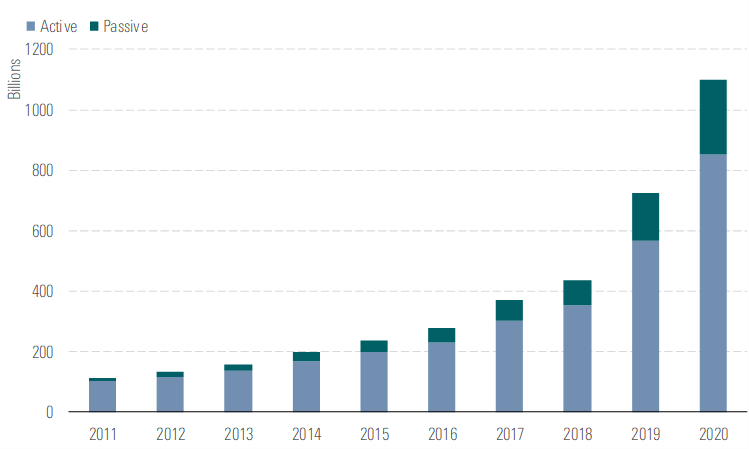

Driven by increased interest in ESG issues from both institutional and retail investors, assets in European sustainable funds have grown almost 10-fold in the past decade, from €112bn at the end of 2010 to €1,101bn at the end of 2020.

In 2020 alone, assets surged 51.8%. This compares with a mere 3% increase in assets for the entire European fund universe. Excluding new fund launches and repurposed funds, sustainable fund assets in existing sustainable funds grew by 32.4%.

Annual European sustainable fund assets (EUR bn)

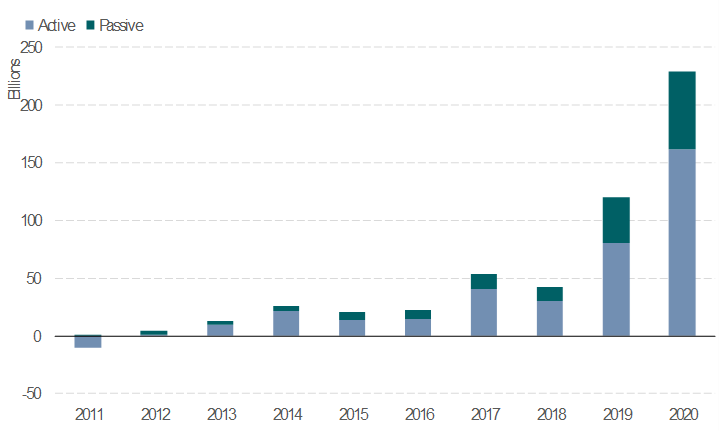

The flows picture looks even more striking. European sustainable funds attracted a record-high €233 billion in inflows in 2020. This was almost double than the figure for 2019 and 10 times higher than five years earlier.

After the decline in inflows during the Covid-19 market shock in the first quarter, sustainable fund flows recovered strongly to reach never-before-seen heights in the fourth quarter, with just shy of €100bn in net new money. Flows were up 84% on the previous quarter giving a strong finish to the year.

Annual European sustainable fund flows (EUR bn)

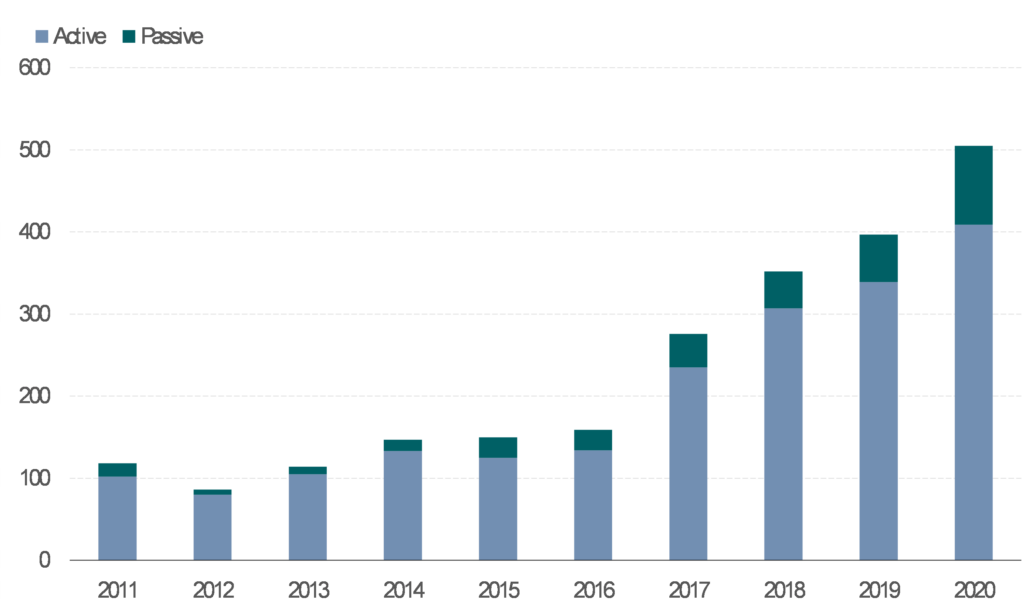

The European sustainable fund space saw an unprecedented level of product development activity in 2020, with 505 new funds coming to market. Asset managers continued to expand the range of options available to investors in terms of asset class, market exposure and theme.

Equity remained the source of the greatest product proliferation with 81 new offerings, followed by allocation and fixed income with 39 and 22, respectively.

Meanwhile, in terms of investing style, passive ESG offerings represented 19% of total new launches, up from 14% in 2019. This year’s passive launches included iShares $ Corp Bond ESG ETF, Lyxor MSCI World Climate Change (DR) ETF and CSIF (CH) I Equity Europe ex CH ESG Fund.

European sustainable fund launches per year

While broad ESG funds continued to represent the bulk of new offerings for 2020, funds with an environmental flavour accounted for 13% of new launches. Of these, 66% (42) target climate change. These include:

- UBS (CH) IF Equities Global Climate Aware Fund,

- RobecoSAM Smart Energy Equities Fund, and

- NN (L) Corporate Green Bond.

Funds such as these allow investors to mitigate risk and/or gain exposure to companies that will benefit from, or contribute to, solutions to environmental and/or social challenges. The range of options for climate-conscious investors is growing.

Consistent with record numbers of fund launches, repurposed funds hit new highs last year. We identified 253 such funds, 87% of which reflected the change by rebranding. Repurposed funds that rebrand typically add terms such as sustainable, ESG, green, or SRI to their name to increase their visibility among investors who are looking to invest more sustainably.