Investors have listed their ESG concerns when it comes to investing, with climate change, workers’ rights and conditions, and executive pay topping the list.

Research in Finance (RiF) asked investors to name three ESG issues that were front of mind when making investment decisions as part of its 2021 UK Responsible Investing Study, which gauged the responses of 210 intermediaries, including 103 DFMs and 107 investment adviser, and 152 consultants and schemes on the institutional side.

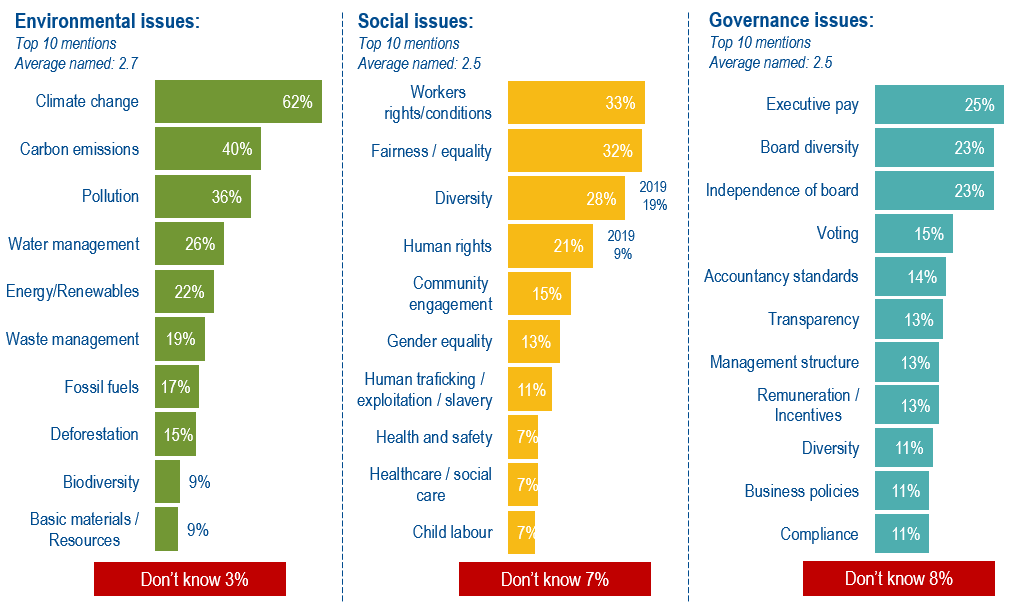

Climate change, emissions and pollution were among the top environmental concerns for retail and institutional investors, while workers’ rights conditions, fairness/equality and diversity were listed as being at the forefront of investors’ minds when it comes to social considerations.

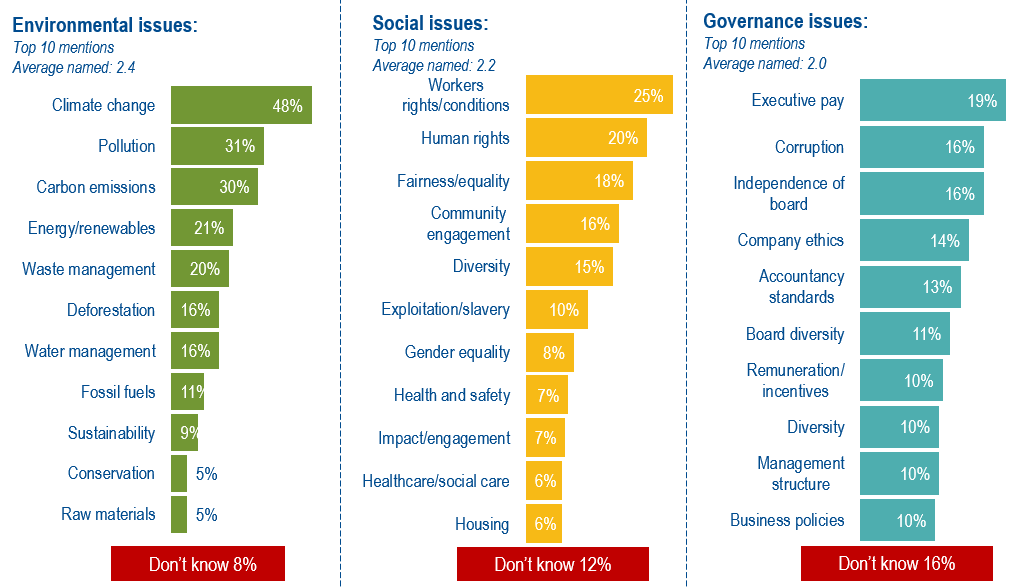

In terms of the sometimes forgotten ‘G’ in ESG, governance concerns were executive pay, board diversity and independence of board for institutional investors, while retail investors placed more importance on corruption (see charts).

Retail investors ESG issues

Institutional investors ESG issues

Environmental concerns appear to be the most familiar with climate change mentioned by 48% of retail investors and 62% of institutional investors, followed by carbon emissions (40% of institutional mentioned and 30% of retail) and pollution (36% of institutional mentioned and 31% of retail).

Jack Dominy, senior research consultant at RiF, said the findings show how environmental issues have moved up the agenda with both groups of investors in recent years.

“Investors now clearly recognise there is a link between how companies navigate environmental challenges and opportunities and the financial performance of the businesses.

“As data gathering and analysis techniques become more sophisticated and regulators continue to press companies to anticipate future environmental issues, it is likely that even more investors will place issues such as climate change and emissions at the forefront of their strategies.”

Furthermore, 41% retail investor such as financial advisers and discretionary fund managers, indicated they are “more likely” to be looking for information on climate change risk exposure within a portfolio – RiF said this figure was even higher among investment advisers, while over half of institutional investors surveyed said they were concerned about the risks associated with climate change and have been actively influenced how carbon reporting is being addressed within fund reporting.