The number of Mexican States exposed to water stress will nearly double by 2050, and what might be most alarming about this is that it doesn’t even represent a worst-case scenario, but rather a 2-degree scenario that includes moderate emissions reduction.

This was the finding of our analysts of physical risk data sets. Assessing the impact of physical climate risks can improve our understanding of local regional government’s potential exposure, level of preparedness, and the potential future influence of climate risks on credit quality over the years to come.

We incorporate the adverse physical effects of climate change, where material and visible, into our credit rating analysis. Despite some budgetary and debt impact, no credit ratings have changed to date because of water stress.

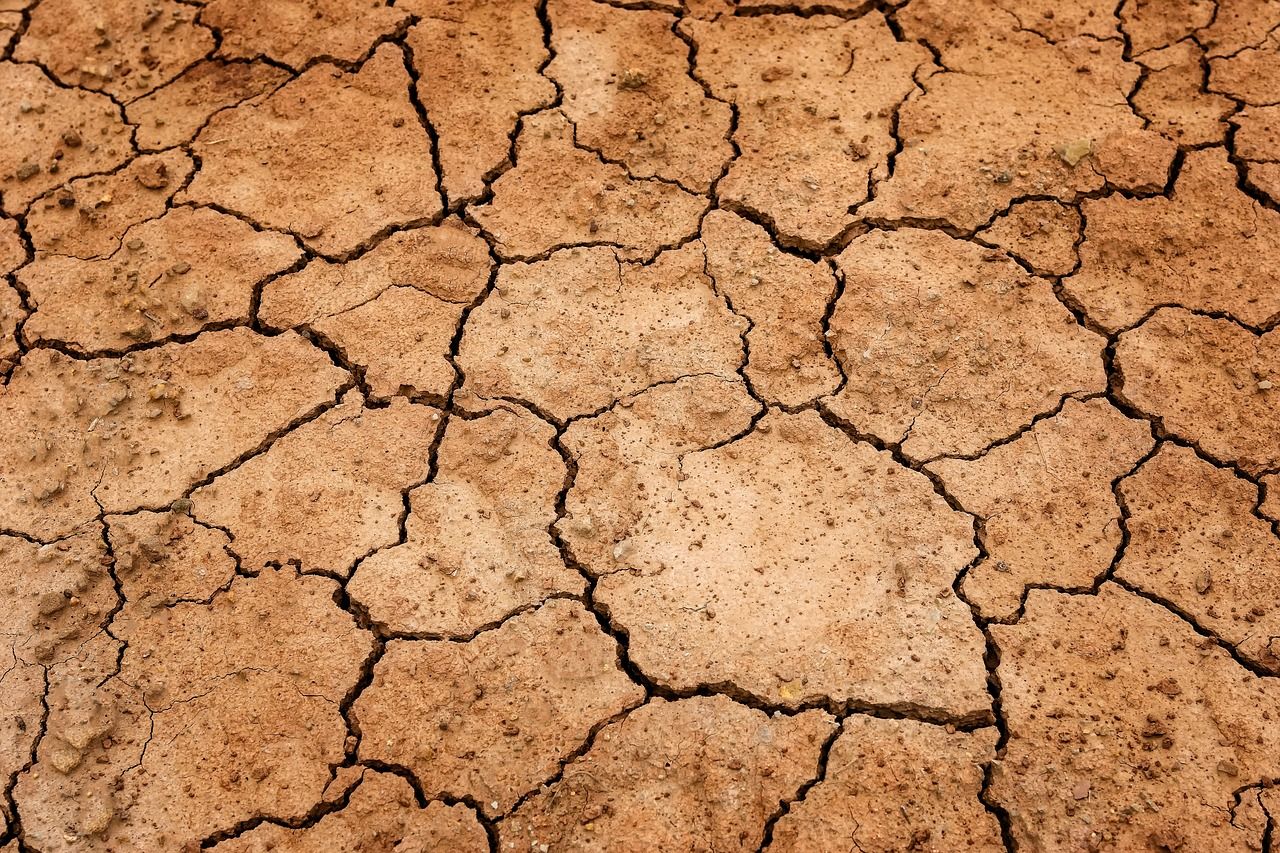

As is often the case with sustainability issues, these findings amplify a challenge that is already significant in Mexico, with two-thirds of its territory located in arid or semi-arid areas. Those areas that are already susceptible to drought are likely to face the worst impacts of accelerating climate change.

Additionally, Mexico is particularly exposed based on its economy’s significant reliance on agriculture, a sector that is one of the most intensive users of fresh water. The options for curbing this dependence are also currently limited, with the UN expecting that water use in agriculture will increase by 30% by 2050, at a time when it is becoming even more scarce in already parched areas.

Moreover, this environmental issue may also create social issues. In sparsely populated regions, industry may use a greater share of water, and, if drought conditions intensify, that could come at the expense of access to water for resident populations.

Investing in the issue

In this case, an increase in investments in water infrastructure over the long term could weaken some states’ and municipalities’ budgetary performance and result in higher debt but go some way to build resilience to water scarcity. Increases in spending related to water could dent budgetary performance by reducing fiscal buffers, increasing the need for extraordinary transfers to water utilities, or raising the share of capital expenditure on water infrastructure.

Given the increasing scarcity of water in the aforementioned regions, we expect various levels of government to invest in improved water infrastructure, which may partially address scarcity and provide some resilience. In fact, in Mexico, the 2023 Federal budget for water infrastructure resilience tripled. We also will continue to monitor whether there are investments made to increase the scale of desalination in the country. While desalination is a technological fix to this specific climate problem, it is fraught with other environmental problems.

Of course, much of what has been discussed heretofore is historical in nature, and, to date, these climate scenarios are not part of our base case analysis. The impact of water stress on our local and regional government ratings will depend in large part on the cooperation between various levels of government in planning and investing to ease water stress. We will continue to assess how Mexico approaches sustainable water management, economic growth, and planning and funding for water and related infrastructure. Strategies to secure sustainable economic growth come with costs and tradeoffs that will confront communities and policymakers as they strive to address water stress exposure.

While Mexican States are uniquely exposed to water stress, they are not the only entities that are impacted. Other countries, such as South Africa, Chile, and Saudi Arabia are also highly exposed and using regulations to reduce water consumption to alleviate these concerns, evidencing that while there may be a common problem, there are numerous solutions that will have to come into effect.

Paul Munday, Sarah Sullivant and Constanza Chamas from S&P Global Ratings also contributed to this article.