The long-term survival and success of asset managers will depend on how they prepare for “the next big shakeup in the market”, which PwC has said in a report is how they differentiate their ESG proposition.

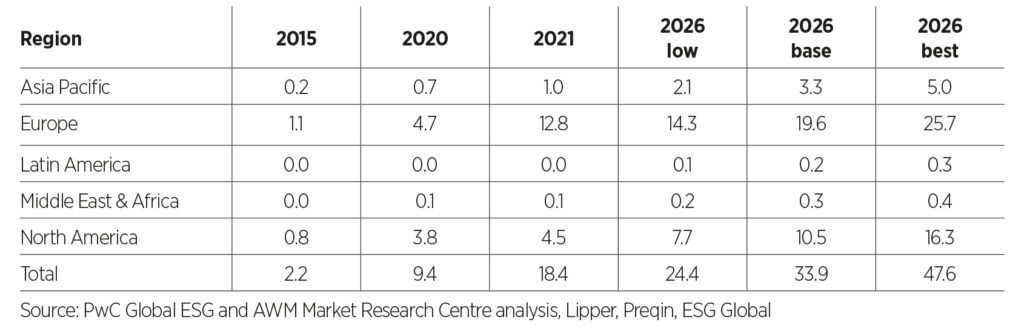

In the report, Asset and Wealth Management Revolution 2022, the auditor forecast ESG-oriented assets under management are set to grow much faster than the wider market – in its base-case scenario, the share of ESG assets over total AUM would increased from 14.4% in 2021 to 21.5% in 2016 – comprising more than a fifth of assets. Global assets in sustainable investments are projected to rise from $18.4trn in 2021 to $33.9trn in 2026. In comparison, total money in sustainable funds in 2015 globally was just $2.2trn.

Global ESG assets under management by region ($trn)

PwC said current growth is largely derived from retrofitted funds, with 27% of funds in Europe being repurposed to integrate ESG factors at the end of 2021, but added these conversion efforts are only a “stopgap” and therefore fund launches will be vital for asset managers to raise new capital.

“Given that ESG is growing rapidly – and is projected to continue to do so – we believe that the market will open up over the next three to five years and present frontrunners with significant opportunities and challenges.

“As our survey underlines, long-term survival and success depend on the ability of asset managers to prepare for the next big shakeup in the market by differentiating their strategy and delivering on their purpose.”

It described the current “sweetspot” as a “once in a generation opportunity to drive innovation and win new mandates”. Nearly eight in 10 institutional investors (79%) plan to increase their allocations to ESG products over the next two years.

Demand outstrips supply

However, the report highlighted a gulf between what investors want and what asset managers are doing in response.

It said repurposing funds is the minimum asset managers should be doing to “stay in the game”, but in terms of new products there is a supply/demand mismatch. Some 88% of institutional investors said fund groups need to be more proactive in developing new ESG products, but only 45% of managers surveyed for the report are planning to launch new ESG funds.

“This expectation gap opens up opportunities. By accelerating new product development and actively supporting green transition, early movers would sharpen innovation, boost relevance and seize market share,” the report said.

There were also significant concerns about fund names with 71% of institutional investors and more than eight in 10 asset managers agreeing mislabelling is prevalent in the asset and wealth management industry, but added this is “rarely intentional”.

“If slip ups do occur, it’s important to be able to quickly explain why, and to correct and learn from mistakes. Delays or lack of transparency can only heighten the reputational damage and risk of regulatory sanction,” PwC warned.

In terms of new products, the report highlighted asset managers have an opportunity to take an “actively interventionist approach” of investing in companies that aren’t sustainable now and then helping them with the finance and expertise needed to incorporate positive ESG outcomes into their operations.

In terms of other challenges, regulation and costs were flagged by PwC. Overall, investors said regulation was an important driver and 71% were in favour of strengthening ESG regulatory requirements for asset managers, but were less enthusiastic about growing costs which can increase by 10% when integrating ESG favouring larger asset managers.

US

The sustainable investing market in the US is projected to more than double by 2026, even as some Republican state leaders have begun to wage a war on ESG.

Assets in investments in North America that consider ESG factors will likely hit $10.5trn by then, up from $4.5trn seen in 2021, according to a report from PwC. During that time, global assets in sustainable investments are projected to rise from $18.4trn to $33.9trn. By comparison, total money in sustainable funds globally was just $2.2trn in 2015.

To read more on the PwC report on US findings click here.

Asia

Asia Pacific is projected to have the fastest growth rate of any major region in ESG assets under management (AUM) by 2026, rising to $3.3trn from $1trn last year, according to a study by PwC.

Even under a worst-case scenario, overall ESG AUM in Asia Pacific is forecast to rise to $2.1trn within the five-year period, while the best case scenario has the figure reaching $5trn.

In contrast, AUM under PwC’s base case in Europe is projected to rise to $19.6trn from $12.8trn, while for North America these figures are $10.5trn and $4.5trn respectively.