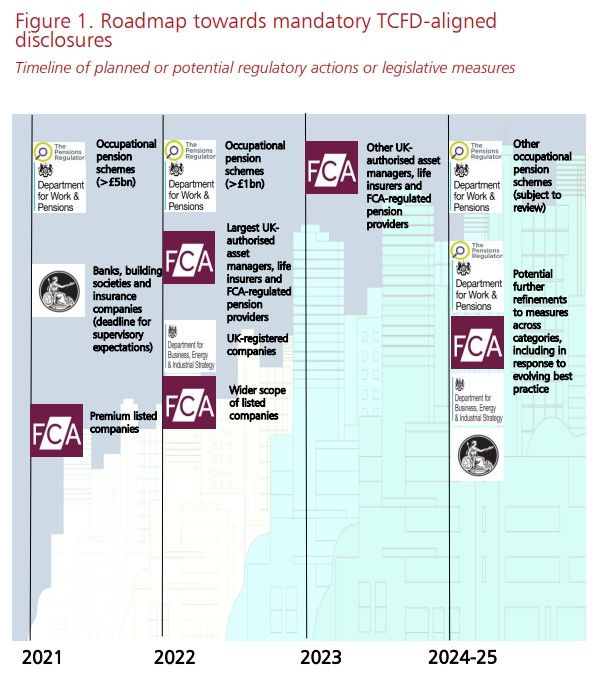

Last year, the UK government’s department for business, energy and industrial strategy (BEIS) stated reporting on Taskforce on Climate-related Financial Disclosures (TCFD) will become mandatory in the UK.

A phased implementation has meant occupational pension schemes have been mandated to do so from 1 October 2021, while from 1 January 2022 listed issuers were required to start collating data from 1 January 2022.

The next milestone date is one month away on 6 April, the start of the next tax year in the UK, where 1,300+ of the largest companies are being required to report against TCFD, including large private companies. For asset managers with more than £50bn in AUM, this is in preparation for the publishing of the first TCFD reports, which are required to be published by June 2023. Smaller managers will be required to do so by June 2024.

The announcement the UK will become the first G20 country to make it mandatory for Britain’s largest businesses to disclose their climate-related risks and opportunities, has been welcomed by ESG experts and industry commentators.

Here, investment professionals share their thoughts on the impact on the industry:

Using the financial system as an accelerator of change

Paul Montague-Smith, director at The Public Affairs Support Service:

“The mandatory introduction of TCFD is not only a marker of intent to show the UK is leading the world in identifying and quantifying climate risk. It is also a key tool to help the government hit the target it has enshrined in law. Its net-zero strategy is ambitious and, for carbon intensive sectors, relies on the development of innovations and technologies that don’t yet exist.

“Ultimately, only the private sector can deliver what will be required to hit net zero, albeit with government support. Ministers of course know this. TCFD is therefore seen as a vehicle for guiding private capital towards green investments in line with their target.

“Under pressure on tax rises and the rising cost of living, there are growing concerns amongst some government backbenchers about whether the transition is already proving too fast and too costly. As we move towards 2050 and the challenge of hitting the target becomes more acute, how to use the financial system as an accelerator of change can be expected to become even more of a focus for policymakers.”

Active engagement will be imperative

Anna Skylakaki, senior manager in the ESG and responsible investment practice at AlphaFMC:

“In addition to company-level reporting to shareholders and clients, TCFD requires asset managers to ‘describe how climate-related risks and opportunities are factored into relevant products or investment strategies’. Asset managers should also describe how each product or investment strategy might be affected by the transition to a lower-carbon economy.

“While many asset managers are now able to disclose ESG-related information to a handful of clients, scaling this up across thousands of clients and hundreds of funds, while conforming to new taxonomies, presents a significant challenge. To meet these requirements at scale and implement the required disclosures by 2022/23, asset managers will need to have access to the right data, supported by well-defined data governance and processes.

“TCFD will also impact asset managers’ engagement and stewardship activity; it mandates ‘where appropriate, engagement activity with investee companies to encourage better disclosure and practices related to climate related risks’.

“Active engagement will therefore be imperative in ensuring asset managers are effectively assessing the practices and progress of the companies they invest in against the incoming TCFD regulations. Regular, outcome-focussed engagement monitored against a benchmark will no longer be a ‘nice to have’ within the ESG space but a must to ensure compliance.”

It’s worth getting ahead on some of the most time-consuming requirements

David Hunter, CIO of Renewity:

“UK pension funds have just weeks before TCFD reporting comes into force.

“Any schemes yet to act on scenario analysis and targets (including relative performance) should be giving this their utmost attention. This is because these elements are new for many investors, particularly those without appropriate data feeds and frameworks already in place.

“Outside of this, it’s worth getting ahead on some of the most time-consuming requirements for the initial level of reporting. These include:

• Emissions data (Scope 1, Scope 2 and especially Scope 3 including historic data sets where relevant.

• Disclosure of infrastructure in place related to the data recording to support reporting (including any external product solutions).

“Longer term, we strongly recommend pension schemes take steps to keep abreast of best practice standards within the reporting frameworks. This because, while carbon emissions reporting is in its early stages, it is already evolving so it will be important to not get left behind.”

Other countries need to follow the UK’s lead

Paul Lee, head of stewardship and sustainable investment strategy at Redington:

“Investors need to understand the risks that they face. With increasing evidence of the significant impacts on the world because of the build-up of greenhouse gases in our atmosphere, one of the greatest and most systematic of those risks is climate change. But it’s not enough for investors to know what the big picture risks are – we need to understand what the implications might be for individual companies and their business models. In particular, as we move towards a carbon-constrained world, which companies are well placed to continue to thrive, and which will face new challenges and risks?

“Understanding this dynamic is crucial for investors – particularly long-term investors – to be able to invest with confidence. So the impending new rules for corporate disclosure are a crucial step to enable investors to take informed forward-looking investment decisions. But we are global investors and so we need other countries to follow the UK’s lead and require similar transparency by their companies.”