The closer a company’s oil and gas extraction project is to an environmentally sensitive site, the more chance there is of an environmental incident causing that company to be criticised and thus posing a risk to its investors, RepRisk has found.

Research from the ESG data company published discovered public companies within a 1km radius showed a 77% increase in environmental risk incidents, with its geospatial tool last year also finding that extraction projects are in fact more likely to be near environmentally sensitive sites.

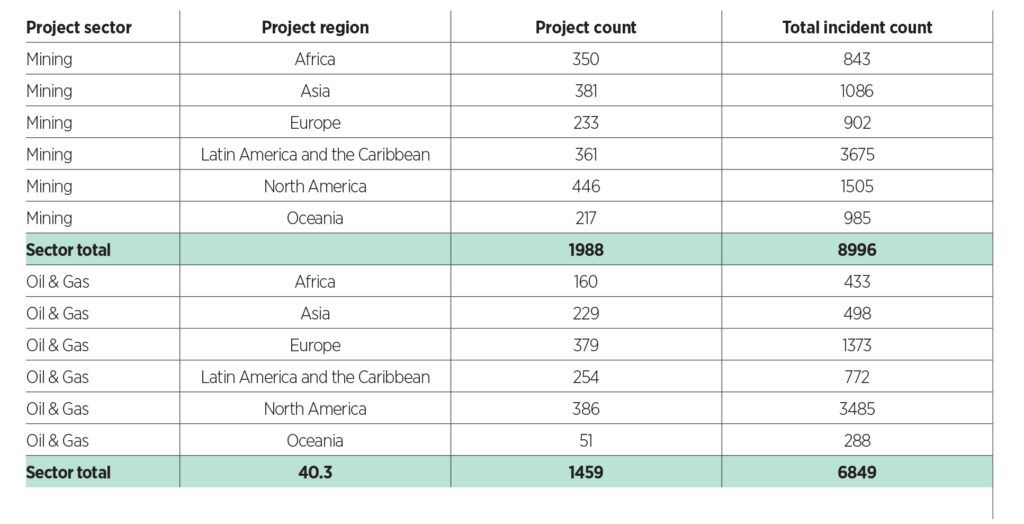

RepRisk, which scrapes public information to assess risk rather than information provided by companies, found 1,373 risk incidents were reported across 379 oil and gas projects taking place in Europe, and 843 risk incidents were reported for the 350 mining projects occurring in Africa.

Of these projects, RepRisk found their proximity to environmental sites correlated with an increase in risk incidents. For example, projects within 1km of Unesco World Heritage Sites and Alliance for Zero Extinction sites experience 36% and 35% more environmental risk incidents than projects within 1km of other site types, respectively.

Number of projects and environmental risk incidents

by region

RepRisk wants investors to consider this correlation between proximity and an increase in incidents in their ESG processes.

“The East African Crude Oil Pipeline is within 1km of 33 environmentally sensitive sites – using geospatial proximity data would have given investors and project planners insights into the potential proximity risks ahead of time,” it said in a statement.

“This research indicates that despite a growing global focus on biodiversity, there is still a lack of awareness about potential material risks associated with the location of extractive projects.”

Philipp Aeby, CEO and of RepRisk, added: “Biodiversity risk is a financial risk: to mitigate potential legal, financial, reputational, or compliance fallout caused by environmental harm, stakeholders need to be equipped with the right data and warning signals, such as proximity data and business conduct data.

“It is critically important that investors and allocators treat ESG risk as a primary consideration when deciding whether to invest in or fund infrastructure projects.”