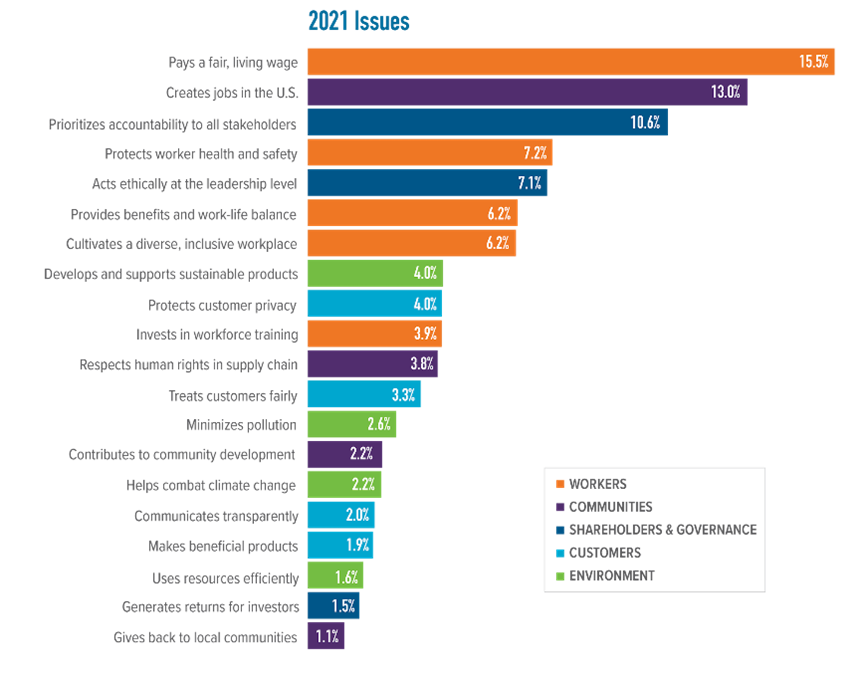

However, despite the political backdrop and the often-divisive nature of issues within the US, there is still a desire for companies to help bring about a fairer society. JUST Capital undertook a survey in 2021 that identified 20 priorities for just business behaviour or issues. Some 3,000 Americans were surveyed, and the results below show the percentage probability that an individual would choose that issue as the most important element in defining a just company.

Active ownership

The role of asset owners and investors and their ability to use their influence and engagement to help drive change and ensure we see better governance and outcomes that benefit investors and wider society has become increasingly important.

How companies react to these changes will be judged by investors and customers. As an example, in the aftermath of the Supreme Court’s Roe vs Wade decision, we have seen a swathe of companies announcing how they will cover the travel costs for female employees who require an abortion.

And, as recent events show, it is not just social issues that appear under attack. Recently proposed regulation from the Securities and Exchange Commission regarding climate-related disclosures, although welcome, will not be enough on their own and it too is threatened by judicial rulings.

However, when it comes to analysing and integrating ESG factors, the political situation makes it a tougher market to navigate at times. For example, we have been speaking to a US-based manager that is reluctant about becoming a signatory to the UN-backed Principles for Responsible Investment; one of the reasons cited is the regulatory outlook in the US.

The US remains an important market for any global or domestic investor given its size and stature, and investors will need to navigate a changing landscape.