Russia’s invasion of Ukraine has rattled global financial markets, leaving investors to believe that riding the surge of oil, gas and armament companies will preserve capital. Although many investing experts have recently touted the importance of ESG, we have seen interest for sustainable investing dip, as most mutual funds and ETFs exclude the those industries.

Military conflict and market instability should not be reasons to discount the long-term power of sustainable investing. Instead, these are some of the most important times to consider the implications of ESG factors.

ESG’s role in ending conflicts

ESG criteria have long played an important role in shortening the duration of oppressive regimes. The earliest use of the term “socially responsible investing” was in Philadelphia in 1758 at the annual meeting of the Religious Society of Friends. Members voted to cease conducting business with any people or companies that would seek to perpetuate slavery. Although it would take another century for slavery to be abolished, one could argue that from an investment perspective, this is where the business case against slavery began.

In the early 1980s global economies began a massive divestment effort from South Africa, to persuade the white minority party to cede power and end apartheid. In 1982, Calvert Investments launched the its Social Investment Fund, and it became the first mutual fund to explicitly refuse to invest in businesses that supported the economy of South Africa. Finally, in 1994, the country abolished apartheid and spent several years in negotiations to form a democratic government, resulting in the election of President Nelson Mandela. Economic sanctions imposed by Western democracies were credited as a major factor in ending apartheid.

Congress implemented a similar strategy with the Sudan Accountability and Divestment Act of 2007. That authorized state and local governments to divest from companies with business in Sudan, to pressure the Sudanese government to end the genocide as a result of the war in Darfur. The war is ongoing, but the importance of divestment from oppressive regimes cannot be understated.

Ultimately, the economic sanctions against Russia provide an important look into how modern warfare can be curtailed, including through proper investment screening practices.

Underperformance during war

It is well known that ESG funds tend to underperform in times of war and socioeconomic strife. Oil, gas and armament companies are typically excluded from these funds and generally surge in value as gas prices and weapons manufacturing rise. We witnessed this same kind of decrease for ESG fund flows in the early days of the wars in Afghanistan and Iraq, when oil and gas prices climbed to over $140 per barrel. According to Amy Domini, founder of Domini Impact Investments, “this is the worst kind of market for ESG investors.”

However, this is only of concern if one’s portfolio is operating on ebbs and flows in the market in the short term. ESG funds tend to be overweight on technology-based service providers and pricier growth sectors that require more time to manifest their full potential.

Volatility is considerably short-lived with sustainable investing. In fact, at no point in history did the underperformance of ESG not bounce back stronger than its traditional counterparts. Such will be the same following Russia’s war on Ukraine, the Covid pandemic and widespread inflation. The cycle is well known to ESG investors, and it is important to consider as we exit this period of uncertainty.

ESG factors in the current conflict

Many investors are making a transition from oil and gas into renewables, which have also surged during these difficult times. People are taking comfort in the fact that renewable energy investments have far less uncertainty and volatility. At the same time, shareholder advocacy and proxy voting on environmental matters at oil and gas firms have spiked in 2022, forcing many of them to deal with emissions questions anyway.

Addressing Russia’s aggression toward Ukraine is no different from an ESG perspective than it has been with other oppressive regimes. The global economic sanctions have already caused a great deal of pain, while at the same time European pensions are already paring back exposure to Russian investments.

However, this model will not end with Russia. The logical progression is to divest from China, as Russia’s claim to Ukraine mirrors China’s claim to Taiwan.

Further, China’s recent actions have not helped inflationary pressures. Many countries are working to find ways to co-exist with Covid without taking away personal freedoms. On the other hand, China’s zero-Covid policies have completely shut down its economic hub, Shanghai, for months, which has fed global supply chain issues and exacerbated inflationary pressures.

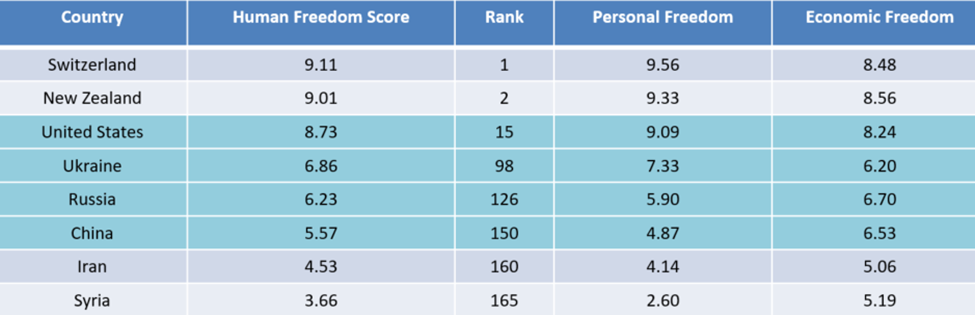

Sustainable investing sometimes utilizes “freedom indexes” as an additional quality screen. The Human Freedom Index, for example, gives each country a score from zero to 10. The combination of personal and economic freedom scores give the country’s overall human freedom score. Below you can see that on a global scale, Russia and China rank near the bottom of overall human freedom.

Part of developing an ESG portfolio is a careful consideration of these human freedoms. If you are going to invest with exposure to authoritarian governments that can shut down their own economy and turn off the stock markets with the flip of a switch, you may want to ask yourself why they are in your portfolio in the first place. Additionally, ask yourself if a world where these types of industries thrive is the kind of world you would like your grandchildren to inherit. If the answer is no, then there is a solution: create a sustainable portfolio today.

Jennifer Coombs is an associate professor at The College for Financial Planning.