The conversation around ESG investing has been reframed as the war in Ukraine and the perfect storm of inflationary pressures that came along with it, cast key ESG values and investing principles in a new light.

Debates began building shortly after sanctions were put in place that restrictions on investments into certain ESG-sensitive areas such as fossil fuels and weapons production may need to be reconsidered.

Those who support Ukrainian independence and, more broadly, European energy independence, must reconcile those beliefs and either adjust their portfolios or their values.

Beyond those two immediate conflicts of ESG interests lie other debates such as how to shore up global food stocks and access critical earth-bound elements needed to help usher in more carbon friendly energy and transportation.

Addressing these two issues stirs up anti-ESG activities like genetically modified foods and expanding mining efforts – and these are just a couple examples of the fragile balance of pursuing socially responsible goals with solving near-term societal needs.

Running in parallel to these debates was the noticeable end to the prolific streak of inflows and advancing assets under management in ESG-themed funds.

But how much of this interruption is a softening of investor appetite for ESG versus an overall reaction to a challenging global economic picture and the potential for fast rising rates and even pockets of recession?

Investors are opportunistically tilting their portfolios in the direction of beneficiaries of newly emerging themes such as inflation hedges and energy independence and many of these tilts are leaning away from ESG objectives.

Indeed, as of this writing in mid-June, energy is far and away the strongest performing market sector boasting a positive YTD return of 35% against a sea of red in the other 10 major sectors.

Dominant ESG fund holdings are largely sitting out of that windfall. In fact, the largest sector representation in ESG funds – technology and communication stocks – sit amongst the top three worst performers so far this year losing 27% & 29% respectively.

If you’re an ESG fund investor who is aware of the opportunities in energy as well as the potential downside of highly valued stocks in a rising rate environment, one would argue you might want to take near-term steps to protect your portfolio.

The below charts show how these forces are impacting ESG investments and abruptly changing their course from the tailwinds that had been driving record inflows throughout the pandemic.

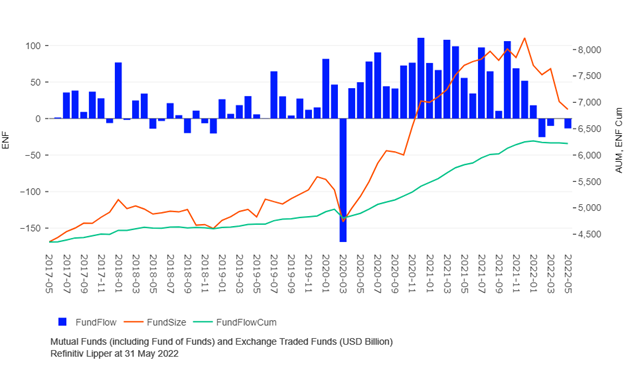

ESG Funds – Global AUM, Net and Cumulative Flows

Cumulative inflows started dropping off in Q1 as a result of outflows being registered in ESG funds for the first time of sustained significance since the market downturns in 2018 and 2020.

The chart below shows the drop off in flows that ESG funds have experienced so far this year after a strong run of month-on-month growth off the trough of March 2020.

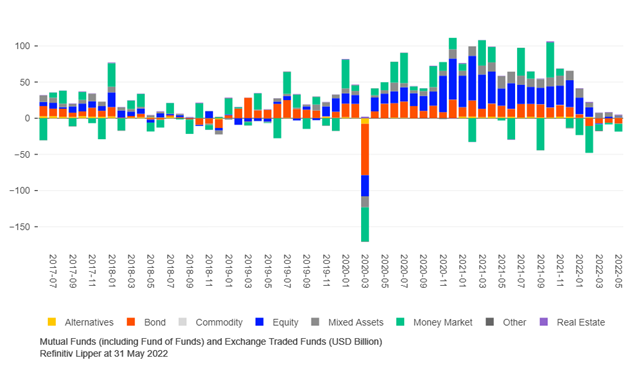

ESG Funds – Global Estimated Net Flows by Asset Type

But are we seeing a run for the exits of ESG funds, or just a run for the exits in reaction to the global economic environment? The two-prior sell off events in 2018 and 2020 seem to provide evidence that broader economic conditions have driven investors away from ESG focused funds, only to see those interests resume and expand.

