After talks at COP27 barely kept the 1.5 warming limit alive and ended with reiterated calls to accelerate climate action, we take stock of the ever-expanding options available to investors looking to reduce climate-related risks in their portfolios and/or take advantage of opportunities arising from the transition.

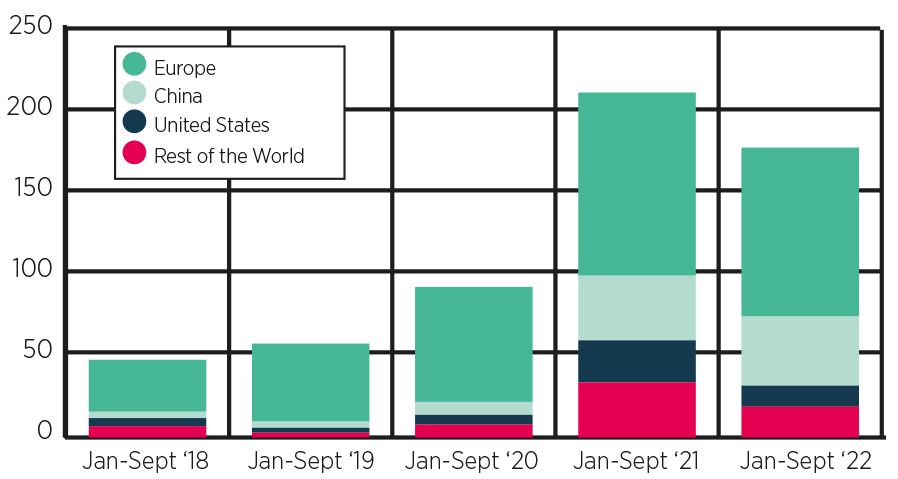

Morningstar data shows the number of mutual funds and exchange-traded funds with a climate-related mandate rose to a record 1,140 globally at the end of September, from 860 at the end of last year.

This 32% growth stemmed from continued strong product development. Close to 180 new climate funds were launched globally in the first nine months of the year. While this is fewer than last year over the same period, more funds have been repurposed this year. At least 100 funds, predominantly in Europe, have switched mandates to adopt a climate-focused strategy or added Paris-aligned emission-reduction targets.

Number of climate fund launches per geography

Climate-aware funds span a range of approaches

Climate-themed funds span a range of approaches that aim to meet different investor needs and preferences. To help investors navigate what can be a confusing mix of offerings, we subdivide the universe into five mutually exclusive categories:

- Low-carbon funds are funds with lower carbon intensity relative to a benchmark.

- Climate-conscious funds select or tilt their portfolios toward companies that consider climate change in their business strategy and therefore are better prepared for the transition to a low-carbon economy. Fitting in this category are Paris-aligned and climate-transition funds, many of which have recently been re-classified from Article 9 to Article 8.

- Climate-solutions funds invest in companies that provide products and services that contribute to the low-carbon transition.

- Clean-energy/tech funds invest in companies that specifically contribute to or facilitate the clean energy transition.

- Green bond funds invest in debt instruments that finance projects facilitating the transition to a green economy.

So far this year, asset managers, particularly in Europe, have focused product development efforts on climate-conscious funds, which represented 37% of all climate fund launches, followed by climate-solutions funds (31%) and clean energy/tech funds (17%).

Climate fund assets are lower but exhibit resilience

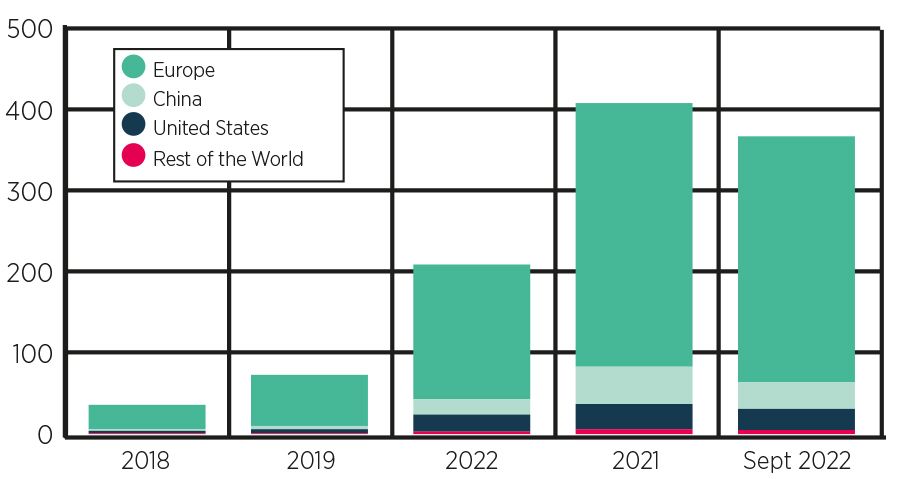

In terms of assets under management, falling stock markets, lower inflows, and the strong dollar drove global US-dollar-denominated assets in climate-themed funds down almost 10% in the nine months through September 2022 to $368bn. China experienced the largest drop (27.4%), followed by the US (15.7%), while Europe shed 6.5%.

