Proposals for the UK regulator’s investment label and Sustainability Disclosure Requirements (SDR) regime, published this week, are intended to encourage investors to “stay inside the tent” of ESG investing instead of resorting to divestment, Sacha Sadan, director of ESG at the Financial Conduct Authority (FCA), has told ESG Clarity.

In an interview, he said he disagrees with how much divestment has become part of sustainable investing: “I’ve always believed as an investor for many, many years that I’d rather stay inside the tent and help influence and change things rather than just exclude. With some of the things that have happened over the years, unintentionally, it’s become more of an exclusionary-based response. And I don’t think that’s the right way.”

Sadan said there was, however, a place for divestment as part of a solution.

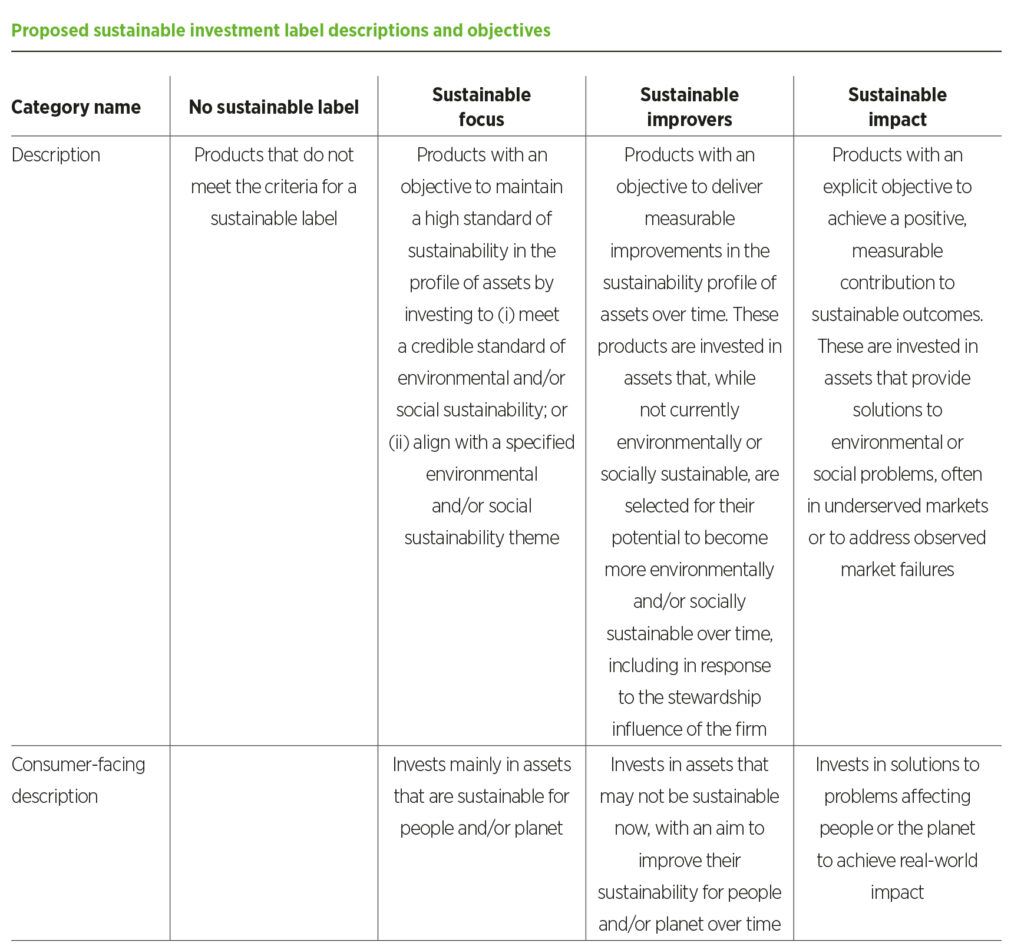

The drive for engagement is reflected in the sustainable improvers product label included in the consultation. The other two labels the FCA suggested are sustainable focus and sustainable impact.

Sustainable improvers, the consultation paper stated, are invested in assets that, while not currently environmentally or socially sustainable, are selected for their potential to become more environmentally and/or socially sustainable over time, including in response to the stewardship influence of the firm.

Sadan pointed out the regime is also designed to make asset managers more transparent over any stewardship they claim to be doing.

Broad approach

While some divestment strategies have been criticised for lacking real-world impact, Sadan explained how the regulator was instead trying to address the whole “ecosystem” of sustainable investing. To that end the FCA is working closely with the Financial Reporting Council on the stewardship code and will be regulating ESG ratings “very soon”. He also mentioned the fact SDR is proposing to mandate entity-level sustainability disclosures.

“We have tried to say it’s really nice that you’ve got this diversity fund. But what are you doing on diversity for your entire assets?”

The regulator will be increasingly focused on the entity level going forward, Sadan said.

Louisa Chender, FCA senior associate, SDR and investment labels lead, added the regulator plans to scrutinise entity-level arrangements to see if firms have capacity for their products to live up to their sustainability labels.

See also: FCA announces three sustainable fund labels in greenwashing crackdown

“As part of the criteria we’re proposing for labels, we’re saying that products must have a sustainability objective, firms must have an investment strategy to support that objective and the firm needs to report on KPIs that measure performance against the objective going forward, as well as on their stewardship approaches where relevant.

“But we’re also saying they need to have the appropriate resources and governance to ensure they can deliver on the sustainability objective… they’ll need to demonstrate they have the organisational arrangements to actually be able to deliver on what they claim they will be doing.”

Costs

The cost to the industry of implementing the regime should not be onerous, Sadan said.

“We’re not forcing people to do certain things. We’re also going to try to use our convening powers and engage with industry as much as we can in the next year… which will help.”

The director of ESG said the FCA is also trying to build on international standards such as the International Sustainability Standards Board, the Taskforce for Climate-related Financial Disclosure and Sustainable Finance Disclosure Regulation where possible and the regime should ultimately help asset managers achieve their sustainability goals. However, some effort would be required on firms’ part.

“We’ll be trying as hard as we can to make this as painless as possible. But like anything in life, if you think it’s worth doing then some people are going to have to put some effort in here – if they want to sell these things on a material scale and think they’re doing things then we think it’s worth that commitment,” he said.

One longer-term outcome of the labelling and disclosure rules, Sadan noted, could be lower costs of sustainable products, though this is not something the regulator is targeting: “I just think this will help standardise the industry… The thing that I think this will do for consumer behaviour is, when they understand products better, they’ve said that they’re more likely to get involved in them and invest in them. And the more that happens, that brings economies of scale. I can’t promise that, but I would think that’s true.”