In a new Morningstar report, we have provided an update on the implementation of the EU Sustainable Finance Disclosure Regulation (SFDR) four months after its introduction.

It analyses the landscape of Article 8 (light green) and Article 9 (dark green) products in terms of assets, market exposures, investment style (active vs. passive), ESG risk and controversial activities exposures, and holdings. It follows the report in March where we looked at the number of Article 8/9 funds 10 days after the implementation.

Since SFDR took effect on 10 March, asset managers have upgraded existing strategies, while also launching new ones in order to meet Article 8 (light green) or Article 9 (dark green) requirements. For example, JP Morgan uplifted 55 funds to Article 8. Out of 210 SFDR-reviewed funds which launched in the second quarter of this year, 48% were classified as Article 8 or 9. This alludes to the idea that fund companies feel commercial pressure to have as many funds as possible meeting the minimum Article 8 requirements. In fact, many distributors and fund buyers across Europe have said they would only consider funds in Article 8 and 9 categories going forward.

See also: – SFDR bites as sustainable fund flows slow in Q2

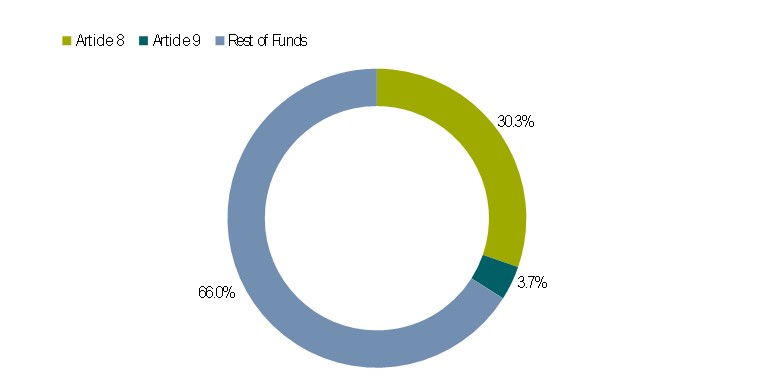

As of 10 July, based on SFDR data collected from prospectuses on close to 82% of funds available for sale in the EU (excluding money market funds, funds of funds, and feeder funds), we have found that 21.8% of funds have been classified as Article 8, while 2.8% have been classified as Article 9. In terms of assets, the two fund groups account for a larger share of the EU fund universe, with a 34% split into 30.3% for Article 8 funds and 3.7% for Article 9 funds. In total, these combined assets amount to just shy of €3trn.

SFDR fund type breakdown (by assets)

Different approaches to product classification

Asset managers have taken different approaches to product classification based on their own interpretation of the regulation.

As expected, the Article 8 category is a catch-all category, with a wide range of products applying a variety of ESG approaches, ranging from exclusions-only to a dark-green thematic approach. A large number of Article 8 funds are broad ESG funds that employ a best-in-class or positive screening strategy. They seek to invest in securities of issuers that exhibit strong or improving ESG credentials.

See also: – Q&A: How can SFDR be improved?

Some employ a combination of exclusions, ESG integration, and engagement. Others, in addition, have set explicit binding constraints at the portfolio level. They must, for example, achieve a higher aggregate ESG score or lower carbon intensity than their benchmark or investment universe. Some use an optimiser to maximise exposure to issuers with higher ESG ratings.

Similar strategies feature in both Article 8 and 9 categories, suggesting that some asset managers may have taken a too prudent approach or others a too generous approach. Managers who parked more funds into Article 9 may be more confident in their ability to demonstrate the ‘sustainable’ nature of their investments in their future disclosures.

In aggregate, Article 8 and 9 funds perform better on ESG metrics than the rest of the universe, Article 9 portfolios exhibiting higher sustainability credentials, as expected. Three fourths of Article 9 funds carry Morningstar Sustainability Ratings of either 4 or 5 globes, compared with 56% of Article 8.

Article 9 funds also typically have lower involvement in controversial weapons, tobacco, fossil fuel, and severe controversies and have higher exposure to carbon solutions, whilst also exhibiting higher exposure to thermal coal. The latter can be explained by the relatively high number of climate-themed funds in the Article 9 category that invest in traditional utilities companies that have built large renewable energy operations but still operate their highly intensive coal-fired electricity generation activities.

Active management largely dominates the post-SFDR ESG fund landscape. Passive funds account for only 11% of assets in Article 8 and 9 funds, half the market share for passive funds in the overall European fund universe.

It is our view that Article 8 and 9 funds may reach 50% of overall EU funds’ assets within the next year (from 34% today). Several managers are already reporting higher asset ratios, including Amundi (75%), BNP Paribas (80%), AXA (90%), and Robeco, (93%). Managers who are currently exhibiting lower numbers plan to catch up, such as DWS, who aims to categorise the quasi-totality of its EU fund assets under Article 8 or 9 and Schroders, who has targeted a 70% ratio by the end of the year.

This article is based on Morningstar Direct data as of 10 July 2021, whereby, Morningstar had collected SFDR Level 1 data from fund prospectuses on 81.6% of funds available for sale in the European Union.