The private sector is being called upon to plug the funding gap in humanitarian aid.

A recent report by the World Economic Forum and Gulf International Bank (GIB) Asset Management, Unlocking Humanitarian and Resilience Investing through Better Data, has said the private sector has a key role to play in investing in the sustainable recovery and resilience of vulnerable communities and should work with humanitarian and development agencies, as well as data providers, to generate the data investors need in this area.

The number of people in need of humanitarian aid jumped by 50% to an estimated 235 million this year, according to the UN, and the funding gap for humanitarian aid more than doubled to $24bn in 2020.

The report said humanitarian and resilience investing (HRI) has similar goals to impact investing, but has not yet become established as an investment theme. It noted there are relatively few examples of HRI taking place compared with many other themes, such as clean energy or water.

“HRI is an emerging investment theme aimed at leveraging private capital in a way that directly benefits vulnerable people and fragile communities,” said Børge Brende, president of the World Economic Forum.

The report found a crucial barrier to private sector investment is the data gaps that impair the identification, appraisal and due diligence of potentially impactful, bankable HRI transactions.

“If action is taken to address these data barriers, it will be easier to multiply and scale up capital, reducing the SDG financing gap and helping to alleviate human suffering,” said Katherine Garrett-Cox, CEO of GIB Asset Management.

Existing metrics are not standardised, the report said, making comparisons across organisations and sectors difficult. Data on social impacts and resilience-building is also hard to collect. And much of the current data focuses on short-term response rather than on crisis prevention and recovery.

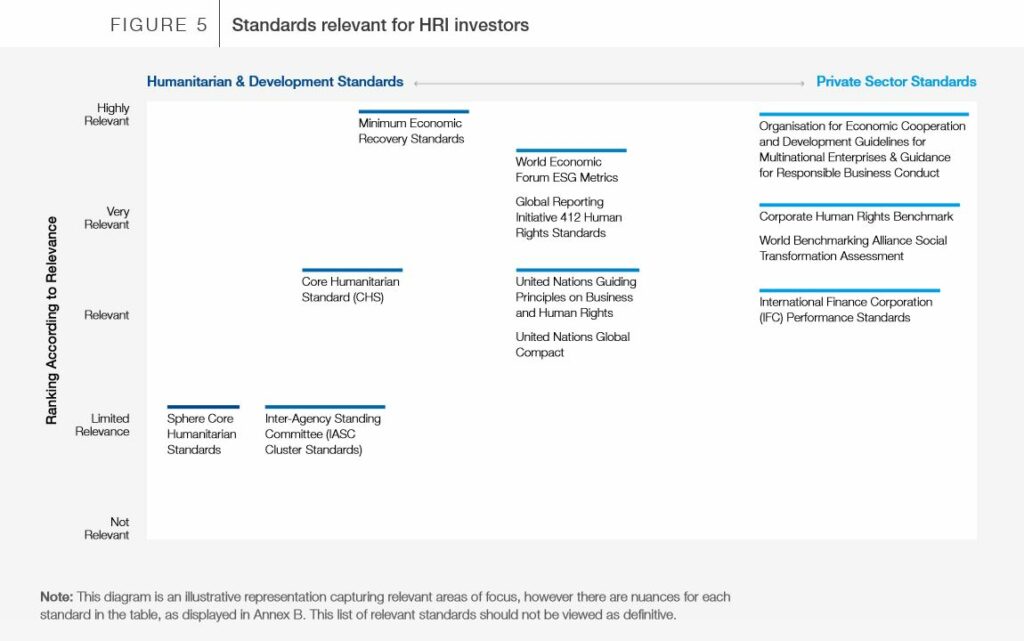

The report highlights some case studies showing the value of good data, as well as some example standards, shown below, and benchmarking.

The report also included five calls to action:

- Investors should provide guidance on their data requirements

- Partners should agree on principles for data privacy and protection up front

- Businesses and initiative owners should disclose what existing data they can, and partners should act where existing data and standards are inadequate

- Investment data providers should mainstream HRI-ready indicators into their regular data production and release cycles

- Partners should work together to harness the potential of digital solutions for HRI-enabling data