CEOs of three of the most well known responsible investment organisations – the Institutional Investors Group on Climate Change (IIGCC), the Principles for Responsible Investment (PRI) and UK Sustainable Investment and Finance Association (UKSIF) – have written to the new UK prime minister calling for clearer net-zero policies that transform the economy.

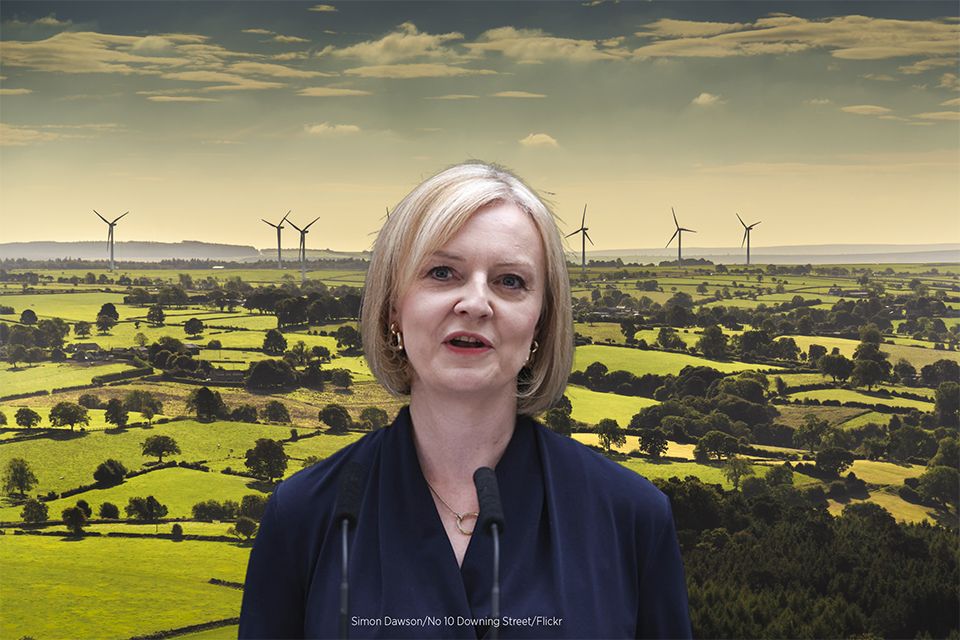

In particular, a letter written to PM Liz Truss urges the government to focus on energy efficiency, power sector decarbonisation and renewables integration and by doing so will address the ongoing energy security and cost of living crises at the same time.

The letter, which has also been backed by investment groups including Aviva, Federated Hermes and Impax, said: “We recognise the immediate priority to keep people and homes warm and bring fuel cost down…Scaling up clean energy solutions today will pave the path towards a more affordable, stable, and resilient energy system in the UK.”

See also: – Is Truss up to tackling climate and cost of living crises?

It added: “Tackling the climate crisis and avoiding the worst of its impacts are in the UK’s national and economic interest, and a top priority for UK citizens. To realise the economic and social benefits of the transition, the government must now provide investors with clarity on the near-term policy actions and milestones that will create the right enabling environment to support the ongoing and positive transformation of the UK economy.”

A clear policy vision with “near-term actions and milestones” needs to be set, said Stephanie Pfeifer, CEO for IIGCC.

“We call on the government to set out a clear delivery plan for the transition of the real economy and financial services, with credible sectoral roadmaps underpinned by the near-term policies, actions and milestones needed to shift financial flows towards net zero,” the letter continued. “The starting point must be policies that transform the real economy, prioritising sectors whose transition will contribute most to the UK’s economic, social and climate goals and sending the right policy signals to investors. This must be supported by the implementation of the UK’s updated green finance strategy and clarity on planned policies to deliver on the COP26 commitment for the UK to become the world’s first net zero aligned financial centre

Truss became PM in early September and the new Chancellor of the Exchequer Kwasi Kwarteng is to deliver an Emergency Budget on 23 September.

James Alexander, CEO at UKSIF and ESG Clarity Committee member, said: “On behalf of financial services institutions committed to promoting sustainability, we urge the incoming government to reaffirm the UK’s objective to be a global leader in tackling climate change risks. A key part of this will be maintaining ambitious climate policies and building the right regulatory environment to support this. We disagree with the view that UK investors favour a ‘light-touch’ regulatory approach in response to the economic headwinds the country faces.”

“For example, our members require greater clarity on the policy landscape for the real economy and financial services in order to invest more capital towards delivering the clean energy transition whilst enhancing the country’s energy security. This should be encouraged through the creation of clear policy and long-term financing frameworks for various sectors of the UK economy.”

David Atkin, CEO at the PRI, added the UK remains a “vital hub for financial services” but said more can be done: “We call upon the new UK government to maintain high ambitions on net zero, by supporting these firms in their investment into a net zero future.”