In this regular series, female members of the ESG investment industry detail how they are dealing with the transition to remote working during the coronavirus fallout

Following on from our sister title Portfolio Adviser which has been running the Working from Home series with investment experts from the wider industry, we are running these articles twice a week with women in ESG. This week we speak to Amy Clarke, chief impact officer at impact wealth manager Tribe.

How has the coronavirus affected your day-to-day work – from both a portfolio and workplace perspective?

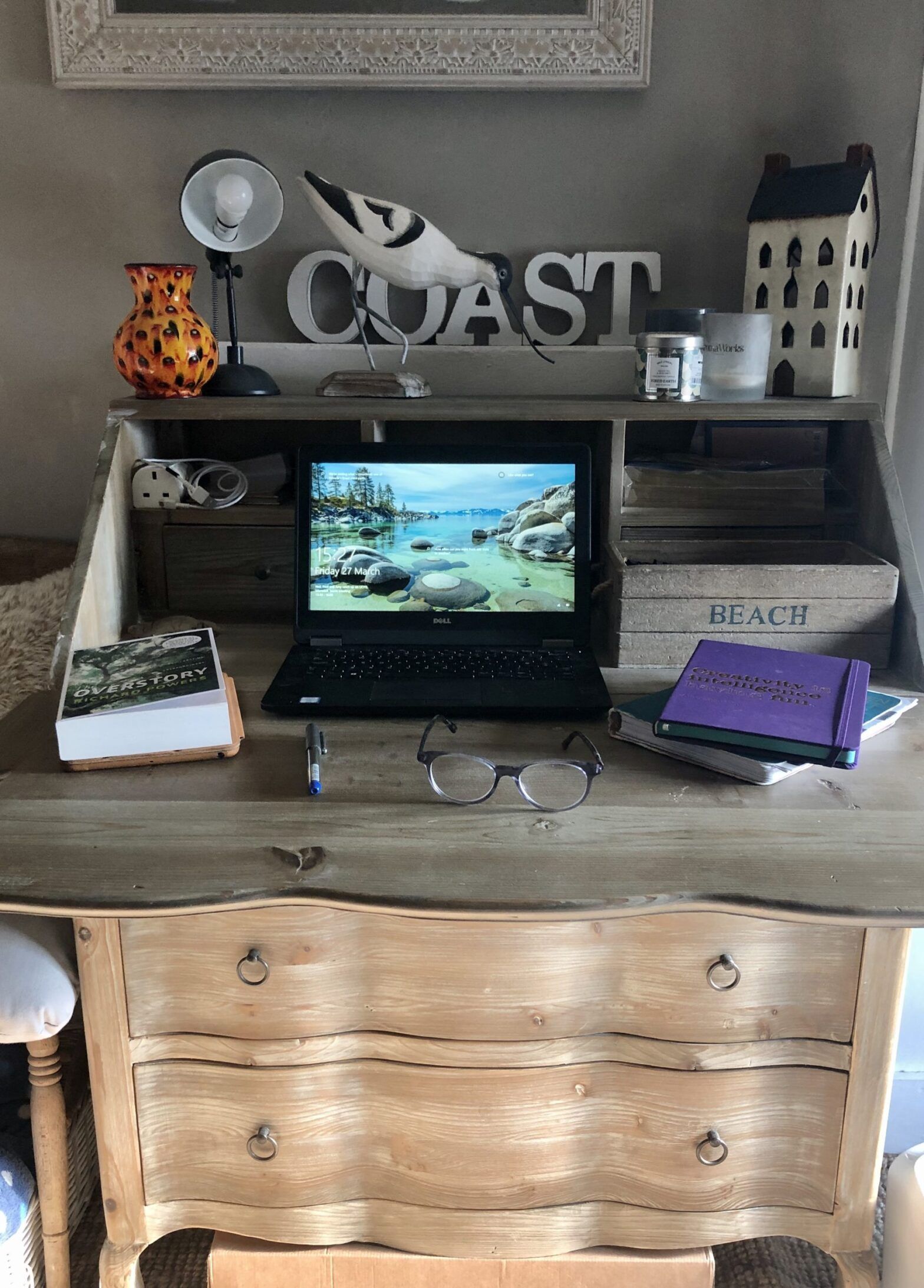

Not as much as you would expect. I work from home a day a week so I’m fortunate enough to have been set up to continue relatively seamlessly. The lack of commute has granted me a couple more hours of worktime a day.

