It’s been two years since the first asset managers released their pledges around meeting net zero. In the months that followed, it seemed like the news agenda was flooded with investment management companies rushing to make commitments in line with the goals of the Paris Agreement.

But how are the pledges translating two years on?

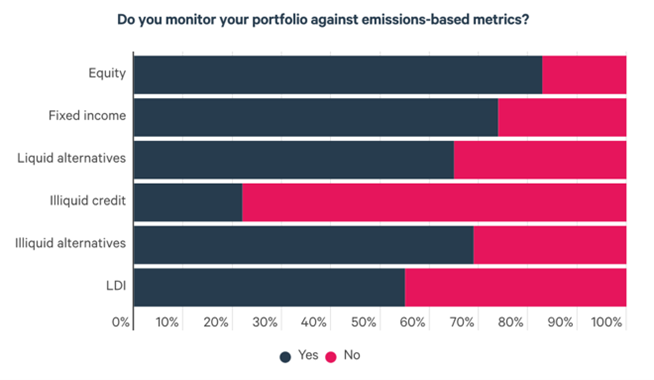

Our latest research shows that 59% of managers have made a net-zero commitment at a firm level. But there are also some potentially worrying discrepancies. For example, only 34% of firms have set targets at a strategy level, while just 17% devised a specific decarbonisation strategy. In a similar vein, only 63% of strategies are performing climate risk assessments and just 67% are monitoring emissions-based metrics.

We understand that some firms made pledges while still working on a specific plan of action at the time of responding to our survey. However, it is not much longer that we will give these managers the benefit of doubt if they don’t come out with concrete plans to decarbonise.

See also: – ESG Clarity’s Net Zero Database

We hope that, regardless of the regulation in place, managers are taking steps to ensure any commitments they are making stand up to scrutiny.

In our experience and based on what we’re seeing in the market, the three primary factors we’d expect asset managers to do to demonstrate the validity of their net-zero objectives are:

Formalised – and specific – decarbonisation objectives

None of this is about achieving net zero in the fastest or most outlandish way, but rather having concrete, considered objectives in place for reducing emissions. An example of this could be committing to excluding high-emitting sectors – such as oil companies – from strategies. Typically, emissions are concentrated within a select few sectors, so this is likely to be an ‘easy win’ for a lot of managers.

Based on our research, we can see that managers have been adopting a wide range of approaches in respect to how they’re actually reducing emissions. In the main however, managers are focussing their efforts on operational emissions – scope one and two – and / or financed emissions – Scope 3. In particular, we are always encouraged to see firms focussing on the latter, because this will represent by far the largest source of their emissions and is the area they are likely to make the biggest impact.

And although we recognise it may not be appropriate for all strategies, we’d like to see more managers incorporating emissions into their engagement strategy. As mentioned, just 63% are currently doing so according to our study, so this should be considered a big area of improvement over the coming year.

Measurable interim targets

Managers who have set themselves clear interim targets – for example achieving a 50% reduction in emissions by 2030 – send a message that they recognise the enormity of the journey ahead and have made it their business to understand the work needed to achieve their ambitions.

Outside emissions reduction, it’s always encouraging to see that a manager has taken steps to complement their net-zero strategy with interim targets with regards to their broader climate impact in the ‘real world’. This looks to go beyond reducing emissions, instead investing in those companies actively responsible for driving the reduction in wider-economy emissions – such as renewable energy and green technologies.

Reporting, reporting, reporting

Though not the most glamorous of areas, one of the most obvious and effective ways asset managers can demonstrate the depth of their efforts to reduce emissions is through the provision of regular and transparent reporting. The most common framework for climate-related financial reporting we look out for is the Taskforce on Climate-related Financial Disclosures (TCFD).

Some 63% of strategies are using climate risk assessments for future forecasting and 67% monitor their portfolio against emissions-based metrics.

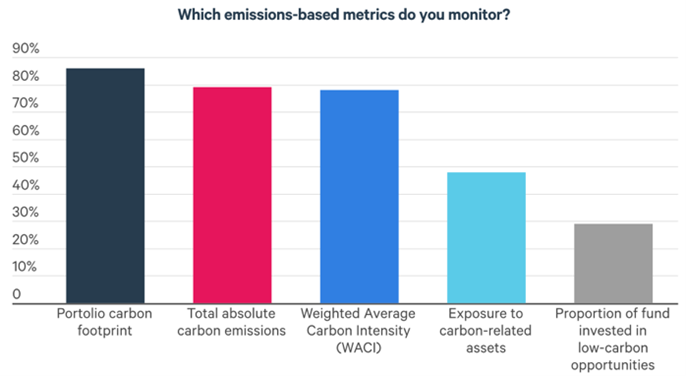

Given regulatory requirements for TCFD reporting, which asks for the carbon footprint of portfolios, this will no doubt improve further.

Linking into reporting and while by no means a deal breaker, those who seek to involve themselves with programmes such as the Net Zero Asset Manager initiative – launched at the end of 2020 – tell the market that they are keen to collaborate and be proactive about taking real world action.

The global transition to net zero is a monumental task. Ultimately, the whole industry needs to work with asset managers to guide and drive their engagement efforts, but we do expect the firms themselves to make themselves accountable to ever improving standards – and that means being 100% certain that any pledges being highlighted to investors reflect what’s actually happening in practice.