Over the past two years there has been a dramatic increase in interest in impact-oriented strategies in emerging markets. But that raises questions about the actual need for impact, the potential to deliver it and what potential returns come with it.

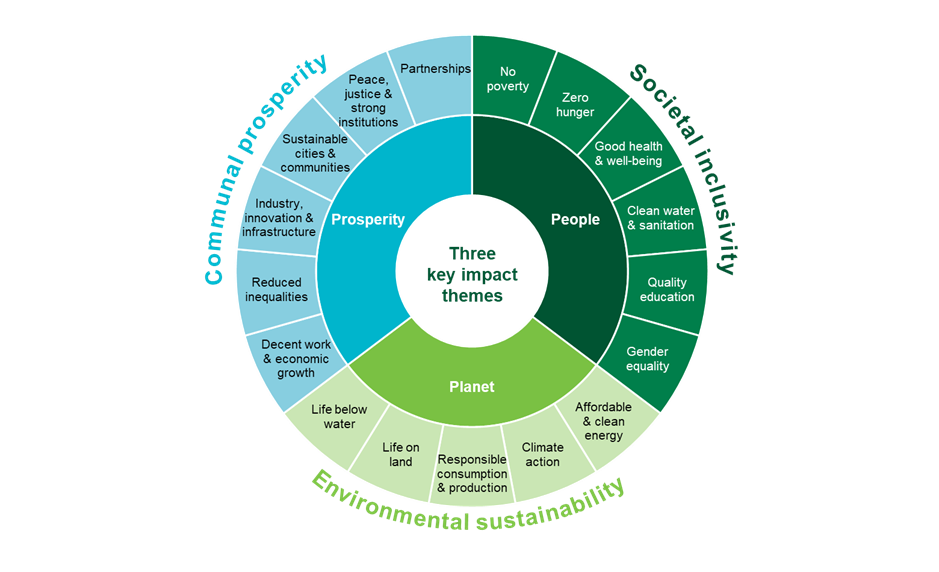

Impact needs can be grouped into three thematic areas based around people, planet and prosperity. Across those themes, it is important to encapsulate the 17 United Nations Sustainable Development Goals (UN SDGs), in order to define and frame how and where capital needs to be deployed.

Looking through that lens, the need for impact capital in developing nations is substantial.

Some 85% of the world’s population live in emerging market countries, and collectively they are home to 99% of the world’s poorest people. There is a clear and pressing need for financing to improve societal inclusivity: reducing poverty; improving gender equality; or supporting basic needs.

Emerging markets represent 77% of the world’s land mass. Not only that, but 70% of emerging markets’ energy supply is reliant on fossil fuels, according to BloombergNEF. To address the climate emergency and support environmental sustainability, capital must be deployed urgently.

While the extent of economic and social development varies greatly, emerging markets are by nature less mature than developed countries. They have a material need for financing to reduce inequalities, support more sustainable communities, and stimulate the development of infrastructure and industry.

The potential for impact

The need for positive impact is great. But so too is the impact investing opportunity set, particularly within corporate debt. Bondholders are the principal provider of public capital to emerging market corporate issuers, given over 60% of them have no publicly listed equity. That places bondholders in a unique position to partner with issuers over the long term.

There are three types of impact opportunity within emerging markets: impact bonds, impact issuers and improving issuers.

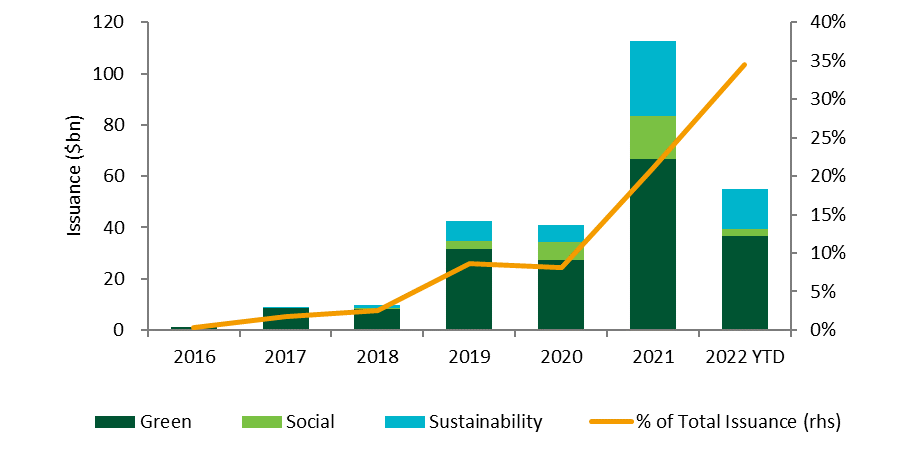

Impact bonds are those whose proceeds are used to finance specific environmental and/or social projects. There are three subtypes: green bonds, for purely environmental projects; social bonds, for social projects; and sustainability bonds, which include both types of projects. The issuer commits to reporting on the allocation of funds and the outcomes achieved over time.

Issuance from emerging markets began in earnest in 2017 and continues to grow exponentially, with impact bonds making up 35% of total issuance so far this year. The hard currency impact bond market now stands at more than $270bn outstanding, from over 200 issuers located in more than 40 countries across all major sectors.

Emerging market impact bond issuance has surged

Impact issuers are those whose very business model supports the delivery of positive impact, be it clean power through renewable energy generation or connecting people to the internet for the first time through building telecoms towers.

Improving issuers set ambitious investment targets around the environment, likely having the greatest incremental impact overall by tackling some of the root causes of climate change.

The opportunity for returns

The need is great, and the opportunities are increasingly there to address those needs. But must investors adopt a purely philanthropic approach to achieve positive impact, or is it possible to achieve financial returns at the same time?

This is where emerging markets perhaps come into their own. Since their beginning as an asset class, in keeping with their non-impact equivalents, emerging market green bonds have typically carried a yield premium compared to green bonds issued by developed market borrowers, data from Bloomberg show. As of the end of June, emerging market green bonds offered yields of 5.2% compared to 3% available in developed market green bonds, according to JP Morgan.

That is particularly significant, given that emerging market green bonds are half the duration of developed market green bonds. Further, by allocating to impact issuers and improving issuers as well, investors have the potential to enhance yields even more, while broadening and deepening potential impact, improving both potential financial returns and impact outcomes.

Investing for change

As investors look to identify areas offering attractive total returns and positive impact, emerging markets are becoming difficult to ignore. They represent an increasingly diversified, rapidly growing opportunity set, combining a structural yield premium with the positive impact needed to help support the delivery of the UN SDGs and address key issues facing people, the planet and prosperity.