More than 95% of funds with the word ‘sustainable’ or similar would require renaming or restructuring in order to meet the sustainability disclosure and label requirements of US, UK and EU regulation, a study by Clarity AI has found.

The data platform looked at the fund requirements in each region, finding “limited alignment” between them, and discovered 95% of ‘sustainable’ funds would require renaming. Specifically, 81% of funds would only comply with one of the regimes, and only 4% of funds would comply with all three.

“This is not only an added cost in terms of compliance, but also underscores how different actors – in this case regulators – are interpreting the meaning of core concepts like ESG and sustainability,” said Patricia Pina (pictured), head of product research and innovation at Clarity AI.

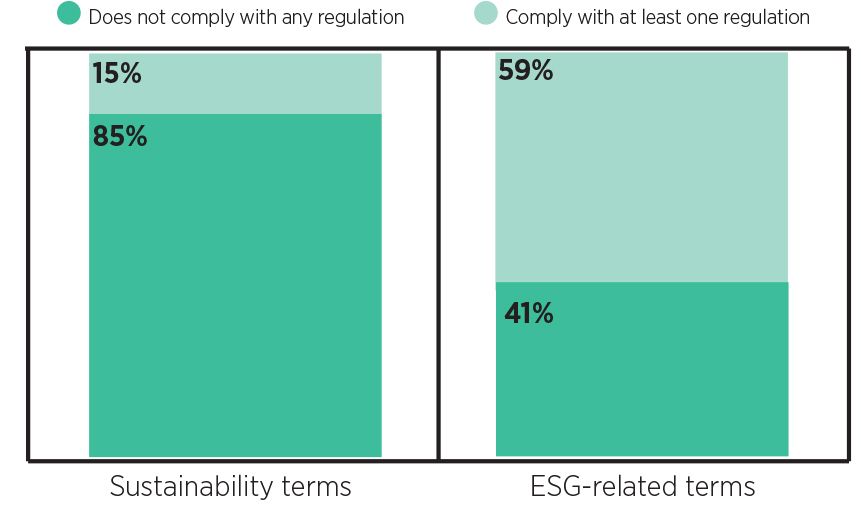

This is not just due to discrepancies between the regulations, however. Clarity AI also found many funds simply are not meeting sustainability requirements. Some 85% of funds with ‘sustainability’ names are not aligned with either the EU taxonomy, SDG framework, do no significant harm principle or are best performers in terms of the Principal Adverse Impact indicators. This drops to 41% for funds with ESG in the title.

For example, in the EU, Clarity AI’s analysis found only 20% of Article 8 funds with the term sustainable (or a derivative thereof) currently plan to make sustainable investment of more than 50% as outlined by the consultation. These funds would therefore fall short of the proposed amendments. The same number (20%) plan to make less than 10% sustainable investment.

“As these regulations come into play, fund managers will need to adjust their strategies in order to continue positioning their funds as sustainable,” the analysis said.

Clarity AI concludes more coherence is needed across regions’ regulatory approaches. “Although each jurisdiction might have contextual differences worth taking into account, capital markets are global markets and we need stronger regulatory alignment across borders,” Pina said.

“Understanding and characterizing ESG and sustainability differently will only contribute to increasing the existing confusion in the market and potentially result in ‘greenwashing,’ which is exactly what these regulations aim to fight.”

Responding to the report, Yann Bloch, head of product and pre-sales Americas at NeoXam, said: “Clarity AI’s report shines a glaring spotlight on how many funds are unprepared as regulators plan to ramp up requirements around ESG labelling. What’s more, the divergence between regulatory regimes adds another hurdle in the race to keep up with requirements.”