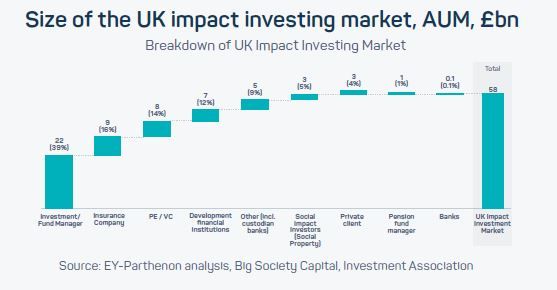

The UK’s total impact investment market was worth around £58bn in 2020, according to research from the Impact Investing Institute.

In collaboration with EY, funded by DCMS with additional support from Big Society Capital, Estimating and describing the UK impact investing market, found the market has grown rapidly over the past decade, with social investors, private equity and venture capital firms and foundations leading the charge and institutional investors identified as the primary drivers for future growth.

Other areas identified as being likely to encourage growth in the market were policy initiatives, such as the Financial Conduct Authority’s consultation on disclosure and labelling of investments, blended finance, greater awareness and education, and more investment vehicles.

Despite this, the report found impact investing still accounts for less than 1% of total AUM in the UK. Sarah Gordon (pictured), CEO of the Impact Investing Institute, said: “This new report demonstrates how far it has come in responding to people’s growing desire for their money to deliver positive impact for both people and the planet as well as a financial return – but it also shows how much further room there is for an impact investment approach to grow and develop.”

See also: – Podcast: Impact Investing Institute CEO Sarah Gordon on the ‘Wild West’ of reporting standards

The researchers also surveyed more than 40 market participants and conducted 20 interviews with relevant industry bodies and subject matter specialists, finding most expected to see growth and were planning to increase their investment in the area. Some 64% predicted 10% annual growth in funds flowing to impact investments with 36% forecasting above 20% a year, with 75% planning to increase their allocation to impact by more than 10% in the next five years. Healthcare, affordable and clean energy, and sustainable cities and communities were the top focus areas for investment.

Penney Frohling, financial services strategy partner in EY Parthenon, said: “The convergence of factors such as the pandemic and recent severe weather events, and the increasing focus on ESG, are intensifying the demand for investments that deliver positive outcomes for people and the planet. The spotlight is firmly on the financial services industry and the critical role it can play in helping to resolve these societal and environmental challenges.”