Looking at companies using an ESG lens can be compared to a forensic scientist looking for additional clues that inform the larger picture. However, unlike a forensic scientist the results can often be open to interpretation and circumstance.

Intangible assets, of which culture is perhaps the most important, are vital considerations for the quality growth investor because they provide important clues about a company’s long-term sustainability but can be hard to assess. A crisis, such as the Covid-19 pandemic, can reveal a lot about a company’s culture but such insights can only be gleaned through a deep knowledge of a company and the context in which it operates. This means culture is not readily captured by standardised ESG scoring systems or through other data providers. Investors should take note of how companies behaved during the most of trying of times but need to always take all of the context into account.

In general, companies with positive, ethical cultures responded to the pandemic in ways that reinforced their relationship with key stakeholders and boosted their brand value, building up goodwill that will stand them in good stead over the next decade and beyond.

Each company is different but many quality growth companies in Europe did respond to Covid-19 in similar ways: they protected the jobs and incomes of employees, (sometimes without government subsidies), they supported the community through donations and they weighted financial sacrifices towards senior staff and shareholders rather than the general workforce.

However, there were nevertheless some notable differences between the approaches of companies. What some of these differences illustrate is the importance of always taking a holistic approach, founded on deep knowledge and an appreciation of context. Undue focus on one or two policies could mean an ESG analyst misses the wood for the trees.

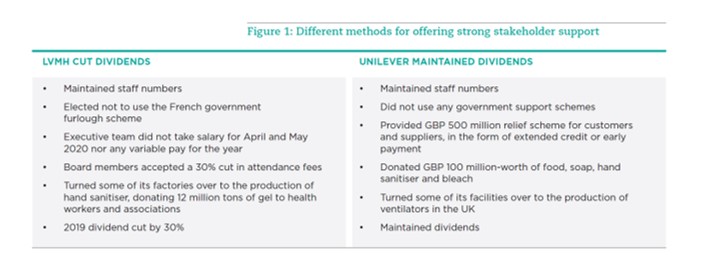

Dividend policy is a good example. Companies maintaining payouts to shareholders during the crisis have been criticised and this policy can be taken as a sign that other stakeholders are less important. It can be a mistake to put too much emphasis on dividend policy though, performance needs to be looked at in the round.

LVMH and Unilever are a case in point. LVMH cut dividends while Unilever maintained them. It would be easy to praise LVMH and criticise Unilever but in other respects they responded to the pandemic in very similar ways. For example, both maintained staff numbers, elected not to use available government support schemes and turned some production facilities over to the manufacture of medical products to combat the pandemic (hand sanitiser in the case of LVMH, ventilators for Unilever). At LVMH the executive team did not take any salary in April and May 2020 and accepted a cut in their directorship’ attendance fees while Unilever instituted generous relief measures for customers and suppliers, offering £500m in the form of extended credit or early payment.

It would be easy to condemn Unilever for maintaining the dividend but this is to overlook its responsible policies in other areas. Similarly LVMH’s decision to cut dividends in April 2020 probably tells investors less about its culture than does its decision to try to keep its employees in their jobs and at full pay, while senior management took a pay cut. This gives insights into the nature of their corporate governance and their attitude to social risks.

This example illustrates how the year of 2020’ does not necessarily tell us whether companies behaved well or badly, but it does give us new information about the types of ESG risks companies might face in the future.

Companies that took care of their most valuable stakeholders should see long-term benefits in terms of future competitive advantage.

Orpéa, Europe’s leading provider of old-age residential care, operates in a sector that received a bad reputation during the crisis. However, as investors we should not tarnish all companies with the same brush. Digging deeper we can observe that Orpéa was a company that showed throughout the crisis why it deserves its reputation as a best-in-the-class provider. As some care homes experienced staff walkouts Orpéa was quick and effective in appreciating the pressures staff were under and moved to allay their concerns. Orpéa swiftly sourced Personal Protection Equipment (PPE) for its employees and paid them an exceptional bonus, amounting to one-fifth of FY19 net income. This then in turn helps the long-term sustainability of the firm as it reinforces its advantage in securing licences to build new facilities which will enable the company to further extend its market share advantage.

L’ORÉAL, a well-known brand in Europe, offered far reaching support to suppliers, customers and other stakeholders. If we think about the sectors impacted by lock-downs, then hair dressers and salons have faced significant disruption and impact to their businesses. L’ORÉAL froze collecting payments from more than 100,000 clients and also sped up its payments to suppliers. In looking for what should make a sustainable long-term investment it is important to assess the value and supply chain. A company that cares for its clients will create longer-term brand loyalty. To change suppliers can be intensive and disruptive to the business. It is not always one action in isolation that makes a difference, but the culmination of many smaller activities that can impact the long-term growth rate and prospects.

L’ORÉAL looked after its work force by maintaining jobs and salaries worldwide and the CEO took a 30% pay cut for 2020 fiscal year. L’ORÉAL did cancel the dividend for the fiscal year 2020 but by looking after their suppliers, staff and clients they are likely to be well positioned as the sector returns to normal post-lockdowns. Additionally, L’ORÉAL’s philanthropic activity is very credible with the following activities:

- Creation of a philanthropic fund of €50m to support associations helping women victims of the social and economic crisis and a €100m impact investing fund for the regeneration of natural ecosystems and to fight against climate change.

- Produced and donated hand sanitisers (close to 14 million units) and donated products such as shampoos and hand creams.

- Cash donations of approximately €3m.

- The L’ORÉAL foundation made €1m available to support people in need.

It is these activities in the wider society that also help inform investors as to a company’s approach to the ‘S’ of E, S and G.

A final example in Johnson & Johnson (J&J). At a time of intense pressure on healthcare systems worldwide, J&J joined global efforts to identify, develop and manufacture a vaccine – a therapeutic area where it was barely present other than through unapproved Ebola and HIV assets. In a show of commitment to its decades old credo, the company not only announced not-for-profit sales for the duration of the pandemic, but also dedicated 500 million doses to lower-income countries through Gavi/Covax to foster equitable access to a cure.

ESG has to be conducted carefully and forensically, and the astute investor should avoid going along with the crowd and putting too much trust in any one measure to assess performance (such as dividend policy). That being said, behaviour throughout the pandemic, when analysed in its proper context, provides a good indicator of long-term sustainability. The actions of these companies during the pandemic may not show up in the short-term updates to ESG databases, but they do provide clues on the values that underpin their businesses and which will play a role in maintaining their brand and earnings growth through the years and decades ahead.