Awareness that modern slavery is a social evil and investment risk continues to grow, putting investors in a pivotal position to identify and root out this risk across industries. Global mining is a particular challenge: risks to people in this industry are high and rising, and they’re not well-managed when compared with high-risk consumer-facing industries such as technology and apparel.

The mining industry sources its employees from particularly vulnerable populations, such as migrant workers and minorities. Many firms operate in geographies rife with conflict, corruption or weak judiciary systems. The work of mining itself is dangerous and the business models – which often rely on outsourcing and seasonal demand – can be high-risk, too.

The mining industry is high among risks to people – both within its business operations and throughout its supply chains. And the risks are rising.

See also: – abrdn mining engagement leads to health and safety recommendations

People risks in many areas with mining operations include exploitative conditions in remote locations, the relocation – sometimes forced – of indigenous people to gain access to minerals, and association with organised crime or armed conflict. These dangers are likely to intensify, because much of the future demand growth for minerals will fall on high-risk geographies.

Engagement for both insight and action has the potential to reduce risks not only for employees in businesses’ mining operations and supply chains, but also for companies and investors.

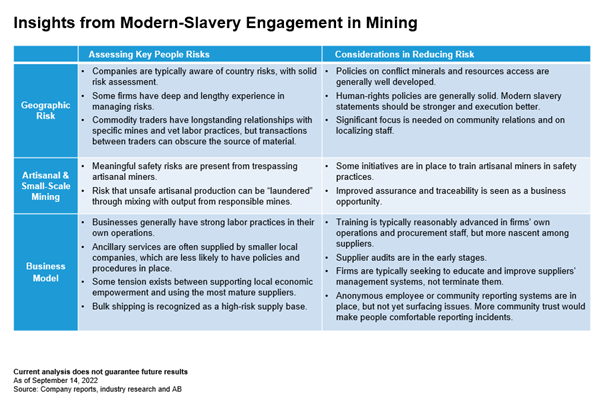

Our own engagement with a range of mining companies with global operations, including South America, Africa, Australia mining different materials such as gold, iron ore, and copper on this topic shows that, while risk awareness among mining companies is reasonably high or increasing, more action can be taken to manage the risks.

For example, the companies we’ve engaged with generally have solid policies in place on human rights and modern slavery, but the quality of execution varies considerably. One key takeaway: training on this issue is quite advanced within firms’ own operations and procurement staffs but is still in the earlier stages with suppliers.

Companies have a long way to go when it comes to introducing modern slavery risk audits into their supply chains. They’ve established anonymous employee or community reporting systems, but these mechanisms haven’t yet brought the issues to light, which raises important questions about their effectiveness.

We acknowledge this is journey. We don’t expect a company to be perfect, but are looking for progress. As investors, we have a seat at the table that we want to use. If a company reports on issues it has found, we don’t see that necessarily as a red flag. Rather, it can be an indication that they have the appropriate risk identification tools in place. Only if modern slavery is found can the issue be managed and the victims remediated. In the short term, we’d like the number of instances found to go up, while in the long term we want them to go down.

The mining industry lags other industries, such as technology and apparel, in risk awareness and reduction efforts. Part of the challenge stems from these industries’ different structures. Technology and apparel are highly sensitive to consumer opinion, and modern slavery awareness is rising among all-important consumers. Because mining companies do business mainly with other companies, they’re to some degree more insulated from consumer opinion than their retail peers.

The industry’s corporate customers are becoming more aware of modern slavery risk and applying more stringent requirements to the miners that supply them. Governments are stepping up their scrutiny of mining companies and supply chains. In the short term, this poses a challenge to mining operations and revenues, and it puts more pressure on investors to diagnose which businesses are responding effectively to the increased attention.

See also: – German supply chain law ‘causing a stir’ with investors

With a thoughtful framework, sound research and company engagement, investors can identify and manage these risks in their portfolios. At the same, they can help mining companies improve their people risk practices – and ultimately make life safer for many of the industry’s millions of workers.