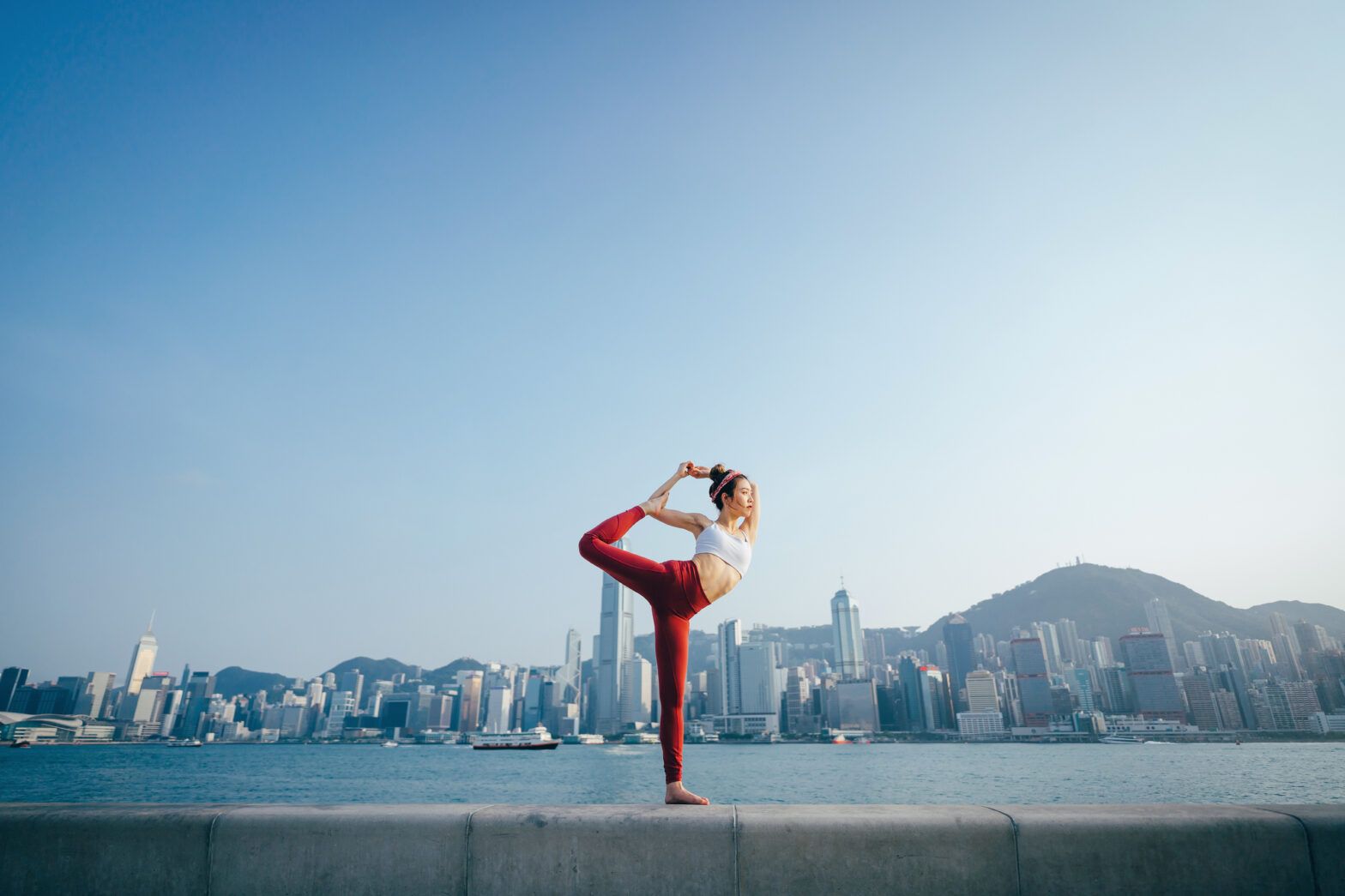

Health and wellbeing have topped a list of specific areas where Hong Kong investors say they would like to see their money have a positive impact, according to research from Schroders.

The group’s Global Investor Study 2022 found 45% of respondents in Hong Kong ranked impact on good health and wellbeing as their top social goal, followed by 42% who indicated education. Both clean water and sanitation and reduced inequalities were also top impact priorities for 37% of investors each and 33% wanted to see their money benefitting climate action.

However, when asked about overall areas where investors would like to make an impact environment was top with 51% choosing this option, while 38% suggested they prefer to align with societal principles.

Increasing allocation

The survey also found 58% of respondents said sustainability as a thematic investment has become more attractive in the last six months and 63% believe sustainable practices are linked to long-term profitability.

Out of the 500 respondents from Hong Kong in the global survey of 33,000 respondents, 77% said the most important driver encouraging them to increase sustainable investments was being able to choose investments aligned to personal sustainability preferences. Meanwhile, 42% said data or evidence showing investing sustainably delivers better returns was the key driver and for another 38% it was more education on sustainable investments.

For three quarters, 74%, of investors in Hong Kong climate change is a key concern, according to the study with 65% agreeing investment can drive progress in such sustainability challenges.

Transparency issues

More than two thirds, or 70%, of investors said a lack of transparency and reported data from providers about impact was the biggest barrier to increasing sustainable investment. Despite this, 59% of investors in Hong Kong are investing up to 30% of their portfolios sustainably.

Amy Cho, Schroders chief executive officer, Hong Kong and deputy head, Asia Pacific, said: “We are excited to see Hong Kong investors’ interest in exploring sustainable investments are favourably on the rise, and that many of them are already taking action.

“While some investors are still looking for convictions to increase their sustainable investments, it is also encouraging to see that they are eager to learn more about the different types of sustainable investments available and aligning their portfolios with their personal sustainability preferences.”

Experts vs novices

The same survey, looking at responses on a global perspective, found seasoned investors are more likely than novices to attribute performance benefits to ESG factors – but they also value sustainable investing most for environmental and social benefits.

Schroders said over the past several years people have become more likely to say they choose sustainable investments because of environmental and social factors, rather than potential for higher returns. Fifty-two percent of people drawn to such funds cited environmental impact as their leading concern, up from 47% who said so in 2020 while 43% pointed to “societal principles,” compared with 32% two years ago. Those saying higher returns were their primary reason declined from 42% to 36%