It’s worth pointing out that this analysis differs depending on the currency used for the calculation. In US-dollar-denominated terms, European assets fell to $303bn from $325bn during the first nine months of 2022; in euros, European assets rose by 7.6% to €309bn from €287bn over the same period. In yuan-renminbi terms, Chinese assets still fell, by 14.3%.

Climate funds have not been immune to the challenging macro environment, but have exhibited resilience, in aggregate. For context, global fund assets shrunk by 24% in dollar terms over the first nine months of the year.

Climate fund assets per geography ($bn)

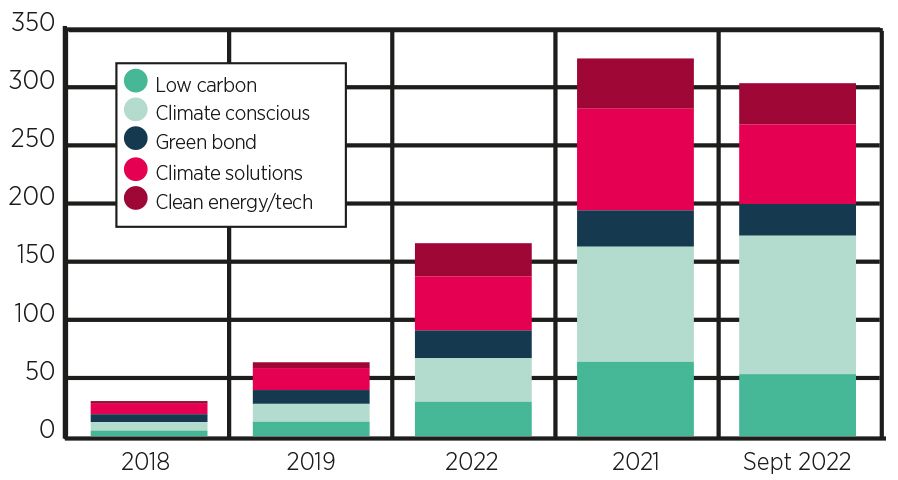

In Europe, more money flows into companies better prepared for the transition

In Europe, in US-dollar-denominated terms, all but one type of climate fund (climate-conscious funds) registered lower assets and inflows at the end of September 2022, compared with December 2021.

Climate-conscious funds, which tilt toward companies better positioned for the transition to a low-carbon economy, attracted $30bn in the first nine months of the year, more than the category’s inflows for all of 2021. This new money drove assets in climate conscious products to a new high of $120bn at the end of September.

Assets in European funds by strategy type ($bn)

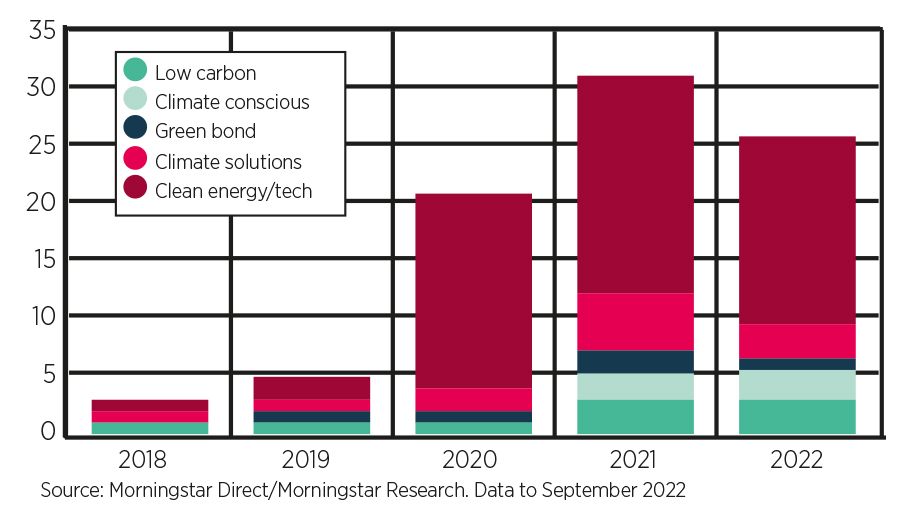

US investors are more focused on clean energy/tech companies

In the US, clean energy/tech funds remained the most popular climate funds at the end of September, with $16.4bn in assets. These, however, were 15% lower relative to December 2021, mainly due to falling valuations. Compounding the lower price effect, clean energy/tech funds bled $430m in the first nine months of the year as investors favoured traditional energy companies amid record oil and gas prices. In comparison, clean energy/tech funds registered $6.9bn of inflows over the same period in 2021.

Assets in US climate funds by strategy type ($bn)

Meanwhile, product development activity slowed down, with only 13 new climate-themed products so far this year—half of last year’s number over the same period. But investors can expect more new offerings to come to market following the approval of the landmark Inflation Reduction Act, an expansive climate, healthcare, and tax package that will unlock $370bn in climate and energy investment.