What has surprised you most about markets during the coronavirus sell-off?

Less of a surprise, more of a reassurance – the increased inward flow of capital to ESG ETFs (which we don’t use by the way, we favour actively managed funds, but this is a good proxy). The early signs are that there has been $14.3bn inflow during Jan and Feb compared to $2.4bn in the same period last year (ETFGI research).

What feedback have you had from clients since the coronavirus sell-off?

Our clients remain reassured that the strategies we have in place for them are the right ones given the lines of communication we have with them and the content we’ve been sharing. We’ve also had queries as to how we all are which has been lovely.

How do you think attitudes to ESG initiatives will be affected as we move through the crisis?

They’re already changing – there is an awakening that is happening. Investors are looking for safe harbours, short and long term, and this crisis has highlighted the innate good sense of investing in well run businesses that are solving the world’s problems. ESG is part of that approach to investing. As we move through these challenging and painful times, we will come out stronger and as an industry it is incumbent on us all to learn the lessons and understand what we are all doing to either help or hinder what we need to do moving forward. I believe this may result in the largest investment shift – into sustainable investing – ever seen. Time will tell.

Share some good news you have heard recently about the holdings/sectors/themes you invest in?

The increased inward flow of capital into our style of investing and how our portfolios have performed so far have reconfirmed what we’ve always known, sustainable and impact investing is just good investing. As a mission driven business we are thrilled the world is waking up to this.

How do you find working remotely during volatile markets?

We are cloud based so we were able to quickly flip our business to remote. We have multiple daily contact points with our teams and our universe of investments so we’ve been able to continue with little interruption. We are ensuring lines of contact are open at all times. And we’re not panicking! If anything, moving to remote has meant that the engagement we are having is better as we’re all using the technology to our advantage. We do fun things together like Team Yoga, Impact Quizzes, and Virtual Team Drinks every Friday to continue what we refer to as the Tribe Vibe (maintaining our culture). We get to see other every day and check up on everyone’s health and wellbeing, as well as work hard and have a little enjoyment along the way. We are blessed to be able to work this way.

What do you do for fun when you take a break from working at home?

Play with Nutjob (not his real name) – the tripawd rescue dog who basically owns the house and everyone and everything in it! Down time is usually centred around mental health time – so, as an environmental scientist, nature is my go to. With a crazy three-legged dog in tow.

What is your favourite sustainable snack/hot drink when working from home?

I’m vegetarian and an organic champion. So for me, it’s organic fair trade fruit. And fair trade organic Earl Grey tea. Come evening time one occasionally swaps to Juniper Green organic gin! Just don’t tell anyone.

If applicable, how is home schooling being managed in your household?

Not applicable although I am running an online book club for my godchildren every week. We have Australian, Portuguese and British godmonsters dialling in. It’s chaotic but great fun! We’re currently reading Animals of Farthing Wood.

Do you have a ‘top green tip’ to share on working remotely?

Yes, get outside as much as work allows. You’ll find yourself more productive (and less stressed) having had a bathe in nature.

To view the previous articles from the Working from Home with … series see below:

Active ownership, hip-hop pilates and natural light: WFH with Federated Hermes’ Kimberley Lewis

Cautious positioning and interactive lessons: WFH with Square Mile’s Diane Earnshaw

Climate debate, board games and weekly podcasts: WFH with Quilter Cheviot’s Claudia Quiroz

Deadlines, schoolwork and team drinks: Working from home with ESG Clarity’s Natalie Kenway