In this series for ESG Clarity Asia, Morningstar dives into ESG funds available in Asia, analysing their investments, performance and ESG credentials.

For this second article, Morningstar’s Ronald Van Genderen takes a look at the Invesco Sustainable Pan European Structured Equity fund.

Invesco Sustainable Pan European Structured Equity was repurposed to a sustainable strategy in 2021, earning the fund a Morningstar ESG Commitment Level of advanced and a Morningstar Sustainability Rating of four globes. But time will tell if changes will prove effective.

Named managers for the strategy are the experienced global head of portfolio management Alexander Uhlmann alongside the equally seasoned and long-tenured Thorsten Paarmann. They benefit from Invesco’s comprehensive and experienced 50-plus member quantitative strategies team. This broader team has grown over the years and has been stable historically, although there have been slightly more changes within the team in recent years. Its members are actively involved in ESG research and active ownership practices, both proxy voting and engagement. However, their average ESG experience is still relatively limited.

The strategy rests on a proven quantitative-factor-driven stock-selection approach. Throughout history, the team has constantly refined its process, which has been essential to maintain an edge for quantitative investing strategies. However, modifications introduced in 2021 have been more substantial than before.

These changes included repurposing the strategy to a sustainable approach. ESG momentum and ESG portfolio objectives were already integrated into its process in 2018, and these were complemented in 2021 by exclusions of controversial activities (for example, coal and other fossil fuel energy sources, weapons, nuclear power, tobacco, and UN Global Compact violations) and a best-in-class screening process that uses an energy transition measure.

Although this has resulted in an improvement of the portfolio’s sustainability profile, the restrictive sustainability criteria effectively exclude around 30% of the investable universe. It remains to be seen if the approach is as effective with this reduced opportunity set.

Another major change involved the decision to break up its portfolio optimisation process into two steps. First, a low-volatility anchor portfolio is constructed, then an optimisation process is used to obtain the desired factor exposure. Although sensible, we have observed various changes in the portfolio’s characteristics, including an increase in number of holdings to more than 150 from around 100 stocks, a decrease in active share versus the MSCI Europe benchmark by roughly 20 percentage points to slightly more than 60%, and a smaller tilt toward mid- and small caps.

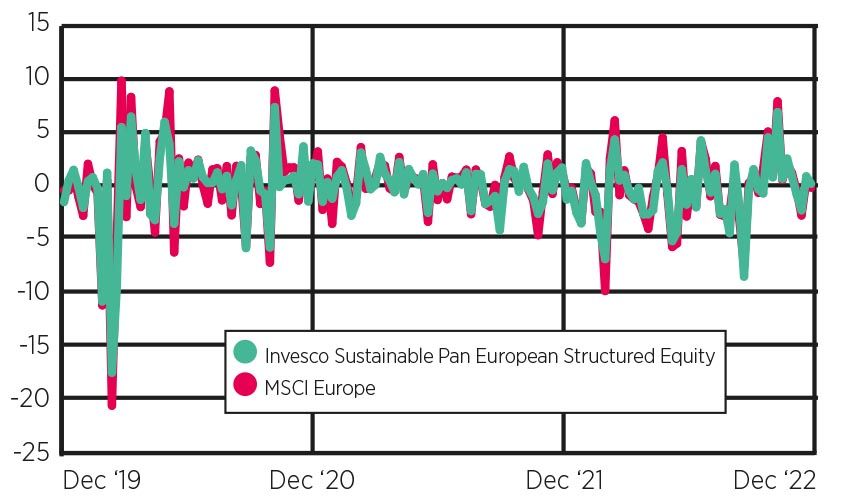

The strategy has a strong long-term record, especially on a risk-adjusted basis. However, given the substantial enhancements to the process in 2021, the resulting impact on the portfolio’s characteristics, and the short period following their implementation, we still need evidence that the revamped approach is as effective as the original strategy and doesn’t compromise the strategy’s future alpha potential.

The fund carries a Morningstar Analyst Rating of bronze for its cheapest share classes, while more expensive ones are rated neutral.

Invesco fund holds steady