To note, the total flows out of ESG funds in the most recent month of May was just 10% of the total drop off in ESG AUM which was down just shy of $150bn.

One can expect valuations to remain under pressure in June given the sharp, anti-inflationary policy moves we’ve seen across the major central banks in the past couple of weeks.

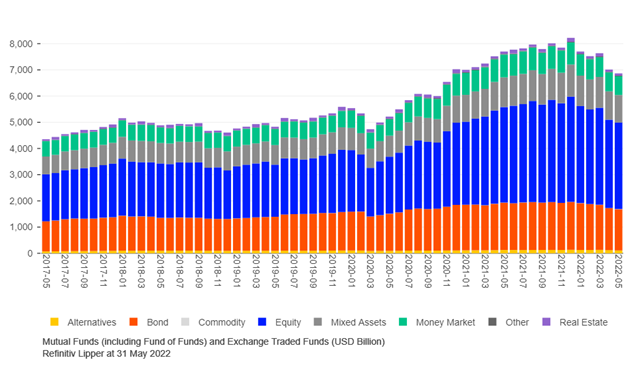

ESG Funds – Global AUM by Asset Type

However, the overall market for funds is a near carbon copy of what we see in the world of ESG investing – with just one notable blip in the month of May when markets enjoyed an end of month run up in AUM before hitting the wall again in the first part of June.

This little uptick in AUM was likely more representative of the non-ESG areas performing well (like energy and other inflation-benefitting stocks) and therefore exposed the differences in the current performance of ESG friendly names vs not-so ESG-friendly names.

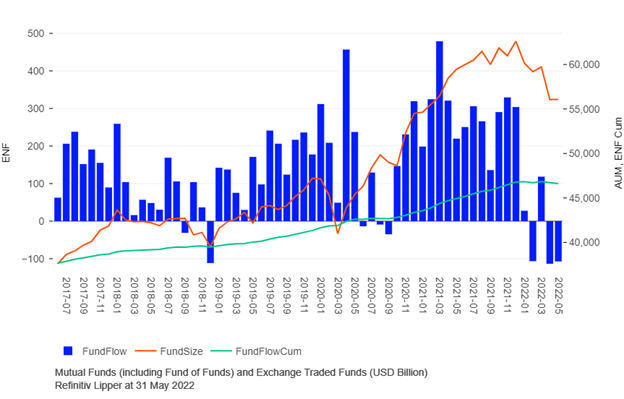

Indeed, flows across all funds were negative in both April and May to the tune of about $110bn in each month, so investors in both ESG and non-ESG funds were redeeming.

All Funds – Global AUM, Net & Cumulative Flows

One can draw from this that ESG funds aren’t immune to the global economic shock that continues to reverberate and send waves through major economies and investor sentiment.

In this case, the economic shock is benefiting non-ESG sectors and investors are reacting accordingly. This is more likely the primary cause for the retrenching in ESG inflows then the recent debates around fossil fuels and weapons.

In some ways, this tempering of ESG enthusiasm may represent a real-world test for the supposed long-term, “values over returns” investment perspective that is claimed to define the socially responsible investing movement.

So, while it appears not all investors are keen to ride out an unfavorable market environment, these recent flows trends likely do not represent a meaningful drop off in ESG investing interest.

The overriding fact is that very real ESG themes, like climate change and equality, will still be in place after the current global macro pressures ease.

Couple these realities with the momentum in both institutional investing mandates as well as regional regulatory initiatives which together all but guarantee ESG-aware investing will continue to grow.

Robert Jenkins is head of research at Refinitiv Lipper, an LSEG Business.

This column first appeared in InvestmentStrategy.