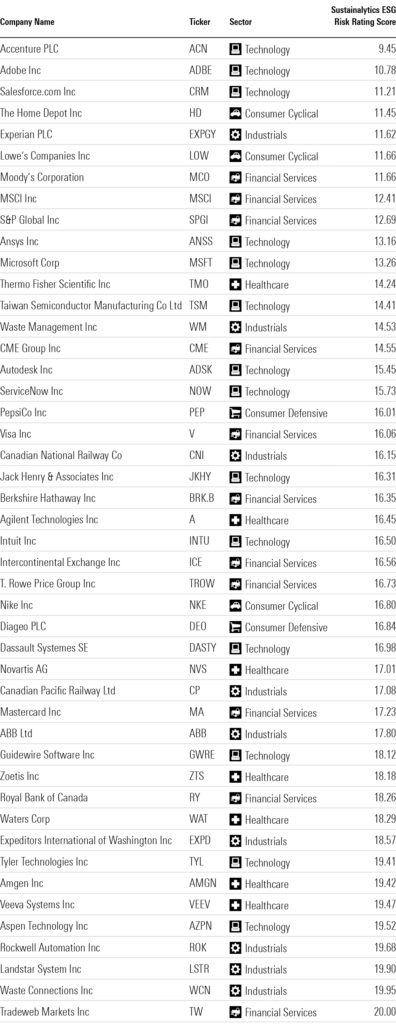

Morningstar has identified the best sustainable companies to own in the US in the coming year, including three financial services firms.

Looking at risk ratings from its research, ratings and data firm Sustainalytics, it has named 46 companies that excel in terms of exposure, or vulnerability to ESG risk, and management, which relates to the action taken by a company to manage a particular ESG issue. It has created a score based on these factors – the lower the number the lower the risk.

The table below highlights the companies with a low or negligible ESG Risk Rating Assessment:

Leslie Norto (pictured left), who conducted the research, said: “Every company faces some sustainability risk, not least because of the industry in which it operates. For example, an oil and gas company will be highly exposed to potential environmental problems, while a consumer technology business will be exposed to social risks like data privacy violations.

“Indeed, Morningstar research finds that the biggest ESG risk is in energy and utilities, with the smallest in technology and real estate.

“A company’s approach to sustainability demonstrates how it anticipates and addresses these long-term risks. Companies that mishandle ESG issues could incur significant economic costs that jeopardise their ability to earn long-term, sustainable profits.”

Tech giants dominate the list with Accenture, Adobe and Salesforce.com taking the top three slots, but financial services also scored well with Moody’s, MSCI and S&P Global among the top ten, and CME Group, Visa, Intercontinental Exchange, T. Rowe Price – the only asset manager – Mastercard, Royal Bank of Canada and Tradeweb Markets all featured among the 46 names.

However, Morningstar’s Norton warned a “spot on this list doesn’t mean that the companies’ sustainability efforts are flawless”.