Excluding China, almost all the markets in the region recorded a decline in inflows, with net fund inflows of $741m, Morningstar’s latest Global Sustainable Fund Flows report shows. Only Hong Kong-domiciled funds gathered more assets in the second quarter than the first.

“Inflows into sustainable funds were rather muted in the Asia ex-Japan region in the second quarter, dropping by 70% compared with the first quarter,” said William Chow, Morningstar’s director of manager research, in a statement.

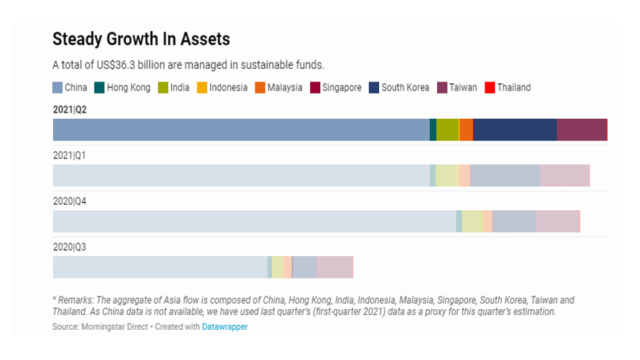

Nevertheless, sustainable funds continue to amass assets across Asia-domiciled funds, and total $36.3bn as at the end of June, according to Morningstar. The figures do not include Hong Kong and Singapore investor flows into sustainable funds domiciled in Europe and the UK.

However, “product development slowed in the second quarter, with 13 new funds across the region, compared with 22 launches in the first quarter of 2021 and 17 in the fourth quarter of 2020, he noted.

South Korea and China led the region in product development, with six new ESG fund launches each in the second quarter, and Taiwan providing the only other new fund.

Five of China’s new launches had a “new energy” theme, including Harfor New Energy Equity, Manulife Teda New Energy Equity, First State Cinda New Energy Select Allocation, Changjiang New Energy Industry Allocation, and TianHong CSI New Energy Car Index.

South Korea saw a relatively sizeable inflow of about $800m in the second quarter, with cash mostly moving into the six new funds. South Korea remains the second-largest market (behind China) by asset size, with a growth of 21% over the previous quarter.

Year-to-date, asset managers in Asia Pacific ex-Japan have launched 35 new ESG-focused funds, versus 43 launched throughout the calendar year of 2020 in the region.

For investors in Asia, equity and allocation funds remain popular tools to obtain ESG exposure. The market share of fixed income funds stands at 7% and has been relatively stable over the past two years. In terms of style, while actively managed funds have been mainstream for sustainable investment, interest in index funds with an ESG overlay has been on the rise, absorbing 30% of the total flow since the beginning of the year.

Globally, driven by an increase in the number of sustainable offerings, positive net flows, and market appreciation, sustainable fund assets grew by 12% globally to $2.24trn at the end of June.